This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hyundai Capital, KNOC and Other Launch $ Bonds

March 24, 2025

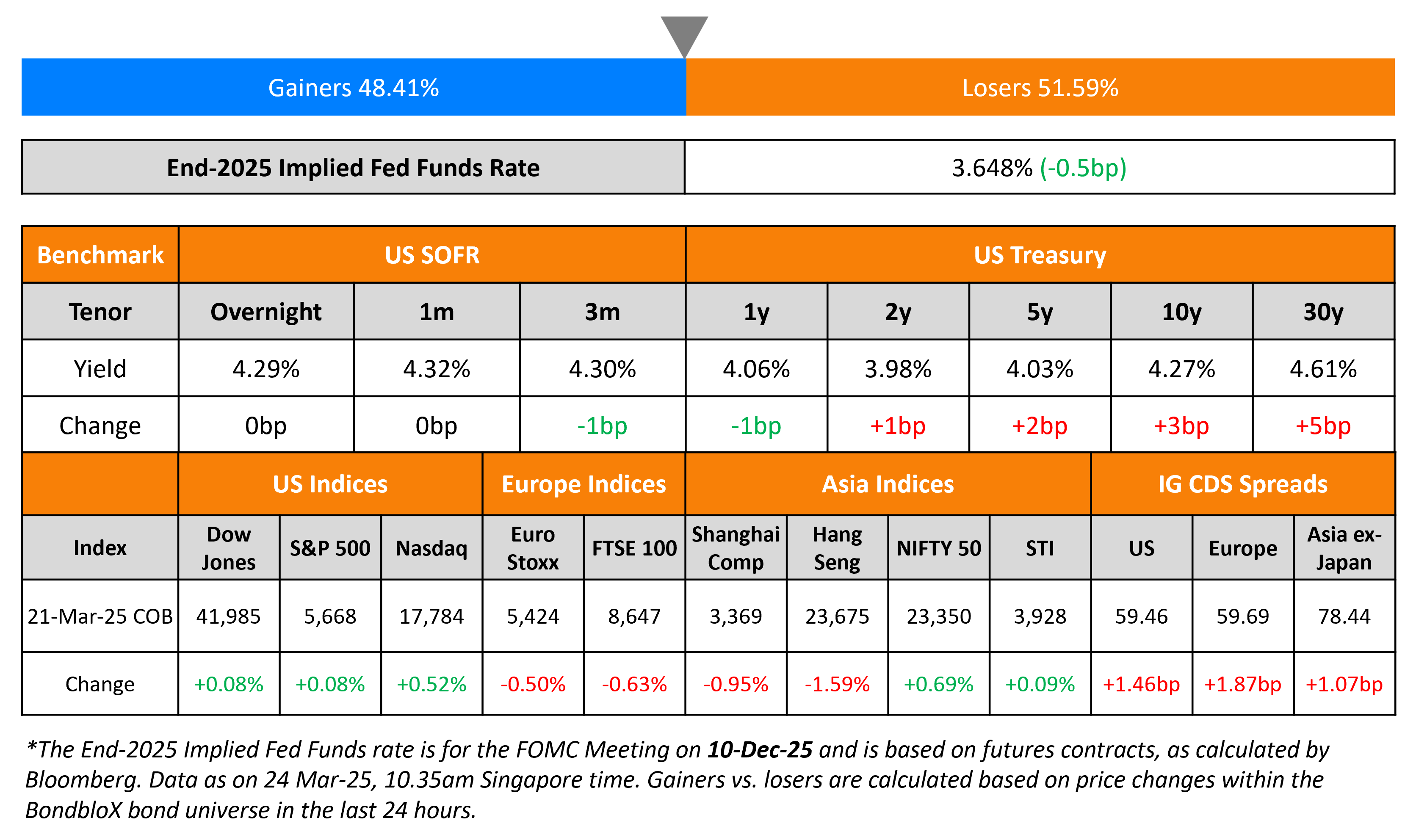

US Treasury yields were broadly stable on Friday. Fed Governor Christopher Waller said that the banking system has enough reserves for the Fed to keep its monthly Treasury QT pace unchanged. Chicago Fed President Austan Goolsbee said that the inflationary impact from tariffs could be transitory provided its scope is limited. Separately, New York Fed President John Williams said that monetary policy was in the right place and that there was no urgency to change interest rates.

US equity markets moved higher, with the S&P and Nasdaq up by 0.1% and 0.5% respectively. Looking at credit markets, US IG and HY CDS spreads widened by 1.5bp and 6.6bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 1.9bp and 7.5bp respectively. Asian equity markets have opened broadly weaker this morning. Asia ex-Japan CDS spreads were wider by 1.1bp.

New Bond Issues

-

Hyundai Capital $ 2Y/5Y/7Y at T+110/135/145bp area

-

Korea National Oil Corp $ 3Y/3Y FRN/5Y at T+95/SOFR eq/T+105bp area

-

Bausch Health $4bn 7NC3 at 10%

-

AVIC International Leasing $ 3Y/5Y FRN at T+110bp/SOFR+135bp area

- Marubeni $ 10Y at T+135bp area

Suntec Reit raised S$175mn via a 6Y bond at a yield of 3.4%. The note is guaranteed by HSBC Institutional Trust Services Singapore Ltd as a trustee. Proceeds will be used for general corporate purposes, financing/refinancing acquisitions and/or investments and financing any asset enhancement works.

New Bonds Pipeline

- Shinhan Bank hires for $ bond

- Morocco hires for € 4Y/10Y bond

- Jollibee hires for $ 5Y bond

- Petronas hires for $ 5Y Long/10Y/30Y bond

Rating Changes

-

Fitch Upgrades IAMGOLD’s IDR to ‘B+’; Outlook Stable

-

Albania Upgraded To ‘BB’ From ‘BB-‘ On Improved Fiscal Position; Outlook Stable

-

Lottomatica Group SpA Upgraded To ‘BB’ On Reduced Financial Sponsor Influence And Solid Performance; Outlook Stable

-

Ardagh Group Entities Downgraded To ‘CC’ Given Restructuring Discussions; Outlook Negative

-

Fitch Revises Outlook on Zhongyuan Agricultural Insurance to Positive, Affirms IFS at ‘A-‘

-

Emirate of Sharjah Outlook Revised To Negative On Rising Fiscal Risks; Ratings Affirmed At ‘BBB-/A-3’

-

Moody’s Ratings affirms Sammaan Capital’s B2 ratings; changes outlook to positive from stable

Term of the Day: Extension Risk

Extension risk is the risk of bonds not getting called by the issuer and thus extending the life of the bond. This is particularly significant in the case of far maturity bonds, Perpetual Bonds (Perps) and AT1s. While market participants often assume that Perps/AT1s will be called on their first call date, that is not always the case. There are a few examples in recent times. Santander and Deutsche Bank shocked the markets in 2019 and 2020 when they did not call their AT1s on the first call date. The most recent case of Deutsche Bank skipping the call on its 4.789% Perp also adds to the list of AT1s whose life has been extended.

Talking Heads

On Diversifying Your Portfolio

Bryan Armour, Morningstar

“We don’t know what’s going to happen, so don’t try to guess. Just hold a diversified portfolio and live to fight another day. Be boring… If you go active, mind your costs”

Emily Roland, John Hancock Investment Management

“It is going to be tough to get more multiple expansion (for equities) from here… What’s unappreciated is boring bonds. They’re mispriced and deserve more attention.”

On Options Market Focused on Jobs and Inflation Over Tariff Reveal

Anshul Gupta and Stefano Pascale, Barclays

“Through the lens of SPX options, markets appear to be downplaying the impact on US equities of the US’s implementation of agricultural and reciprocal tariffs”

Max Grinacoff, UBS Securities

Investors who are long US equities are not “flooding into puts, as they did on August 5th”

On Not Fighting Bessent’s Treasury’ Being the New Mantra in the US Bond Market

Guneet Dhingra, BNP Paribas

“What used to be often mentioned in the bond market is the idea of don’t fight the Fed. It’s somewhat evolving into don’t fight the Treasury.”

Subadra Rajappa, SocGen

“They’ve kind of capped yields. If they see yields start to drift higher than 4.5%, I think you are going to see them jawboning…”

Top Gainers and Losers- 24-March-25*

Go back to Latest bond Market News

Related Posts: