This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, AAHK Launch $ Bonds; Large $ Deals incl. StanChart, BBVA, Santander, SMFG Priced

January 8, 2025

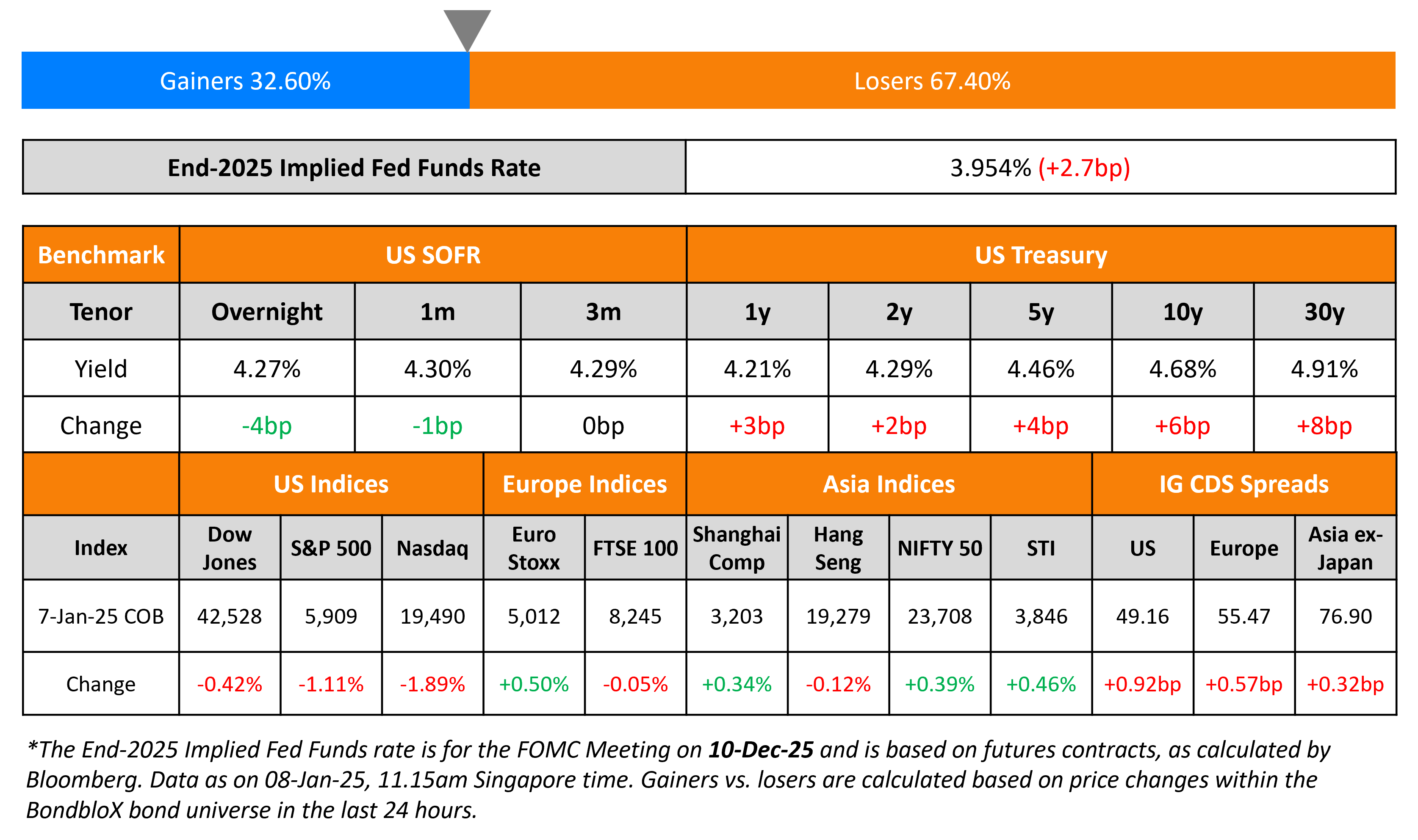

US Treasury yields moved higher again on Tuesday on the back of strong economic data, with the 10Y yield up 6bp. The ISM Services reading for December came-in at 54.1, higher than expectations of 53.5 (and the prior month’s 52.1). Among the sub-components, the inflationary Prices Paid reading came-in sharply higher at 64.4 vs. expectations of 57.5. Besides, the JOLTS job openings for November was much higher at 8.098mn vs. estimates of 7.77mn. Following this, markets are now pricing-in a Fed rate cut only in the second half of this year.

US IG and HY CDS spreads widened by 0.9bp and 6.3bp respectively. Looking at US equity markets, the S&P and Nasdaq closed 1.1% and 1.9% lower respectively. European equities ended mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.6bp and 3.7bp respectively. Asian equities have opened lower this morning. Asia ex-Japan CDS spreads were 0.3bp wider. Borrowers from the APAC region sold over $10bn in dollar bonds yesterday, the biggest since September 2023 as per Bloomberg data.

New Bond Issues

- Airport Authority Hong Kong $ 3.5Y/5.5Y/10Y at T+75/85/105bp area

- Indonesia $ 5Y/10Y at 5.65/5.95% area

Standard Chartered raised $1bn via a PerpNC7 AT1 bond at a yield of 7.625%, 25bp inside initial guidance of 7.875% area. The subordinated notes are rated Ba1/BB-/BBB-. If the bonds are not called by 16 July 2032, the coupon will reset to the US 5Y Treasury yield plus 302.3bp. A trigger event would occur at any time if the CET1 ratio falls below 7%. Proceeds will be used for general business purposes and to strengthen further regulatory capital base.

BBVA raised $1bn via a PerpNC7 AT1 bond at a yield of 7.75%, 50bp inside initial guidance of 8.25% area. The junior subordinated notes are rated Ba2/BB (Moody’s/Fitch). If the bonds are not called by 14 January 2032, the coupon will reset to the US 5Y Treasury yield plus 324.9bp. A trigger event would occur at any time if the CET1 ratio falls below 5.125%. Proceeds will be used for general corporate purposes.

Santander raised $2bn via a two-part deal. It raised $1bn via a 5Y bond at a yield of 5.565%, 25bp inside initial guidance of T+135bp area. It raised $1bn via a 10Y bond at a yield of 6.033%, 25bp inside initial guidance of T+160bp area. The senior non-preferred bonds are rated Baa1/A-/A-. The new 5Y bond was priced at a new issue premium of 12.5bp over its existing 5.538% 2030s that yield 5.44%.

Credit Agricole raised S$400mn via a 10NC5 Tier 2 bond at a yield of 4.25%, 30bp initial guidance of 4.55% area. The subordinated notes are rated Baa1/BBB+/A-. The bonds have a clean-up redemption option applicable, if 75% of initial aggregate nominal amount of notes have been redeemed. The new bonds are priced at a new issue premium of 22bp over its existing 4.85% Tier 2 bond due 2032 that yields 4.03%.

Dai-Ichi Life Insurance raised $2bn via a PerpNC10 bond at a yield of 6.20%, 42.5bp inside initial guidance of 6.625% area. The subordinated notes are rated A-/A (S&P/Fitch). If the bond is not called by 16 January 2035, the coupon will reset to the US 5Y Treasury yield plus 251.5bp along with an additional coupon step-up of 100bp. Proceeds will be used for general business purposes of group and to strengthen further regulatory capital base.

Fosun International raised $200mn via a tap of its 8.5% 2028s at a yield of 8.233%. The senior unsecured notes are rated BB- (S&P). Proceeds will be used to refinance some of its existing offshore indebtedness, including any payment in connection with its concurrent purchase offer, for working capital and for general corporate purposes. The bonds are callable at 104.25 from 19 November 2026 to 18 November 2027; and again at 102.125 on or after 19 November 2027.

Clifford Capital raised $500mn via a 5Y bond at a yield of 4.781%, 30bp inside initial guidance of T+65bp area. The senior unsecured notes are rated AAA (S&P). The bond is guaranteed by the Government of Singapore. Proceeds will be used for general corporate purposes.

BOC Aviation raised $500mn via a 3Y bond at a yield of 4.914%, 30bp inside initial guidance of T+60bp area. The senior unsecured bonds are rated A-/A- (S&P/Fitch). Proceeds will be used for new capital expenditure, general corporate purposes and/or refinancing of existing debt. The bonds were priced roughly in-line with its existing 4.5% 2028s that yield 4.92%.

SMFG raised $3.2bn via a four-trancher.

The senior unsecured bonds are rated A1/A-/A-. Net proceeds will be used to extend unsecured loans, intended to qualify as internal TLAC to SMBC, with SMBC intending to use the proceeds of the loans for general corporate purposes.

Chile raised $1.6bn via a 12Y bond at a yield of 5.739%, 32.5bp inside initial guidance of T+135bp area. The senior non-preferred notes are rated A2/A/A-. Proceeds will be used for general governmental purposes.

BPCE raised €750mn via a 10.5NC5.5 Tier 2 bond at a yield of 4.298%, 40bp inside initial guidance of MS+235bp area. The subordinated notes are rated Baa2/BBB/BBB+, and received orders of over €6.2bn, 8.3x issue size. The new bond is priced at a new issues premium of 14bp over its existing 5.1% Tier 2 bond due 2035 (callable in 2030) that yields 4.16%.

NatWest raised €1bn via a 5Y bond at a yield of 3.182%, 29.5bp inside initial guidance of MS+110/115bp area. The senior unsecured notes are rated A1/A/A+, and received orders of over €3bn, 3x issue size.

New Bonds Pipeline

- Aldar hires for $ 30.25NC7.25 bond

Rating Changes

- Fitch Upgrades El Salvador to ‘B-‘; Outlook Stable

- Fitch Upgrades CLISA to ‘CCC’ on Completion of Consent Solicitation

- NCL Corp. Ltd. Outlook Revised To Positive On Expected Deleveraging, Proposed Unsecured Notes Rated ‘B+’ (Recovery: ‘4’)

- Moody’s Ratings confirms U. S. Steel’s Ba3 CFR; changes outlook to stable

Term of the Day: Clean-up Call

A clean-up call refers to a call provision, whereby once a stated percentage of a security is retired, the issuer is obliged to call the remainder of the tranche. While clean-up calls are generally more commonly observed in mortgage-backed securities (MBS), they may also be present as a feature in some bonds. This is different from a normal call option in a bond where the issuer has an option to redeem their bond fully during the specified call date./period.

Talking Heads

On Frenzy of Sales in Red-Hot Debt Market Drawing Yield-Hungry Buyers

Alfonso Peccatiello, Palinuro Capital

“Issuers are taking advantage of calm markets, low volatility and tight spreads before Jan 20th… large amount of investors ready to put money at work… proves the extent of the animal spirits at play”

JPMorgan Chase & Co. analysts

“The ‘contest’ between tight spreads and high yields is continuing as 2025 begins, and recent history shows us that yields have been winning this battle”

Fabianna Del Canto, Mitsubishi UFJ Financial

“The money coming back into funds from December and January maturities means that buyers have plenty of cash to deploy”

On Wall Street Hit by Inflation Angst Amid Tech Rout

Kenny Polcari, SlateStone Wealth

“Rising yields are not necessarily an issue for stocks unless, of course, the economy starts to fail. Then all bets are off… will be an issue if inflation rears its ugly head.”

Bill Adams, Comerica Bank

“Fed will likely switch from cutting interest rates at every decision, as they did between September and December, to pausing in between rate cuts in 2025”

On Rising Treasury Yields Risk Crisis Seen Under Truss – Apollo’s Global’s Torsten Slok

“80% of the increase in long rates since September has potentially been driven by worries about fiscal policy. Higher for longer has a number of consequences that brings back memories of what we saw in 2022”

Top Gainers and Losers- 08-January-25*

Go back to Latest bond Market News

Related Posts:

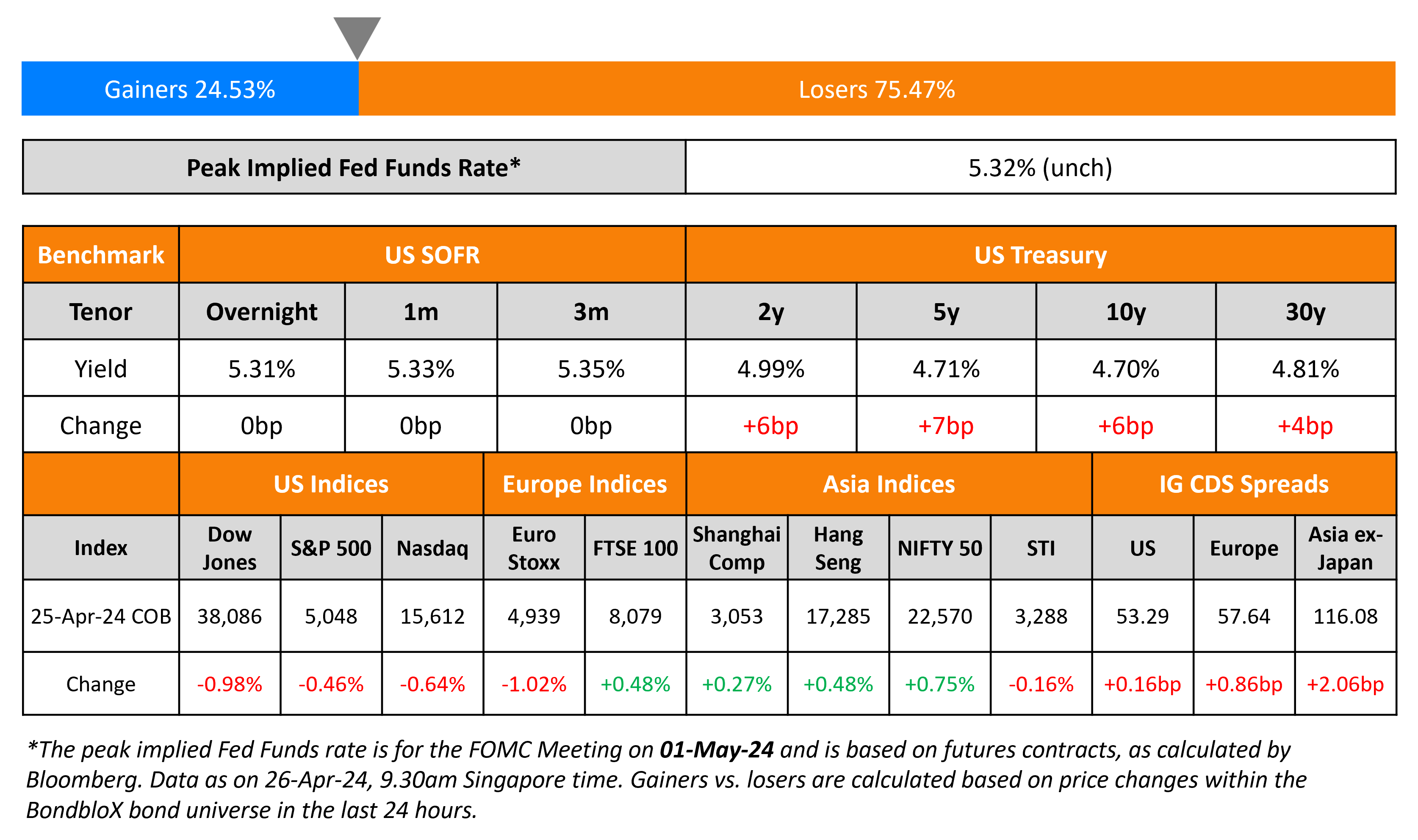

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024