This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC Prices $7bn Deal; Kenya, Danske, Doha Bank Price $ Bonds

February 27, 2025

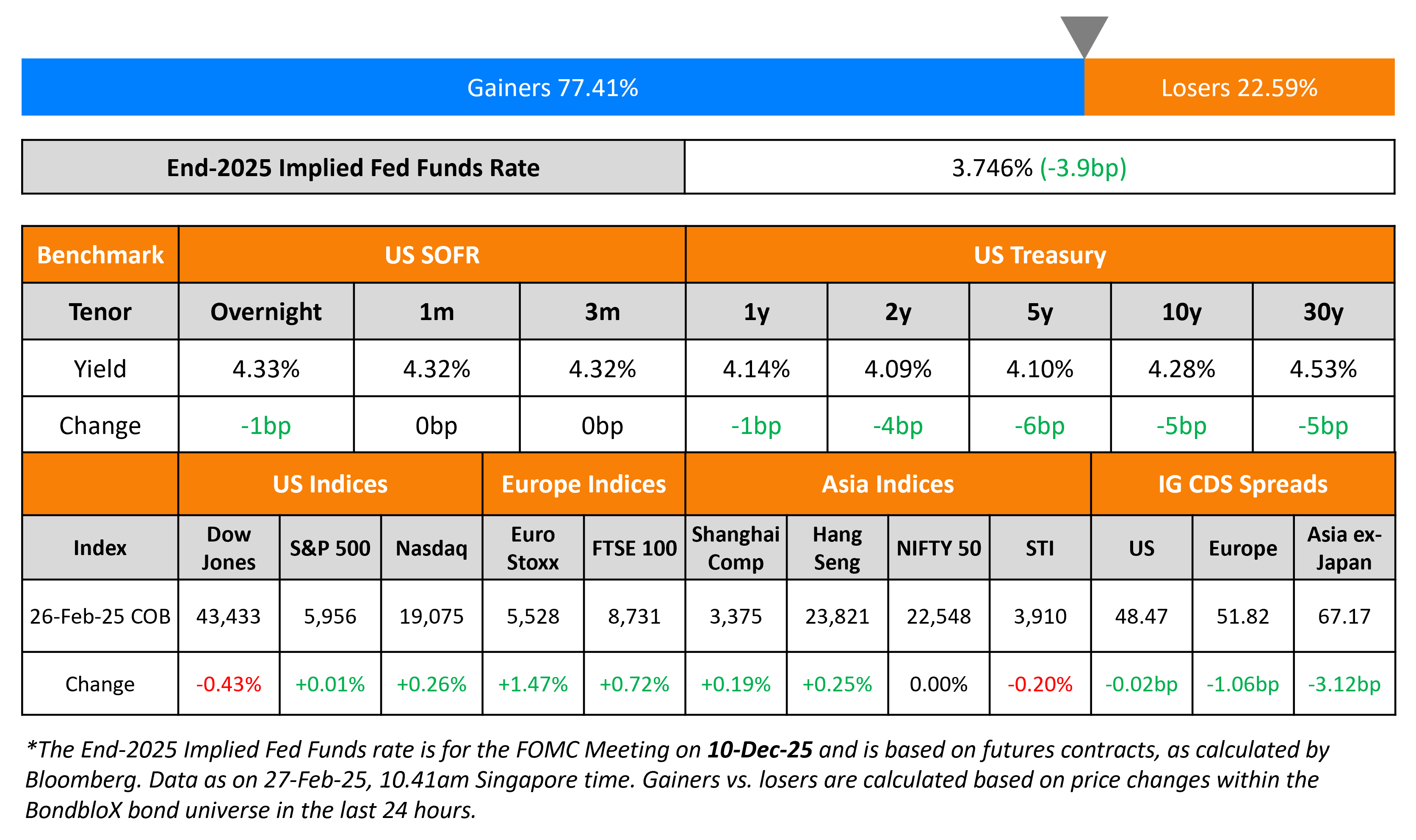

US Treasuries yields continued to ease, down by 4-6bp across the curve. The spread between the US 10Y yield and the 3m T-Bill has again turned negative, after moving into positive territory in early December. US January new home sales fell 10.5% MoM, to its lowest in three months. Separately, Atlanta Fed President Raphael Bostic said that the Fed should keep interest rates steady and show a “restrictive posture”.

US equity markets saw the S&P and Nasdaq ending marginally higher. Looking at credit markets, US IG and HY spreads CDS spreads were flat. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads tightened by 1.1bp and 6.3bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by 3.1bp.

New Bond Issues

HSBC raised $7bn via a five-part issuance

The senior unsecured notes are rated A3/A-/A+. Proceeds will be used for general corporate purposes.

Kenya raised $1.5bn via a 11Y bond at a yield of 9.95%, 55bp inside initial guidance of 10.50% area. The bond is rated B-/B- (S&P/Fitch). Proceeds will be used to finance repayment of outstanding debt, including purchasing its $900mn 7% 2027s under its tender offer, and any remaining funds for general budgetary expenditure and refinancing purposes.

Doha Bank raised $500mn via a 5Y bond at a yield of 5.35%, 35bp inside initial guidance of T+155bp area. The senior unsecured note is rated Baa1/A (Moody’s/Fitch). Proceeds will be used for general corporate purposes.

Danske Bank raised $750mn via a 6NC5 bond at a yield of 5.109%, ~24.5bp inside initial guidance of T+115/120bp area. The senior non-preferred note is rated Baa1/A-/A+. Proceeds will be used for general corporate purposes.

Rating Changes

-

Moody’s Ratings upgrades Buenaventura’s ratings to Ba3; stable outlook

-

Fitch Upgrades Western Alliance Bancorporation to ‘BBB’; Outlook Stable

-

Fitch Downgrades Nissan Motor to ‘BB+’; Outlook Negative

-

Fitch Downgrades Reno de Medici S.p.A. to ‘B’; Outlook Negative

-

Fitch Revises Hasbro’s Outlook to Stable; Affirms IDR at ‘BBB-‘

Term of the Day: Interest Rate Swaps (IRS)

Interest rate swaps (IRS) are derivative contracts used to hedge against the risks of interest rates rising/falling for a period of time. They typically entail paying/receiving a fixed interest rate whilst simultaneously receiving/paying a floating interest rate (like LIBOR or SOFR) plus a spread in return. IRS are of two types, a payer swap and a receiver swap. In the former, the party entering the swap pays a fixed interest rate in return for a floating rate; in the latter, the party entering the swap receives a fixed interest rate and pays a floating rate in return. If an issuer issues a fixed-rate bond, they are exposed to the risk of interest rates falling and thereby having to pay a higher current coupon rate. Thus, they can enter into a receiver swap where they essentially nullify the fixed rate component (pay a fixed coupon whilst receiving a fixed rate on the swap) and thereby end up having to pay only a floating rate. Thus the swap converts a fixed rate bond into a floating rate instrument.

Talking Heads

On Predictions of Big Capital Returns from Lloyds

Robert Noble, Deutsche Bank

“Very few European banks offer the same enviable combination of strong revenue growth; tangible net asset value; dividend and buyback growth that Lloyds has to offer…If the business plan continues to deliver then there is further substantial upside for shareholders.”

Aman Rakkar, Barclays

“[The fundamentals on offer at Lloyds are] too good to ignore.”

On Investors’ Anticipation of Federal Reserve Pivot to Focus on Slowing Economic Growth

Matthew Hornbach, Morgan Stanley

“[If central bank] rhetoric grows more dovish as a result of better core PCE inflation data, we think that investors will buy more duration – allowing market-implied trough rates to fall further”

On Fed’s quantitative tightening expectations upended by debt-ceiling worries

Wrightson ICAP

“We assume that the FOMC would be inclined to ‘slow’ the overall pace of runoffs rather than freeze them altogether… the concern expressed in the January FOMC minutes may be less about the level of bank reserves and more about how quickly they fall between August and October”

LH Meyer

“Pausing potentially turns into a full stop if not resumed… Resumption might prove tricky, especially if the debt-limit episode was bruising in retrospect for market-function confidence”

Top Gainers and Losers- 27-February-25*

Go back to Latest bond Market News

Related Posts: