This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, AAHK, YPF, Deutsche, Aldar Price $ Issuances

January 9, 2025

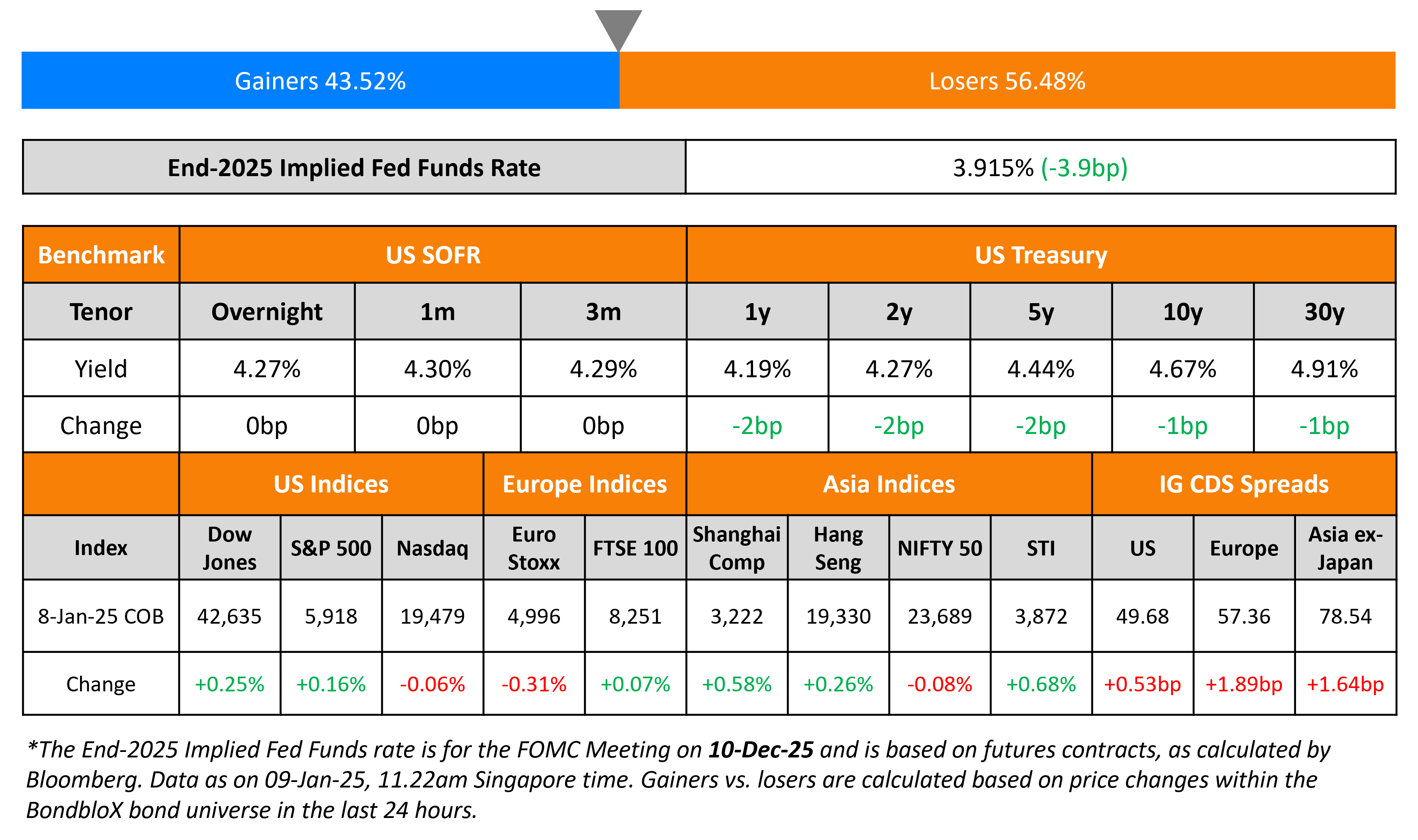

US Treasury yields were marginally lower on Wednesday. ADP Payrolls for December came-in at 122k, lower than expectations of 140k. Also, initial jobless claims for the prior week improved to only 201k vs. expectations of 215k. The FOMC’s December meeting minutes indicated that the officials believed in the need to slowdown the pace of rate cuts soon. US President-elect Donald Trump is said to be considering a new tariff program by using the International Economic Emergency Powers Act (IEEPA) which would unilaterally authorize the president to manage imports during a national emergency.

US IG and HY CDS spreads widened by 0.5bp and 3.7bp respectively. Looking at US equity markets, the S&P ended 0.2% higher while the Nasdaq closed 0.1% lower. European equities ended mixed too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 1.9bp and 8bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads were 1.6bp wider.

New Bond Issues

-

CLP Power Hong Kong $ PerpNC5.25 at 5.875% area

Indonesia raised $2bn via a two-part deal. It raised $900mn via a 5Y bond at a yield of 5.30%, 35bp inside initial guidance of 5.65% area. It raised $1.1bn via a 10Y bond at a yield of 5.65%, 30bp inside initial guidance of 5.95% area. The senior non-preferred bond was rated Baa1/A-/A-. The new 5Y bond was priced in-line with its existing 2.85% 2030s that yield 5.29%. Similarly the 5Y bond was priced in-line with its existing 8.5% 2035s that yield 5.64%.

Airport Authority Hong Kong raised $4.15bn via a three-trancher. It raised:

- $1.30bn via a 3.5Y bond at a yield of 4.792%, 30bp inside initial guidance of T+75bp area

- $1.85bn via a 5.5Y bond at a yield of 4.97%, 35bp inside initial guidance of T+85bp area

- $1bn via a 10Y bond at a yield of 5.249%, 50bp inside initial guidance of T105bp area

The senior unsecured notes are rated AA+. Proceeds will be used refinance existing debt, fund capex including its 3RS Project and for general corporate purposes.

YPF raised $1.1bn via a 9NC4 bond at a yield of 8.50%, 25bp inside initial guidance of 8.75% area. The senior unsecured notes are rated CCC/CCC. The bonds have a change of control put at 101. Proceeds will be used to repay and/or refinancing debt (including a concurrent tender offer and redemption of 2025s); investments in Argentinian fixed assets, acquisition of Argentinian businesses and other permitted uses. The bonds amortize 30% in January 2032, 30% in January 2033 and 40% at maturity.

Deutsche Bank NY raised $1.75bn via a two-part deal. It raised $1.25bn via a 4NC3 bond at a yield of 5.373%, 25bp inside initial guidance of T+130bp area. It raised $500mn via a 4NC3 FRN at SOFR+121bp vs. initial guidance of SOFR equivalent area. The senior non-preferred notes are rated Baa1/BBB/A-. Proceeds will be used for general corporate purposes. The new 4NC3 fixed-rate bond was priced in-line with its existing 6.72% 2029s (callable in 2028) that yield 5.39%.

Santander UK raised $1.25bn via a 6.25NC5.25 bond at a yield of 5.694%, 25bp inside initial guidance of T+150bp area. The senior unsecured bonds are rated Baa1/BBB/A. Proceeds will be used for general corporate purposes.

Lufthansa raised €500mn via a 30NC6 hybrid bond at a yield of 5.25%, 50bp inside initial guidance of 5.75% area. The subordinated notes are rated Ba1/BB/BB. The bonds have a change of control put at 100. Proceeds will be used for general corporate purposes including the refinancing of its existing 4.382% 2075s callable from February 2026. If not called, the notes have a coupon step-up of 25bp from 15 January 2036, a further 75bp from 15 January 2051, and 500bp in a CoC event if not called.

Emirates NBD raised $700mn via a 5Y formosa FRN at 5.392% (SOFR+110bp). The senior unsecured notes are rated A2/A+ (Moody’s/Fitch). Proceeds will be used for general corporate purposes.

Aldar raised $1bn via a 30.25NC7.25 bond at a yield of 6.625%, ~37.5bp inside initial guidance of low 7% area. The subordinated note is rated Baa3. Proceeds will be used for general corporate purposes. If not called by 15 April 2032, the coupon will reset to the 5Y US Treasury yield plus 204.2bp, with a coupon step-up of 100bp applicable on/after 15 April 2035. If a change of control (CoC) event occurs, then the coupon will step-up by 500bp.

Kuwait Finance House raised $1bn via a 5Y sukuk at a yield of 5.376%, 25bp inside initial guidance of T+120bp area. The senior unsecured notes are rated A (Fitch).

BNP Paribas raised €1.75bn via a 6NC5 bond at a yield of 3.583%, 30bp inside initial guidance of MS+150bp area. The senior non-preferred notes are rated Baa1/A-/A+.

Term of the Day: Tap

A ‘tap’ refers to a bond issuance wherein the issuer issues more of an existing bond rather than issue a new bond. Taps, also known as re-openings, are common in the bond market and can be quoted as a price or yield during the initial price guidance stage of issuance.

Fosun raised $200mn via a tap of its existing 8.5% 2028s at a yield of 8.233%.

Talking Heads

On Seeing Term-Premium Rise, Rate Repricing Behind Yield Climb – Janet Yellen, US Treasury Secretary

“When we see strong data – surprises to the upside on indicators to the performance of the economy… suggests that the path of interest rates going forward is going to be a little bit higher than people expected”… term premium has “begun to normalize”

On Treasury Market Gets First 5% Yield in Sign of What Could Come

James Athey, Marlborough Investment Management

“US market is having an outsized effect as investors grapple with sticky inflation, robust growth and the hyper-uncertainty of incoming President Trump’s agenda”

Lilian Chovin, Coutts

“Treasury yields at 5% is definitely on the cards… a risk premium, a term premium going on with the very large fiscal deficits.”

On Best EM Carry Trade Boosted by Turkey’s Inflation-Proofed Lira

Peter Kinsella, Union Bancaire Privee

“In terms of carry, it is a very well-paying strategy… only question is to what extent and how quickly will the Turkish central bank cut rates?”

Viktor Szabo, Abrdn

“For now the lira carry trade remains attractive, but we will have to see how fast will the central bank cut rates”

Top Gainers and Losers- 09-January-25*

Go back to Latest bond Market News

Related Posts: