This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

IIFL, Citi, JPM, MS, H&H and Others Price $ Bonds

January 17, 2025

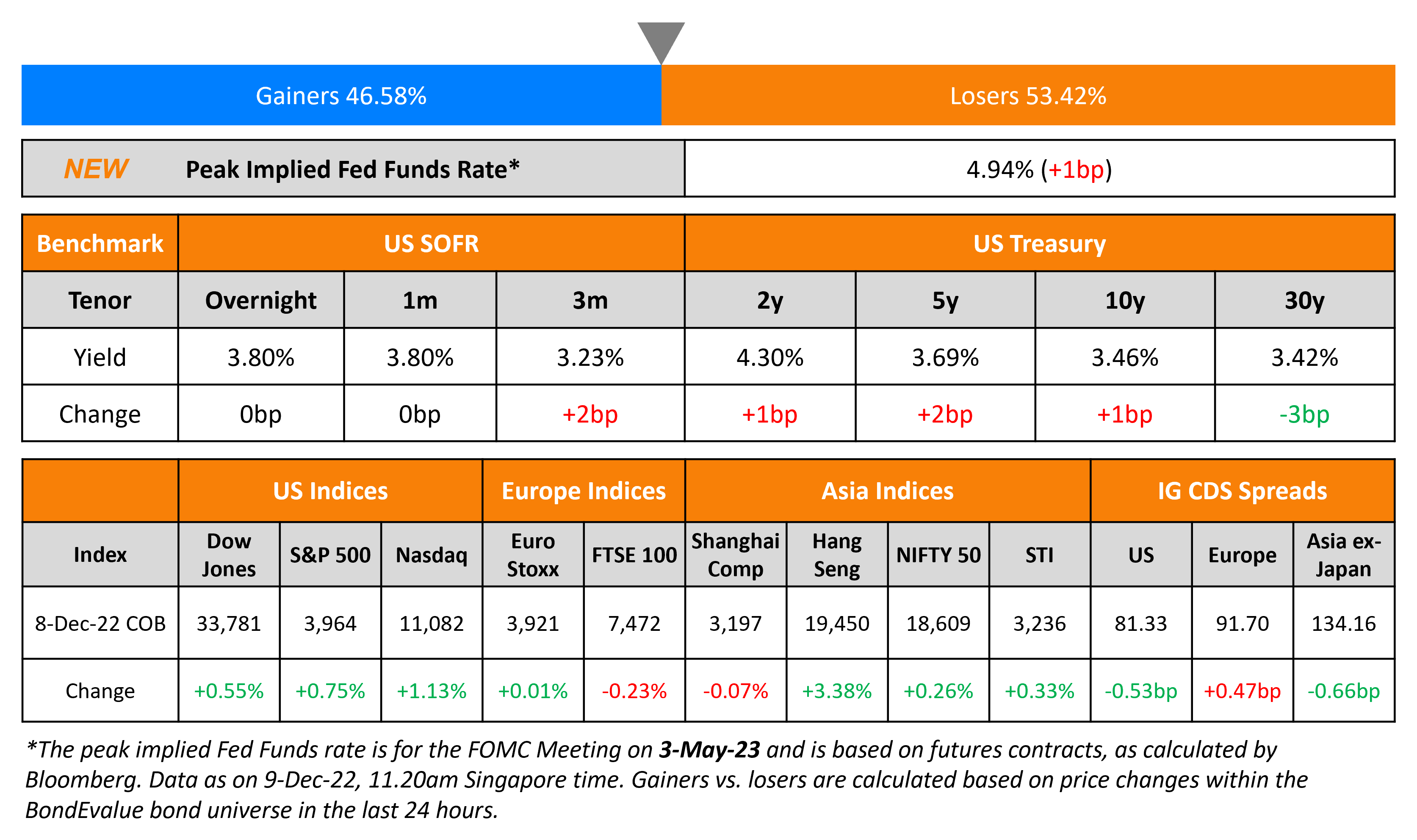

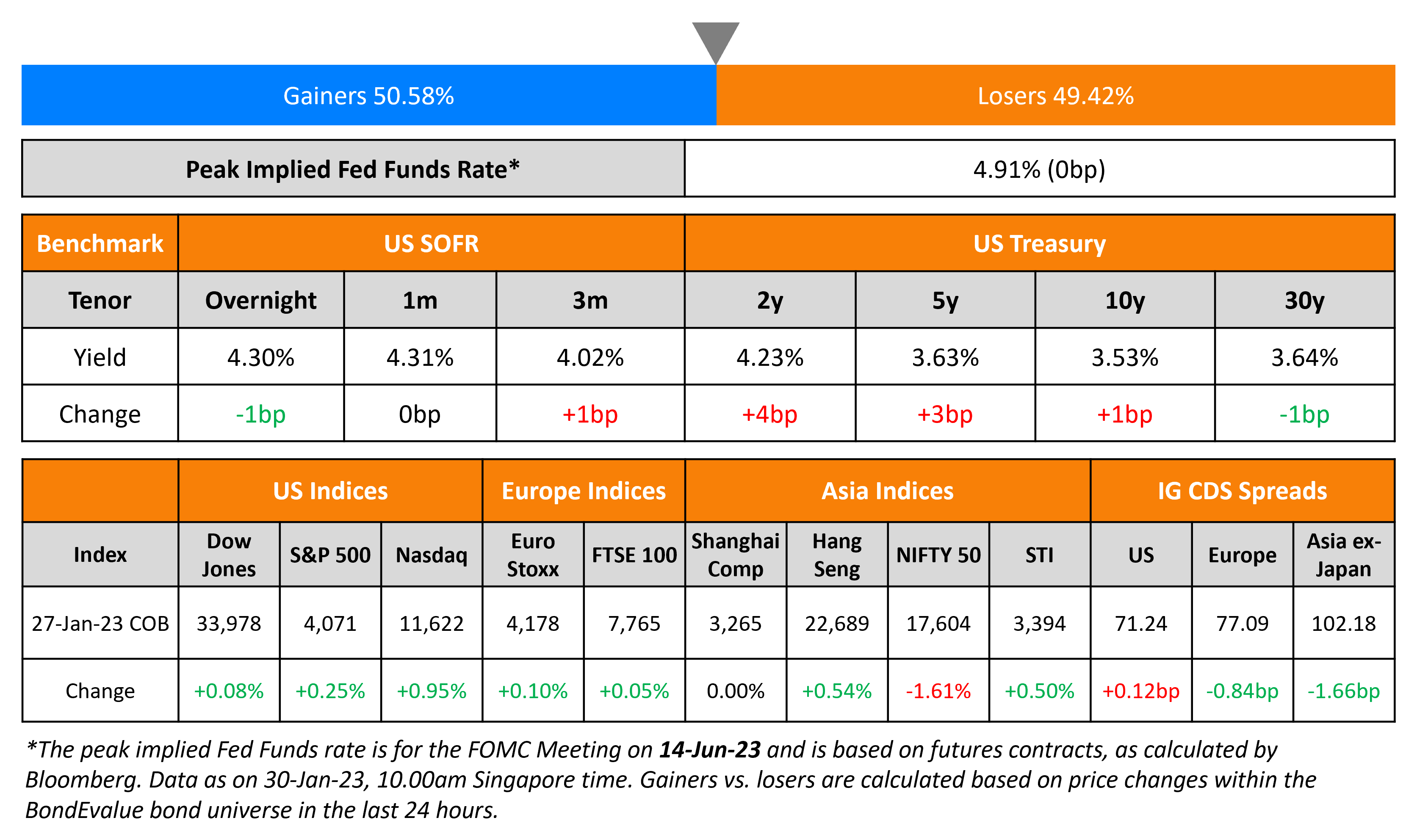

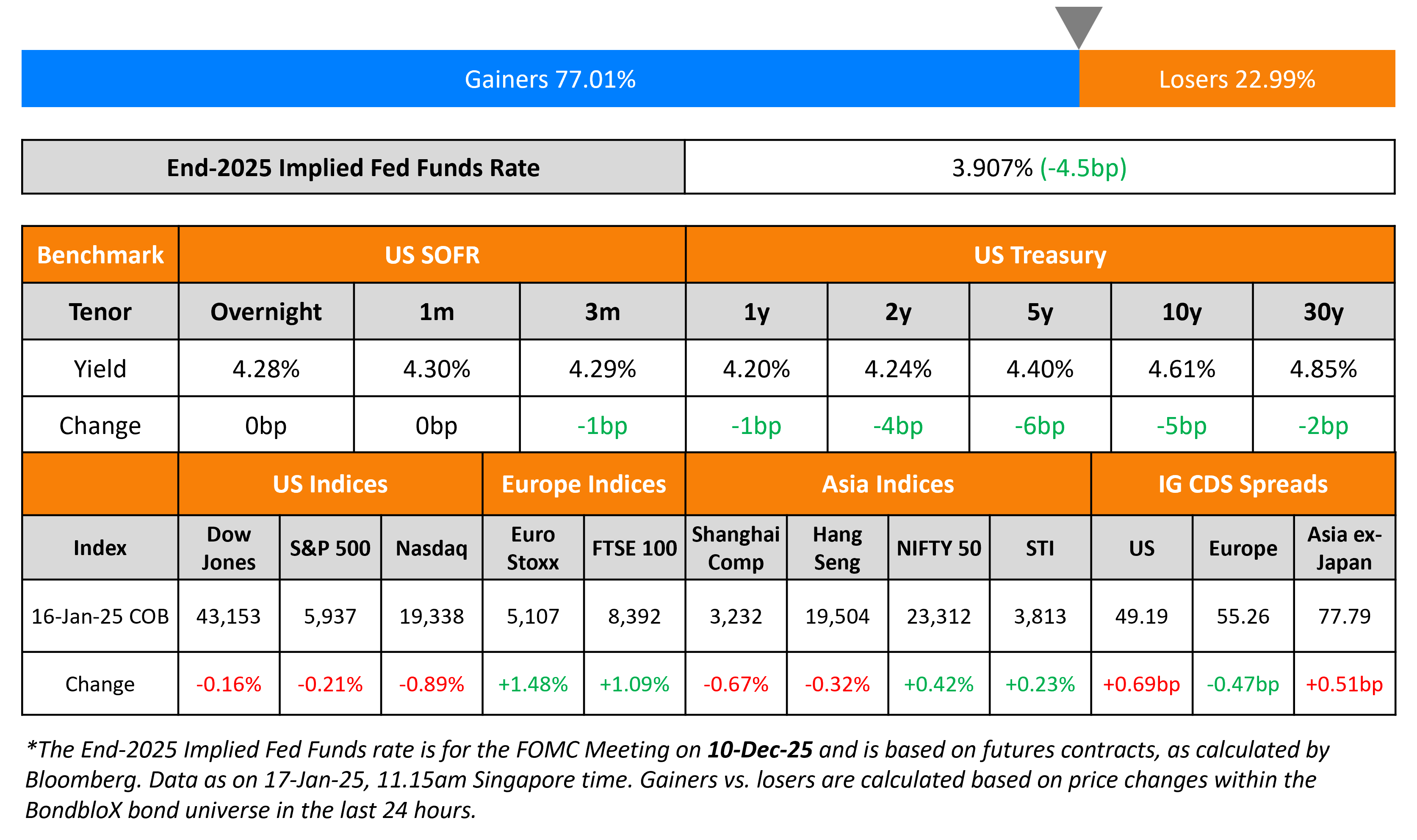

US Treasury yields eased further, by 4-6bp across the curve. US Retail Sales for December rose by 0.4%, lower than expectations of 0.6% and the prior month’s 0.8%. The core reading also rose by 0.3%, lower than expectations of 0.4%. Initial jobless claims for the previous week rose by 217k vs. expectations of 210k. On the positive side, the Philly Fed Business Outlook reading for January came-in at 44.3, much better than expectations of -5 and the prior month’s -16.4.

US IG and HY CDS spreads widened by 0.7bp and 4.5bp respectively. US equity markets ended lower, with the S&P and the Nasdaq down by 0.2% and 0.9%. European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.5bp and 0.8bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads were 0.5bp wider.

New Bond Issues

IIFL Finance raised $325mn via a 3.5Y bond at a yield of 8.8%, 20bp inside initial guidance of 9% area. The senior secured bond is rated B+/B+ (S&P/Fitch). There is a change of control put at 101. It has the following maintenance covenants: (a) Capital adequacy ratio of at least 15% to be maintained in line with RBI guidelines; (b) Security coverage ratio of at least 1x with a security at all times to consist of standard assets; (c) Net NPA ratio of at least 5%. Proceeds will be used for onward lending and supporting growth of its businesses.

Turkcell raised $1bn via a dual-trancher. It raised $500mn via a 5Y bond at a yield of 7.45%, 17.5bp inside the initial guidance of 7.625% area. It raised the other $500mn via a 7Y sustainability bond at a yield of 7.65%, 22.5bp inside the initial guidance of 7.875% area. The senior unsecured WNG bonds are rated as BB/B- (S&P/Fitch). Proceeds will be used to finance and/or refinance eligible projects in accordance with its framework.

Citigroup raised $3bn via a 11NC10 bond at a yield of 6.02%, 22bp inside initial guidance of T+165bp area. The subordinated note is rated Baa2/BBB/BBB+.

CaixaBank raised €1bn via a PerpNC7 bond at a yield of 6.25%, 37.5bp inside initial guidance of 6.625% area. The junior subordinated note is rated BB (S&P). If not called by 24 January 2033, the coupon will reset to the 5Y Mid-Swap plus 393.5bp, without any coupon step-up. A trigger event would occur if the CET1 ratio of the bank or group falls below 5.125%.

Health & Happiness raised $300mn via a 3.5NC1.5 bond at a yield of 9.7%, 42.5bp inside initial guidance of 10.125% area. The senior unsecured bond is rated Ba3/BB. Proceeds will be used to refinance existing debt, including funding repayment of 2026 notes, accrued interest, through a concurrent tender offer announced on January 13.

Morgan Stanley raised $8bn via a four-part offering.

The 4NC3 notes are issued by Morgan Stanley Bank NA, whereas the the 6NC5s and 11NC10s are issued by the group. Proceeds will be used for general corporate purposes.

JPMorgan raised $8bn via a four-part offering.

Wells Fargo raised $6bn via a three-part offering. It raised:

- $2.35bn via a 3NC2 bond at a yield of 4.9%, ~25.5bp inside initial guidance of T+90/95bp area.

- $650mn via a 3NC2 FRN at SOFR+78bp vs initial guidance of SOFR equivalent area

- $3bn via a 6NC5 bond at a yield of 5.244%, ~25.5bp inside initial guidance of T+110/115bp area.

The senior unsecured notes are rated A1/BBB+/A+. Proceeds will be used for general corporate purposes.

Rating Changes

-

Fitch Upgrades Arcos Dorados’ IDR to ‘BBB-‘; Outlook Stable

-

Fitch Upgrades Radian’s Ratings; Outlook Stable

-

Moody’s Ratings upgrades Zoetis to A3; stable outlook

-

Endeavor Group Holdings Inc. Downgraded To ‘B+’ On Higher Leverage After Buyout By Silver Lake; Outlook Stable

Term of the Day: Will Not Grow (WNG) Bonds

Bonds whose size is fixed and cannot be increased are called ‘Will Not Grow (WNG)’ or ‘No Grow’ bonds. Sometimes, issuers increase the final size of a deal to accommodate investor appetite. WNG bonds however have a fixed size and will not be increased. For example, green bonds often fall into this category as per the Climate Bonds Initiative (CBI). The CBI says that issuers need to show that there are enough green projects to match the amount that they intend to raise and for some, the number of suitable projects is limited. This according to them shows why green bonds tend to be smaller than vanilla bonds from the same issuer whereas for others there is more flexibility and the final size of the deal can be increased to accommodate investor appetite.

Talking Heads

On The Eyes-Closed High-Yield Emerging Bonds Trade Is Winding Down

Thys Louw, Ninety One UK

“The rally is pretty late-stage… just needed to close your eyes and buy anything within the high-yield space.”

Arif Joshi, Lazard Asset

“Focus on the idiosyncratic opportunities until the macro clears up”

Martin Bercetche, Frontier Road

“After such a significant rally in frontier spreads, are we getting paid enough for the risk?”

On Vanke’s Bond Selloff Signals Growing Worries About Debt Payments

Zerlina Zeng, Creditsights Singapore

“Bondholders are concerned about Vanke’s ability to repay its upcoming onshore bond and make coupon payments in January and February… More market participants would question China’s support measures and further underweight China in their bond portfolio”

On ECB Officials Seeing More Easing as Appropriate If Baseline Holds

“A measured pace of interest-rate cuts was consistent with the general notion that more ‘check points’ had to be passed… Some members noted that a case could be made for a 50 basis-point rate cut… gradual approach was needed”

Top Gainers and Losers- 17-January-25*

Go back to Latest bond Market News

Related Posts: