This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC Prices $ AT1 at 6.95%; YapiKredi Prices 5Y at 7.25%

February 25, 2025

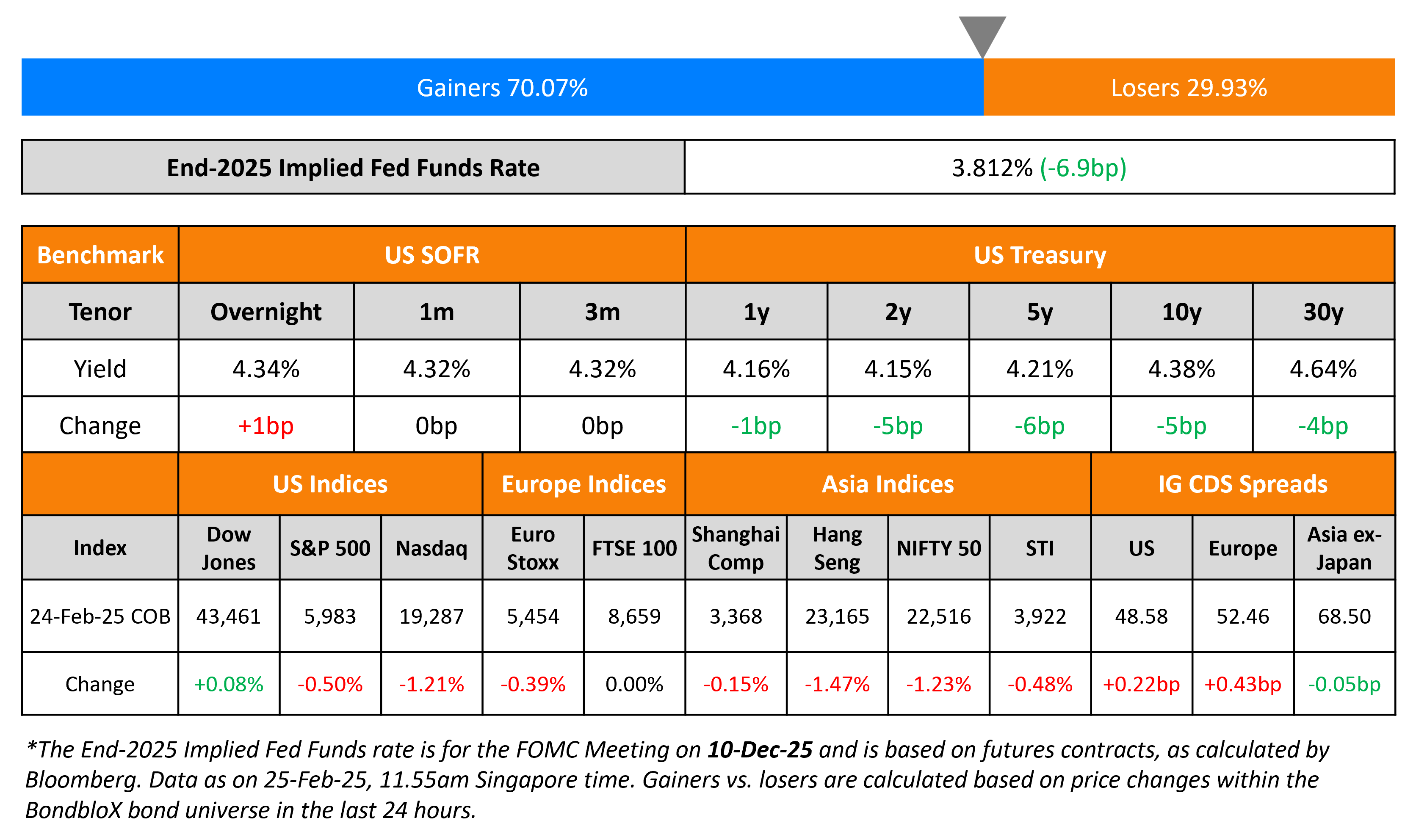

US Treasury yields ticked lower again on Monday, by 5-6bp across the curve, as the broad risk-off sentiment continued to weigh. On Friday, US President Donald Trump signed a memorandum directing the CFIUS to restrict Chinese investments in strategic areas such as technology and energy. The Office of the US Trade Representative has made a proposal to curb China’s dominance in shipbuilding.

US equity markets saw the S&P and Nasdaq ending lower by 0.5% and 1.2% respectively. Looking at credit markets, US IG and HY CDS spreads were 0.2bp and 2.1bp wider respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads widened by 0.4bp and 2.4bp respectively. Asian equity markets have opened broadly weaker this morning. Asia ex-Japan CDS spreads were tighter by 0.1bp.

New Bond Issues

-

Varanasi Aurangabad $ 9NC3 at 6.375% area

-

Bank of China $ 3Y FRN at SOFR+105bp area

HSBC raised $1.5bn via a PerpNC7 bond at a yield of 6.95%, 55bp inside initial guidance of 7.50% area. The junior subordinated notes are rated Baa3/BBB (Moody’s/Fitch). If not called by 27 February 2032, the coupon will reset to the 5Y UST plus 263.5bp. Proceeds will be used for general corporate purposes and to maintain or further strengthen its capital base. A capital adequacy trigger event will occur if at any time the non-transitional consolidated CET1 ratio is less than 7%.

YapiKredi raised $500mn via 5Y bond at a yield of 7.25%, 37.5bp inside initial guidance of 7.625% area. The senior unsecured notes are rated BB-, and received orders of over $1.5bn, 3x issue size. Proceeds will be used for general corporate purposes.

Rating Changes

-

Moody’s Ratings upgrades Samarco to B2; outlook changed to positive from stable

-

Fitch Upgrades Western Alliance Bancorporation to ‘BBB’; Outlook Stable

-

Fitch Downgrades Newfold Digital’s IDR to ‘CCC+’

-

Fitch Revises Outlook on Bahrain to Negative; Affirms at ‘B+’

-

Moody’s Ratings places Coinbase on review for upgrade (B2 corporate family rating)

Term of the Day: Eurobond

A Eurobond is a bond denominated in any currency other than the home currency of the country or market in which it is issued. Eurobonds are a way for companies to raise funds by issuing bonds in a foreign currency and generally come with the issuing currency suffixed. For example, a Chinese company raising money in USD will issue a euro-dollar bond and if it raises money in Yen, it would be called a euro-yen bond.

Euro-dollar bonds should not be confused with euro denominated bonds since the former is denominated in USD. The word ‘Euro’ here implies any currency other than the issuer’s home currency. These bonds are issued to entice investors to the currency in which the bond is issued but from a foreign market.

Talking Heads

On Skepticism by the Bond Market regarding Musk’s DOGE (Department of Governmental Efficiency)

Kent Smetters, Wharton School, University of Pennsylvania

“The actual cuts so far have been small and the relatively larger cuts have been mostly curtailed by court actions… not enough to appease bond markets that are seeing a ballooning deficit.”

Ian Lyngen, BMO Capital Markets

“There isn’t any practical way for investors to evaluate the effectiveness of the DOGE initiatives at this stage … difficult to envision any true clarity for the foreseeable future.”

On Detriment to the Global Economy due to Trump administration

Lesetja Kganyago, South African Reserve Bank

“We are seeing trade fragmentation, we are seeing economic fragmentation, and it just raises the level of uncertainty”

On the “Killer” effects of ending tax breaks for the NYC MTA (Metropolitan Transportation Authority)

Kevin Willens, MTA (NYC)

“There’s been discussion of eliminating tax exemptions for public sector infrastructure projects, which would be a killer to our ability to raise capital…Unless we got additional revenue, we’d have to borrow less because debt service cost for every dollar borrowed would be higher”

Top Gainers and Losers- 25-February-25*

Go back to Latest bond Market News

Related Posts: