This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC Prices Tier 2 at 6.547%; All Eyes on US CPI

June 13, 2023

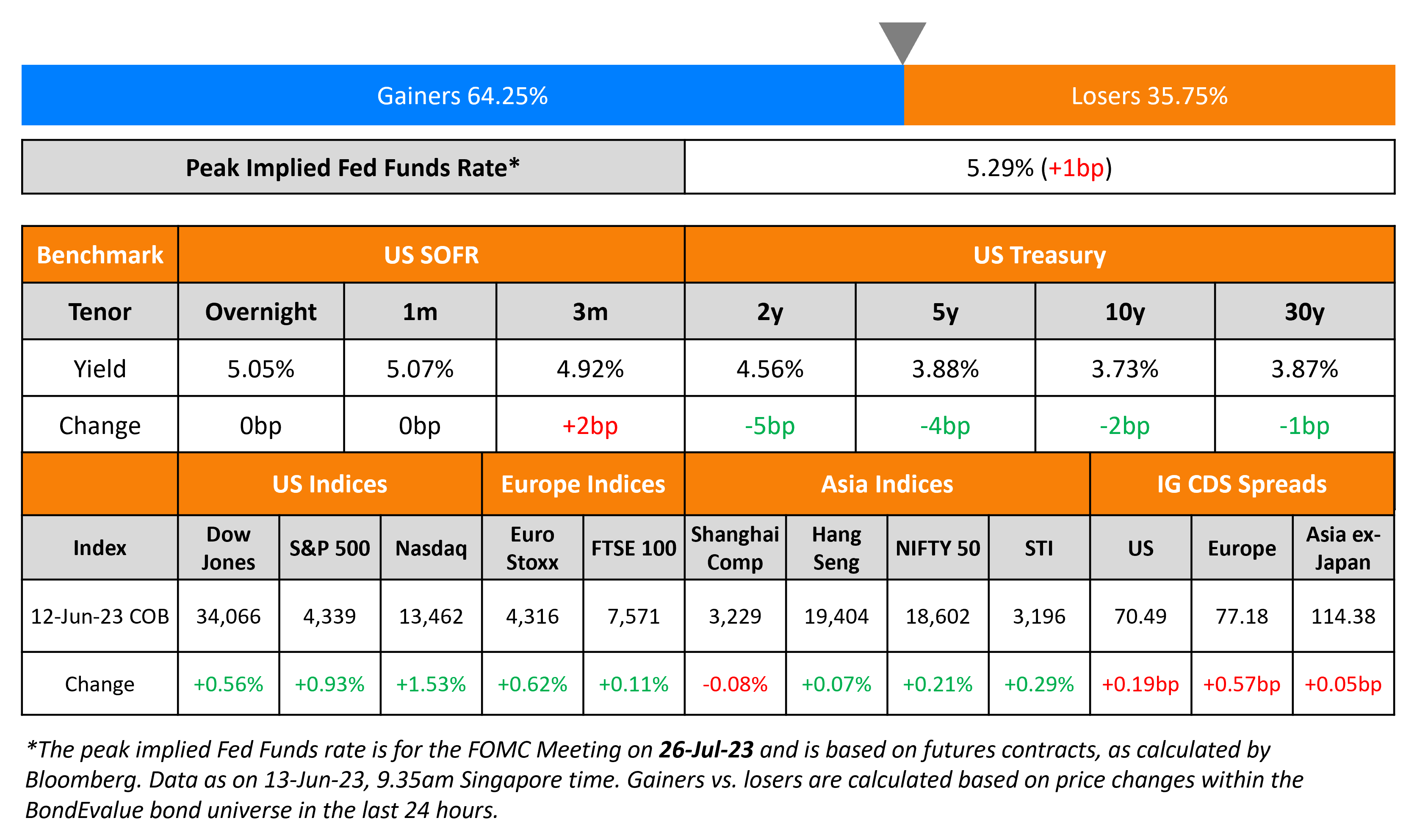

US Treasury yields moved lower on Monday by up to 5bp across the curve. Expectations of a rate pause at tomorrow’s meeting stands at 80%. For the July meeting, markets are pricing in a 57% probability of a 25bp rate hike and a 12% likelihood of a 50bp increase. The peak Fed Funds Rate was 1bp higher at 5.29% for July. All eyes are now on the US CPI data due later today – expectations are for a headline CPI print of 4.1% and core CPI of 5.2% for May. This compares to 4.9% and 5.5% in April respectively. Equity indices ended higher with the S&P and Nasdaq up by 0.9% and 1.5%. US IG and HY CDS spreads widened 0.2bp and 0.5bp respectively.

European equity indices closed slightly higher. European main CDS spreads were 0.6bp wider and Crossover spreads widened 1.6bp. Asia ex-Japan CDS spreads were flat and Asian equity markets have opened broadly in the green this morning.

We Are Merging Our Brands BondEvalue and BondbloX

We are excited to share that we will be merging our two brands – BondEvalue, our bond information service, with BondbloX, our award-winning bond exchange. BondbloX will be the name of the combined brand going forward. Read more about the change and what it means for you here.

New Bond Issues

HSBC raised $2bn via a 11NC10 Tier 2 bond at a yield of 6.547%, 30bp inside initial guidance of T+310bp area. If not called on the call date, the coupon will reset at the overnight SOFR plus a spread of 298bp and will be paid quarterly until the maturity date. The subordinated notes have expected ratings of Baa1/BBB/A-. Proceeds will be used for general corporate purposes, including to maintain or further strengthen capital base pursuant to UK capital requirements regulation (CRR). The new bonds are priced largely in-line with its comparable 8.113% Tier 2 bond due November 2033, callable in November 2032 that was yielding 6.57% at the time of final pricing of the new bonds. The yields on both the Tier 2s have since moved a tad higher as can be seen in the table below, where we have listed comparable dollar Tier 2 bonds from prominent banks.

Intesa Sanpaolo raised $2.75bn via a two-part deal. It raised $1.25bn via a 10Y senior preferred bond at a yield of 6.634%, 25bp inside initial guidance of T+315bp area. It also raised $1.5bn via a 31NC30 senior non-preferred bond at a yield of 7.778%, 35bp inside initial guidance of T+425bp area. The 10Y paper has expected ratings of Baa3/BBB-/BBB-, while the 31NC10 notes have expected ratings of Baa1/BBB/BBB, due to the difference in seniority.

New Bonds Pipeline

- SK Broadband hires for $ 3Y or 5Y bond

- Pertamina Geothermal hires for bond

Rating Changes

- Moody’s downgrades NagaCorp’s CFR to B3, changes outlook to negative

- Nasdaq Inc. Downgraded To ‘BBB’ From ‘BBB+’ On Announced Acquisition Of Adenza Group; Outlook Stable

- Moody’s affirms

UBS Group AG’s senior unsecured debt ratings at A3 and changes the outlook to positive from negative and upgrades Credit Suisse Group AG’s senior unsecured debt ratings to A3, with a positive outlook, concluding review for upgrade

- Fitch Downgrades UBS and Upgrades Credit Suisse on Closing of Acquisition; Outlooks Stable

Term of the Day

Subordinated Bonds

Subordinated bonds refer to bonds that rank below senior debts on the capital structure. In the event of liquidation, holders of subordinated debt would only be paid after all the senior debt is repaid. Thus, the ratings and yield of subordinated debt tend to be lower and higher respectively, to account for the greater risk associated with subordinated vs. senior debt.

There are different kinds of subordinated debt that can include perpetuals/AT1 CoCos, Tier 2s, payment-in-kind notes, mezzanine debt, convertible bonds, vendor notes etc. Subordinated debt rank higher to preferred equity and common equity in the capital structure.

Talking Heads

On Bond Traders’ Misperception of Inflation – Citigroup strategist Raghav Datla

“We do not think markets have been adequately pricing downside risks for inflation heading into the May inflation release…A lower-than-forecast print is likely to propel a decline in front-end inflation expectations…Bond traders have overestimated month-over-month headline inflation heading into four of the last seven CPI releases.”

On a Potential Fed Rate Hike Amidst Stickier Inflation – Goldman Sachs CEO David Solomon

“Inflation is a little bit stickier, and I do think, in the distribution of outcomes, there’s a reasonable chance that rates go higher.”

On Record Low US Junk-Bond Maturities

Bob Kricheff, portfolio manager and global strategist at Shenkman Capital

“Shorter maturity is helping lead to shorter duration that theoretically creates less volatility, but it also is likely leading to shorter maturity walls…This can cause problems, especially if financial liquidity tightens too much… As long as capital markets stay liquid and we continue to see issuance, it shouldn’t be a problem…If not, companies will have trouble reaching maturities.”

Andrzej Skiba, Head of BlueBay US Fixed Income at RBC Global Asset Management

“Another reason for the shrinking maturities is the exodus of Covid-era fallen angels that have recovered…Those borrowers expanded overall maturities on being downgraded, which contracted again as they ascended.”

On Fed’s Future Interest Rate Decisions

Andrew Ticehurst, rates strategist at Nomura

“(Investors are) signaling that rates will have to hold at a higher level for longer than previously thought…Central banks are not yet done: rates are still going to go up a little bit, and we’ve already had a little bit of a scare last week already with the Reserve Bank of Australia and Bank of Canada raising rates unexpectedly.”

Praveen Korapaty, strategist at Goldman Sachs

“Absent a recession, we remain skeptical that the amount of easing currently priced will be realized… We continue to believe risks to these forward rates are to the upside.”

On Potential Future BOE Rate Hikes – BOE policy maker Jonathan Haskel

“My own view is that it’s important we continue to lean against the risks of inflation momentum, and therefore that further increases in interest rates cannot be ruled out…Inflation remains much too high…we remain committed to bringing it back to our 2% target, and that is what we will do. Our tool for doing this is interest rates.”

Top Gainers & Losers – 13-June-23*

Go back to Latest bond Market News

Related Posts: