This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC, SBI, FAB, Brazil, ING, Fosun, Ford and Several Others Price $ Bonds

September 3, 2025

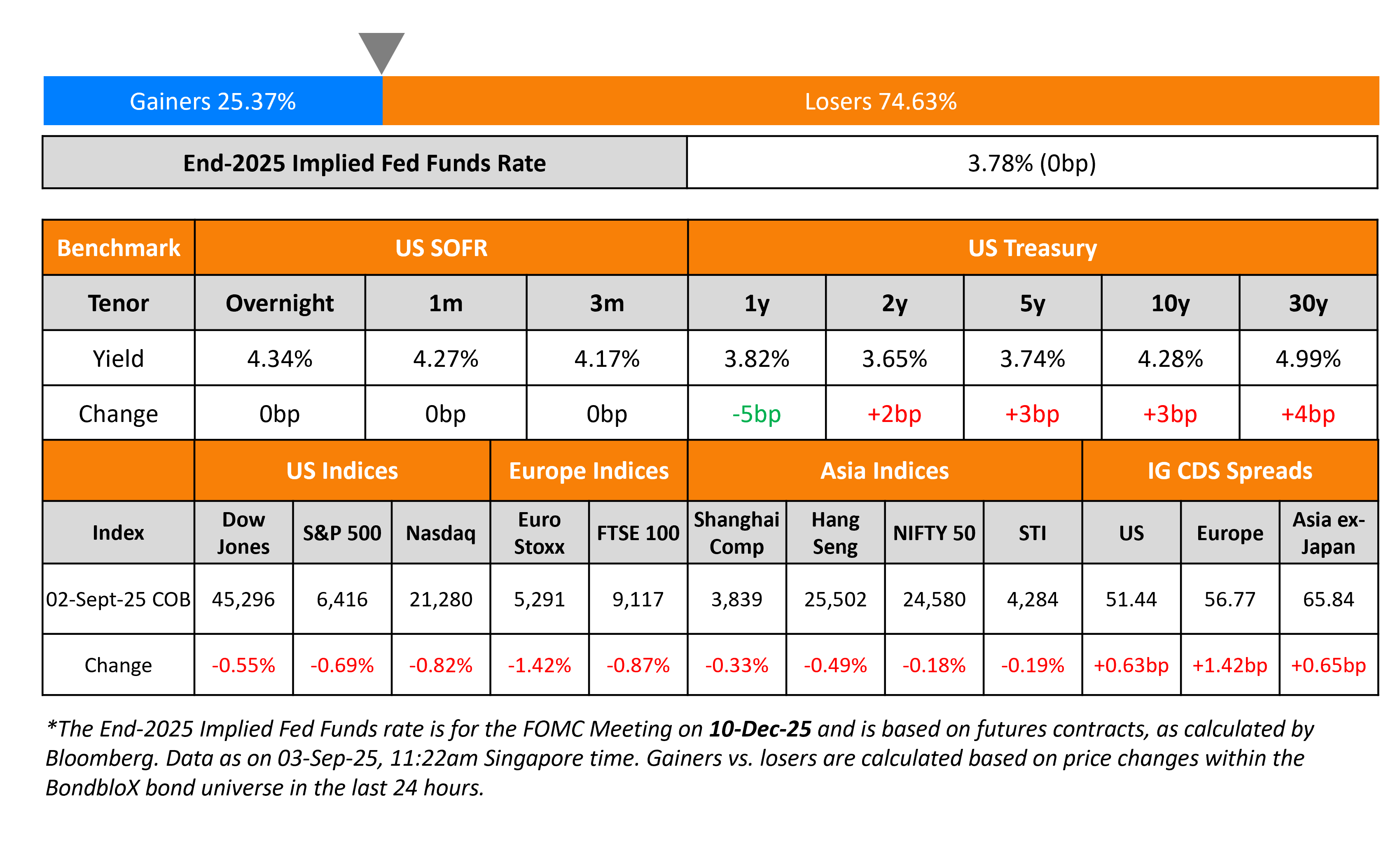

US Treasury yields inched higher by ~3bp across the curve. On the data front, the ISM Manufacturing PMI for August came-in at 48.7, contracting for a sixth straight month and also coming-in worse than expectations of a 49.0 print. While the Prices Paid subcomponent came-in softer than expectations, the New Orders index moved into expansionary territory (above the 50-reading) from the earlier contractionary reading. The tariff narrative continued to dominate the commentary from manufacturers as per the ISM survey.

Looking at US equity markets, the S&P and Nasdaq ended 0.7% and 0.8% lower respectively. US IG CDS spreads were 0.6bp wider and HY spreads widened by 3.4bp. European equity markets ended lower too. The iTraxx Main and Crossover CDS spreads were 1.4bp and 0.3bp wider. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were 0.7bp wider.

New Bond Issues

- PTTGC $ PerpNC5.25/PerpNC10 at 7%/7.625% area

- Sumitomo Life Insurance $ 30NC10 subordinated bond at 6.125% area

HSBC raised $1.5bn via a 11NC10 Tier-2 bond at a yield of 5.741%, 23bp inside initial guidance of T+170bp area. The subordinated note is rated Baa1/BBB/A-. Proceeds will be used for general corporate purposes and to maintain or further strengthen the issuer’s capital base. The new bond offers a yield pick-up of ~13bp over its existing 5.874% 2035s that currently yield 5.61%.

Ford raised $1.25bn via a 5Y bond at a yield of 5.73%, 27bp inside initial guidance of T+225bp area. It had also planned a 5Y FRN which was dropped at guidance stage. The senior unsecured note is rated Ba1/BBB-/BBB-. The new bond is priced roughly inline with its existing 7.35% 2030s that currently yield 5.69%.

Fosun International raised $400mn via a 4NC2.5 bond at a yield of 6.8%, 40bp inside initial guidance of 7.2% area. The senior secured note is rated BB- by S&P. The issuer is Fortune Star BVI Ltd. Proceeds will be used to refinance some of its existing offshore debt including any payment in connection with the concurrent buyback offer, for working capital and general corporate purposes.

State Bank of India (SBI) raised $500mn via a 5Y bond at a yield of 4.503%, 30bp inside initial guidance of T+105bp area. The senior unsecured bond is rated BBB/BBB-. The note has a change of control put at 101. Proceeds will be used for general corporate purposes and to meet the funding requirement of the SBI’s foreign offices/branches.

FAB raised $750mn via a 5Y sustainability bond at a yield of 4.38%, 30bp inside initial guidance of T+95bp area. The senior unsecured note is rated Aa3/AA-/AA-, and received orders of over $2.3bn, ~3.1x issue size. Proceeds will be used exclusively to fund or refinance, in whole or in part, a portfolio of eligible projects in line with its sustainable finance framework. The new bond is priced at a new issue premium of 5bp over its existing 5.153% 2030s that currently yield 4.33%.

ING Groep raised $1.5bn via a PerpNC7 AT1 bond at a yield of 7%, 37.5bp inside initial guidance of 7.375% area. The junior subordinated note is rated Ba1/BBB. If not called by 16 November 2032, the coupon will reset to the US 5Y SOFR Mid-Swap plus 359.4bp. A trigger event would occur if, at any time, the CET1 ratio on either a consolidated or an individual basis falls below 7%. Proceeds will be used for general corporate purposes and to strengthen its capital base.

Credit Agricole raised $1.5bn via a PerpNC10 AT1 bond at a yield of 7.125%, 37.5bp inside initial guidance of 7.50% area. The junior subordinated note is rated Baa3/BBB-/BBB. If not called by 23 September 2035, the coupon will reset to the US 5Y Mid-Swap plus 358.4bp. The new bond is priced at a new issue premium of ~31bp over its existing 6.7% Perp that currently yield 6.82%. Separately, Credit Agricole launched a tender offer to buy back its USD 8.125% Perp (at a purchase price of $101.125 per 100 in principal) and GBP 7.5% Perp (at a purchase price of £102.35 per 100 in principal). The offer expires on September 8, and the group plan to buy any/all of the above two notes for cash.

Brazil raised $1.75bn via a two-trancher. It raised $750mn via a tap of its 5.5% 2030s at a yield of 5.20%, 25bp inside initial guidance of 5.45% area. It also raised $1bn via a long 30Y bond at a yield of 7.50%, 25bp inside initial guidance of 7.75% area. Proceeds will be used in part for liability management transactions, including the purchases of its old bonds under its concurrent tender offer, and/or for repayment of outstanding federal public debt. It announced a tender offer for its 7.125% 2037s, 5.625% 2041s, 5% 2045s 5.625% 2047s, 4.75% 2050s and 7.125% 2054s.

Saudi Arabia raised $5.5bn via a two-part deal. It raised $3.25bn via a 5Y bond at a yield of 5.20%, 25bp inside initial guidance of T+95bp area. It also raised $2.25bn via a 10Y bond at a yield of 5.50%, 25bp inside initial guidance of T+105bp area. Saudi Arabia has already sold around $14.5bn of sovereign debt in dollars and euros this year, the most among emerging markets after Mexico, as per Bloomberg.

MUFG raised $4bn via a four-part deal.

If not called by its call date in 2035, the PerpNC10’s coupon will reset to the US 5Y Treasury yield plus 207bp.

Arab National Bank raised $750mn via a PerpNC5.5 AT1 sukuk at a yield of 6.4%, 47.5bp inside initial guidance of 6.875% area. The junior subordinated note is unrated, and received orders of over $2.45bn, ~3.3x issue size. If not called by 9 March 2031, the coupon will reset to the US 5Y Treasury yield plus 259.9bp.

BHP Billiton raised $1.5bn via a two-part deal. It raised $500mn via a 10Y bond at a yield of 5.045%, 23bp inside initial guidance of T+100bp area. It also raised $1bn via a 30Y bond at a yield of 5.799%, 29.5bp inside initial guidance of T+112.5bp area. The senior unsecured notes are rated A1/A. Proceeds will be used for general corporate purposes.

ORIX raised $500mn via a 5Y bond at a yield of 4.489%, 25bp inside initial guidance of T+100bp area. The note is rated A3/A-/BBB+. Proceeds will be used for general corporate purposes.

Nomura Holdings raised $750mn via a 10.75NC5.75 Tier-2 bond at a yield of 5.043%, 30bp inside initial guidance of T+160bp area. The subordinated note is rated BBB.

Norinchukin Bank raised $1bn via a two-part deal. It raised $500mn via a 5Y bond at a yield of 4.674%, 32bp inside initial guidance of T+125bp area. It also raised $500mn via a 10Y bond at a yield of 5.359%, 32bp inside initial guidance of T+140bp area. The senior unsecured notes are rated A1/A.

New Bond Pipeline

-

Turkey Wealth Fund $ bond

-

CBQ hires for $ 5Y bond

-

Sobha Realty hires for $ 5Y bond

-

SK Hynix plans $ 3Y/5Y bond

-

KHFC hires for $ 3Y/5Y FRN bond

Rating Changes

-

Spirit Airlines LLC Downgraded To ‘D’ On Chapter 11 Bankruptcy Filing; EETC Ratings Lowered

-

Moody’s Ratings affirms Atrium’s Baa2 rating, outlook changed to stable

Term of the Day: Additional Tier 1 (AT1) Bonds

Additional Tier 1 (AT1) bonds are hybrid securities issued by financial institutions to meet their regulatory capital requirements. AT1s typically carry a provision wherein the instruments can be fully or partially written-down or converted to equity if the issuing bank’s capital ratio falls below a certain threshold. This is why AT1s are also known as contingent convertibles (CoCos). The key characteristics of AT1 bonds are:

– They have a perpetual maturity with a call option

– They are subordinated in nature, and the first line of debt to incur losses

– They can be written-down or converted into equity on the occurrence of a “trigger event”

– Coupons are usually higher as compared to other debt by the issuer, to compensate investors for the higher risk AT1s carry. However, coupons can be discretionary in nature.

Talking Heads

On Loss of Fed independence would push up borrowing costs – ECB member, Isabel Schnabel

“Any attempt to undermine central bank independence is going to lead to an increase in medium and long-term interest rates. History is very clear about the benefits of central bank independence: it lowers risk premia and it eases financing conditions for households, firms and governments… If the loss of Fed independence happened – and I very much hope that it doesn’t – this would be very disruptive for the global financial system and it also would have an impact on the ECB”

On Euro-Zone Inflation Well Under Control – ECB’s Governing Council member, Francois Villeroy

“With this relative resilience, it’s more important than ever to deal with the French economy’s number one problem: our very excessive deficits and debt… Today there is no easy, effortless solution for fiscal repair… the longer our country waits to attack this, the more painful the medicine will be”

On Treasuries Joining Global Bond Selloff With 30-Year Yield Near 5%

Kathy Jones, Charles Schwab

“The bond market is telling you, not just here but everywhere else, it is worried about the path that we are on… market will continue to price in a higher term premium until we get some sort of coherent policy or a signal that the economy is slowing down”

Ed Al-Hussainy, Columbia Threadneedle

ISM report was “in line with weak expectations for the labor market and some recovery in demand looking ahead”

John Briggs, Natixis

“The 30-year bonds may just be stalling a little here against 5%… don’t think it’s a magical number at all and I have had some serious concerns (about long end)

Top Gainers and Losers- 03-Sep-25*

Go back to Latest bond Market News

Related Posts: