This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC, Meta, Ziraat Bankasi, Santander, NatWest Price $ Bonds

October 31, 2025

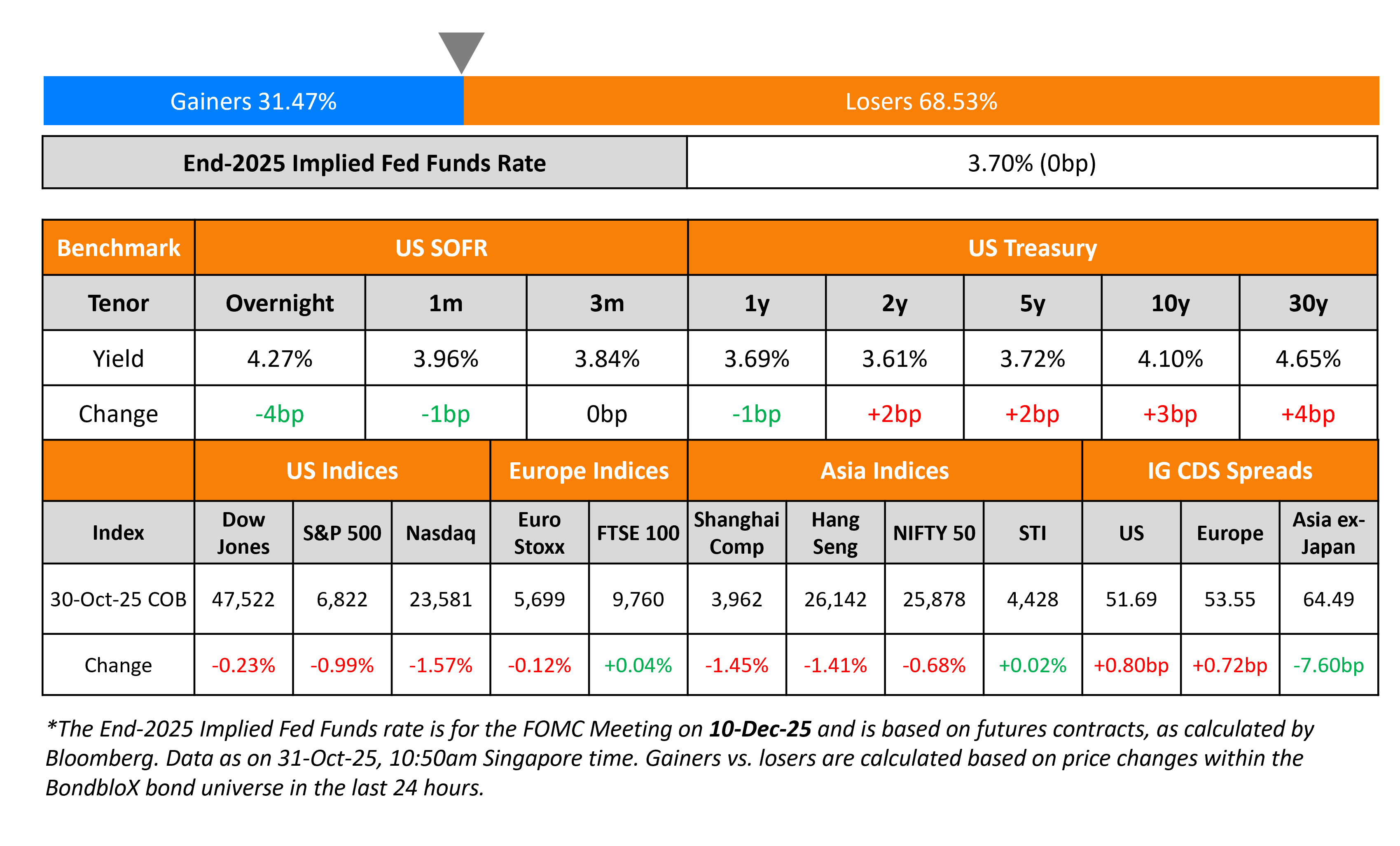

US Treasury yields continued to rise, by 2-3bp on Thursday. US President Donald Trump and Chinese Presient Xi Jinping concluded their summit. The US agreed to reduce fentanyl-related tariffs on China by 10% and suspend the 24% reciprocal tariff imposed on Chinese goods for a year. The overall tariff rate on Chinese goods will fall to 47% from 57% earlier. Meanwhile, China will suspend the expanded export controls on rare earths, begin buying US energy and will restart its purchases of American soybeans.

Looking at equity markets, the S&P and Nasdaq ended lower by 1.0 and 1.5%. The US IG and HY CDS spreads widened by 0.8bp and 3.2bp respectively. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.7bp wider while the Crossover CDS spreads were 0.1bp wider. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 7.6bp tighter. The BOJ voted 7-2 to keep its target rate unchanged at 0.50% (inline with expectations), with two dissenting votes favouring a 25bp increase. BOJ Governor Kazuo Ueda said that they wanted to wait for “a bit more data”.

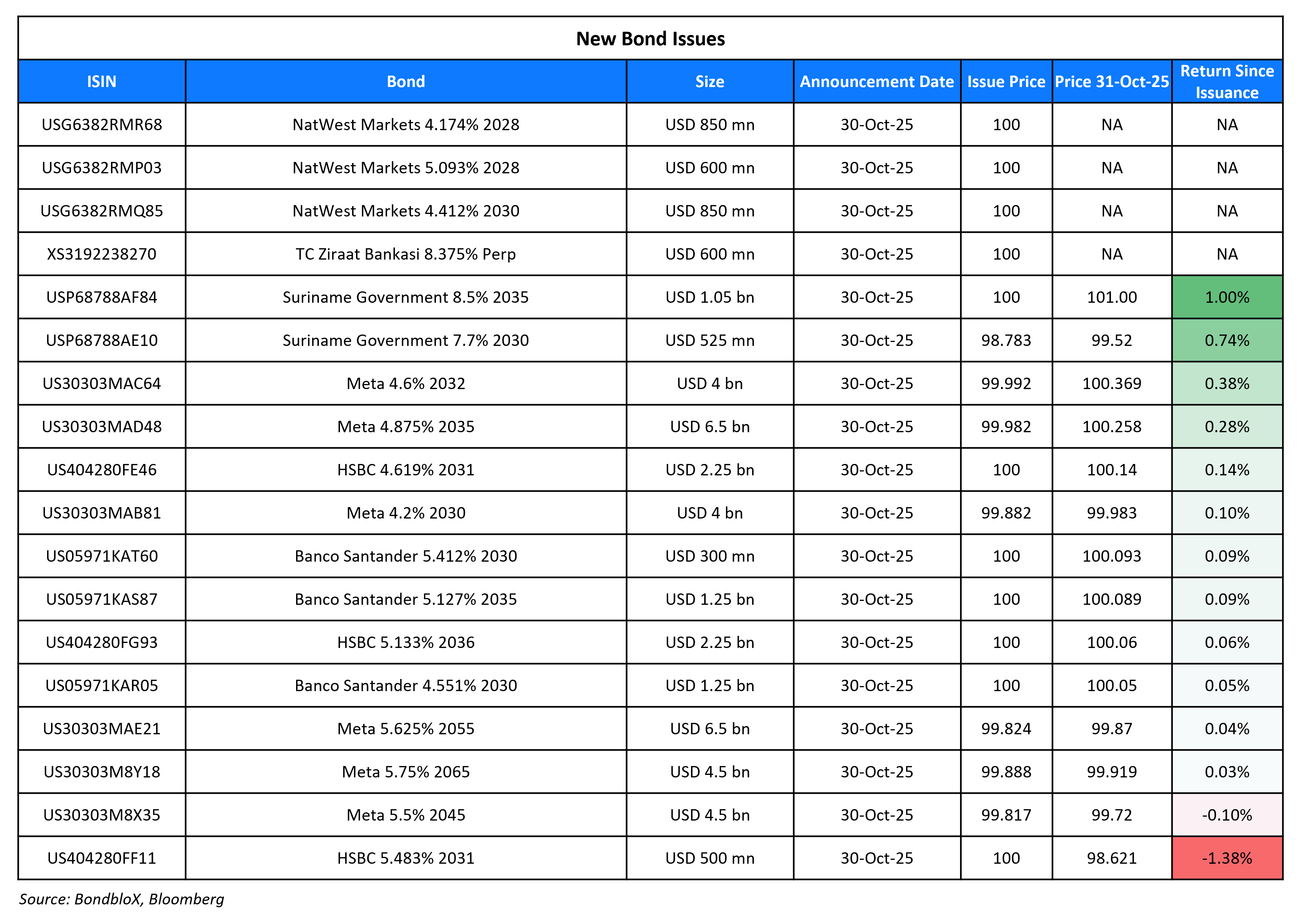

New Bond Issues

HSBC raised $5bn via a three-part deal. It raised:

- $2.25bn via a 6NC5 bond at a yield of 4.691%, 25bp inside initial guidance of T+115bp area

- $500mn via a 6NC5 FRN at SOFR+119bp vs. initial guidance of SOFR equivalent area

- $2.25bn via a 11NC10 bond at a yield of 5.133%, 25bp inside initial guidance of T+130bp area

The senior unsecured notes are rated A3/A-/A+. Proceeds will be used for general corporate purposes.

NatWest Markets raised $2.3bn via a three-part deal. It raised:

- $850mn via a 3Y bond at a yield of 4.174%, 23bp inside initial guidance of T+80bp area

- $600mn via a 3Y FRN at SOFR+80bp vs. initial guidance of SOFR equivalent area

- $850mn via a 5Y bond at a yield of 4.412%, 25bp inside initial guidance of T+90bp area

The senior unsecured notes are rated A1/A/AA-. Proceeds will be used for general corporate purposes.

Santander raised $2.8bn via a three-part deal. It raised:

- $1.25bn via a 5Y bond at a yield of 4.551%, 27bp inside initial guidance of T+110bp area

- $300mn via a 5Y FRN at SOFR+112bp vs. initial guidance of SOFR equivalent area

- $1.25bn via a 10Y bond at a yield of 5.127%, 27bp inside initial guidance of T+130bp area

The senior non-preferred notes are rated Baa1/A+/A. Proceeds will be used for general corporate purposes.

TC Ziraat Bankası raised $600mn via a PerpNC5.5 AT1 bond at a yield of 8.375%, ~43.75bp inside initial guidance of 8.75-8.875% area. The junior subordinated note is rated B3 by Moody’s. If not called by 5 May 2031, the coupon will reset to the US 5Y Treasury yield plus 461.6bp. A write-down trigger event may ocur if the CET1 ratio falls below 5.125%. Proceeds will be used for general corporate purposes.

Suriname raised $1.575bn via a two-trancher. It raised $525mn via a 5Y bond at a yield of 8%. It also raised $525mn via a 10Y bond at a yield of 8.5%. The senior unsecured notes are rated Caa1/CCC+. Proceeds will be used to refinance existing debt including its outstanding 2033s and a portion of the Oil-Linked Securities and/or certain bilateral debt.

YPF raised $500mn via a tap of its 8.75% 2031s at a yield of 8.25%, 25bp inside initial guidance of 8.5% area. The senior unsecured note is rated B2/B-. Proceeds will be used to (a) refinance existing debt (b) finance working capital (c) finance investments in fixed assets in Argentina, and/or (d) finance the acquisition of shares of companies or businesses located in Argentina.

New Bonds Pipeline

- KEPCO $ sustainability bond

-

Export Finance Australia A$ 5Y bond

Rating Changes

- Mongolia Upgraded To ‘BB-‘ On Sustained Fiscal Consolidation And Strong Growth; Outlook Stable

- Moody’s Ratings upgrades Magnolia’s CFR to Ba2; stable outlook

- Cheniere Corpus Christi Holdings LLC Debt Rating Raised To ‘BBB+’ On Stage 3 Progress, Outlook Positive

- Moody’s Ratings places Raizen’s Baa3 ratings under review for downgrade

- Moody’s Ratings affirms Clearwater’s Ba3 CFR; outlook changed to negative

- Fitch Revises Borr Drilling’s Outlook to Negative; Affirms IDR at ‘B’

- Elevance Health Inc. Rating Lowered To ‘A-‘ From ‘A’ Due To A Lower Capital Adequacy Assessment; Outlook Stable

Term of the Day: SOFR

Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. SOFR is calculated as a volume-weighted median of three rates – tri-party repo data collected from BNY Mellon, General Collateral Financing (GCF) Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC’s DVP service, which are obtained from DTCC Solutions LLC. SOFR was selected as the representative rate for use in USD derivatives, and was suggested as an alternative to LIBOR.

Talking Heads

On Powell’s December Warning Exposing Hardening Divisions at Fed

Pooja Sriram, Barclays

“This was clearly something that we did not expect there would be such a strong pushback against. The one thing that we can make out from the press conference is they clearly had a lot of discussion about December”

Joe Brusuelas, RSM US

“Expect dissents to be a near-permanent feature of the meetings going forward”

On US Heading for Debt ‘Reckoning’ If Growth Flags – David Solomon, Goldman Sachs CEO

“If we continue on the current course and we don’t take the growth level up, there will be a reckoning. The path out is a growth path… Fiscal stimulus and an aggressive fiscal play is really just embedded… accelerated meaningfully in the last five years”

On Fed’s language shows they are ‘stuck in the past’ – Scott Bessent, US Treasury Secretary

“The decision by the Federal Reserve yesterday – the decision to cut rates by 25 basis points, I applaud, but the language that went with it, tells me that this Fed is stuck in the past. Their inflation estimates have been terrible so far this year… Their models are broken”

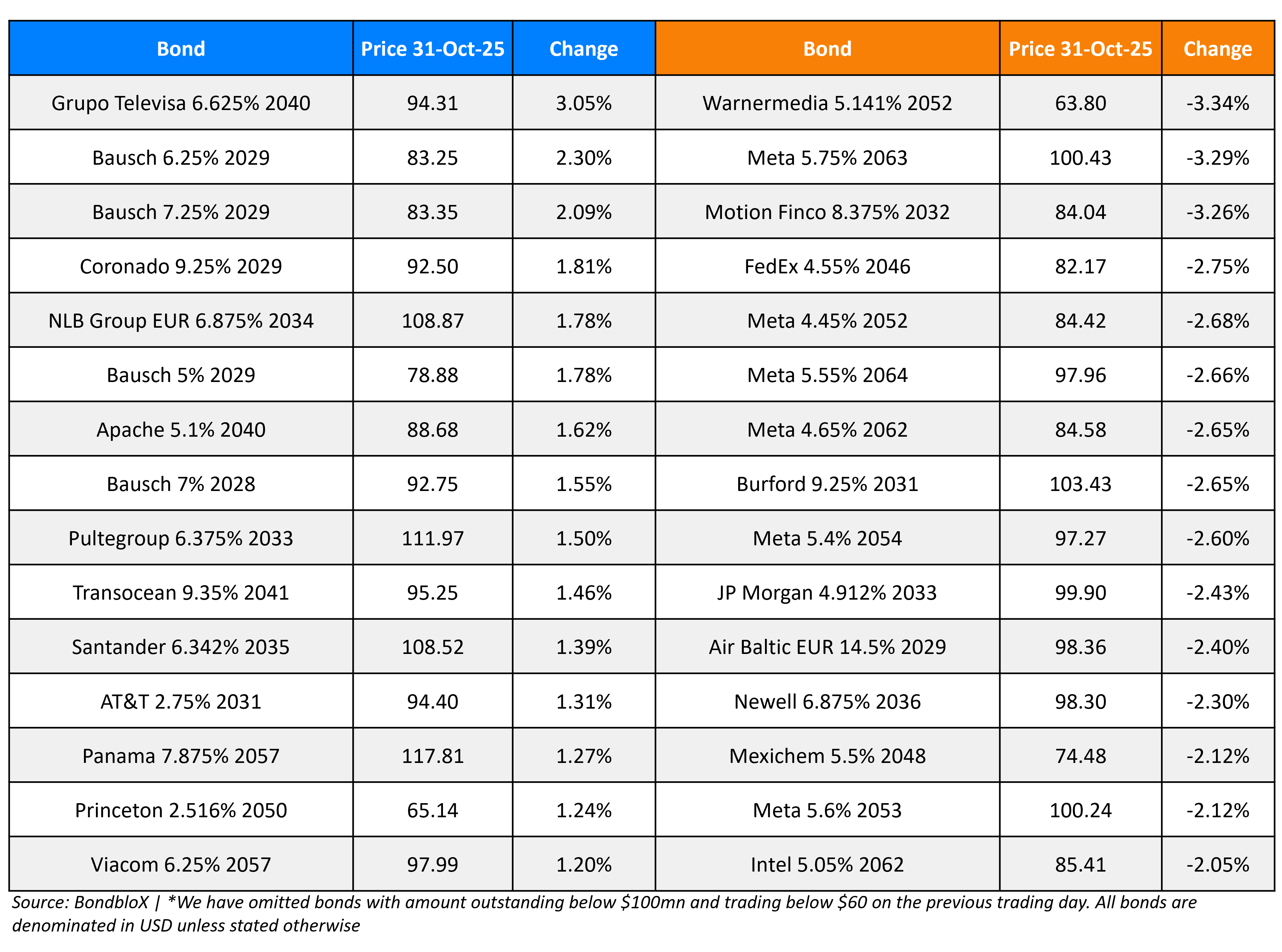

Top Gainers and Losers- 31-Oct-25*

Go back to Latest bond Market News

Related Posts: