This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC, Medco, AIB Price $ Bonds

May 9, 2025

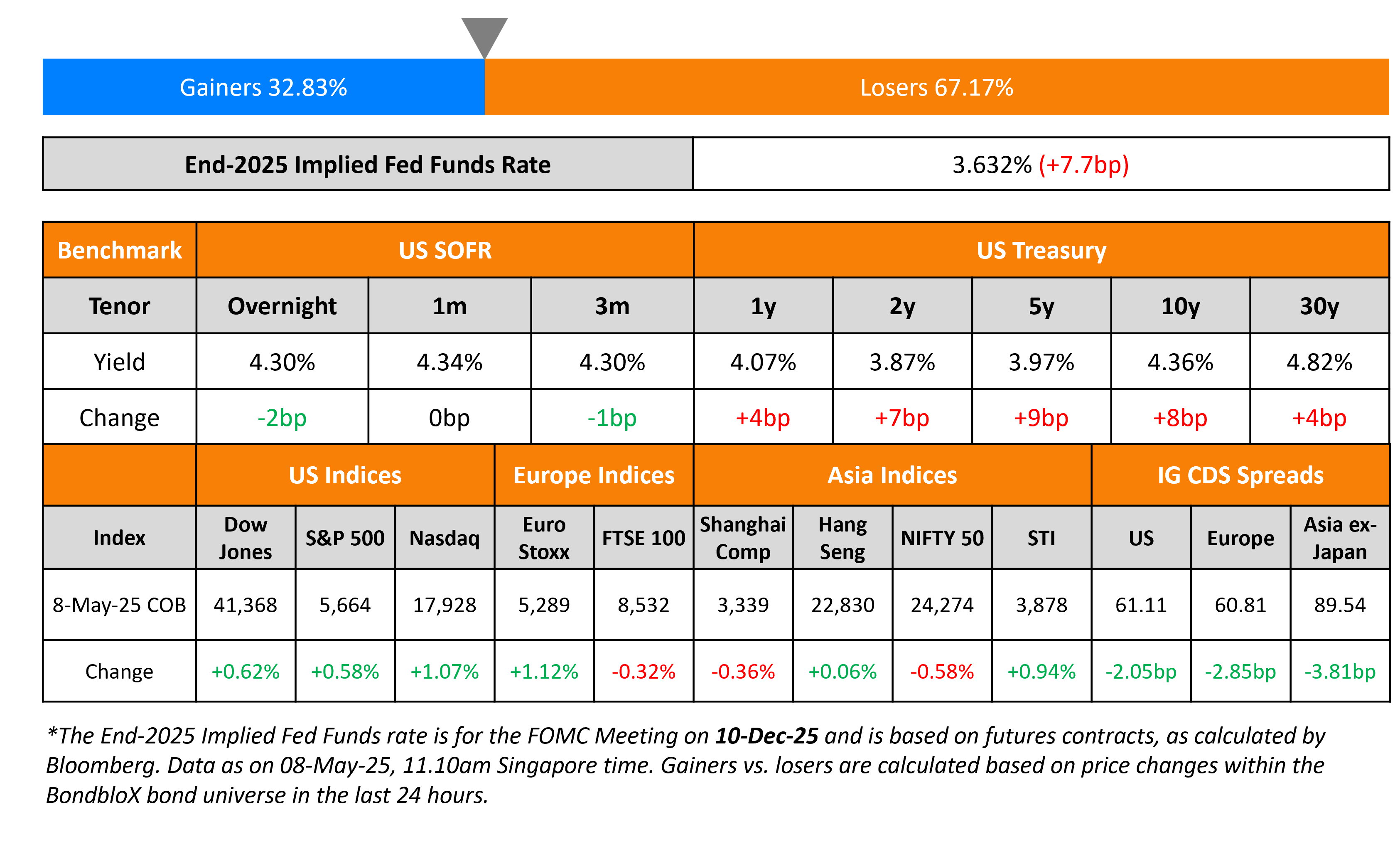

US Treasury yields rose across the curve by as much as 9bp. Initial jobless claims for the prior week in the US showed an increase of 228k, better than expectations of 230k. The US reached a trade deal with the UK and will maintain a 10% blanket tariff on UK imports.

Looking at equity markets, the S&P and Nasdaq were both higher by 0.6% and 1.1% respectively. Looking at credit markets, US IG CDS spreads were tighter by 2.1bp, while HY CDS spreads tightened by 6.5bp. European equity markets ended mixed. The iTraxx Main CDS spreads tightened by 2.9bp and Crossover CDS spreads tightened by 10.4bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 3.8bp.

New Bond Issues

HSBC raised $5.5bn via a three-trancher. It raised:

- $2.25bn via a 6NC5 bond at a yield of 5.24%, 30bp inside initial guidance of T+155bp area

- $1.25bn via a 6NC5 FRN at SOFR+157bp vs. initial guidance of SOFR equivalent area

- $2bn via 11NC10 bond at a yield of 5.79%, 30bp inside initial guidance of T+170bp area

The senior unsecured notes are rated A3/A-/A+. Proceeds will be used for general corporate purposes.

Medco Energi raised $400mn via a 5NC2 bond at a yield of 8.875%, 25bp inside initial guidance of 9.125% area. The guaranteed notes are rated B1/BB-/BB-. Proceeds will be used to refinance/repay existing debt (including 2026s and 2027s) via a tender, redemption or other purchase offers. The bond’s covenants include a debt incurrence test of a FCCR greater than 3x and net debt-to-EBITDA lower than 5x, in line with its existing notes. The notes have a first priority lien on the collateral consisting of (a) a charge by Medco Strait Services Ptd. Ltd. of all the capital stock (b) a security interest granted over all of the issuer’s rights in the interest reserve account and (c) an assignment by the issuer of its interest and rights under intercompany loans.

AIB Group raised $750mn via a 6NC3 bond at a yield of 5.32%, 32bp inside inside initial guidance of T+165bp area. The senior unsecured note is rated A3/BBB. Proceeds will be used for general corporate purposes.

Rating Changes

-

Coeur Mining Inc. Upgraded To ‘B+’ On Strong Credit Metrics; Outlook Stable; Debt Ratings Raised

-

Hikma Pharmaceuticals PLC And Senior Notes Upgraded To ‘BBB’ On Continued Good Business Momentum; Outlook Stable

-

Moody’s Ratings upgrades Gatwick Funding’s and Gatwick Airport Finance’s ratings to Baa1/Ba2; stable outlook

-

Fitch Upgrades Hanwha Life’s IFS Rating to ‘A+’; Outlook Stable

-

Fitch Places BBVA on Rating Watch Positive on Possible Sabadell Deal

-

NTT Corp. Ratings Placed On CreditWatch Negative On Planned Tender Offer For NTT Data Group

New Bonds Pipeline

- Pertamina Hulu Energi hires for $ 5Y/10Y bond

- Sobha Realty hires for $ Long 3Y bond

Term of the Day: Special Drawing Rights (SDR)

Special Drawing Rights (SDR) issued by the IMF to its member countries’ central banks are a reserve asset that can be exchanged for hard currencies with another central bank. The value of an SDR is set daily based on a basket of five major international currencies: the USD (43.38%), the EUR (29.31%), the CNY (12.28%), the JPY (7.59%) and the GBP (7.44%). An allocation of SDRs requires approval by IMF members holding 85% of the total votes and US is the biggest holding 16.5% of the votes.

Talking Heads

On Powell Keeping Congress on His Side, Despite Trump’s Criticism

Frank Lucas, member of the House Financial Services Committee

“He’s done quite admirably, considering what he’s faced. He’s a stabilizing force”

Sam Tombs, Pantheon Macroeconomics

His comments amounted to an “assertion of independence,” as well as a “thinly-veiled critique” of Trump’s trade policy

On Neuberger Berman, Aberdeen Favoring Indian Bonds Despite Border Row

Peeyush Mittal, Matthews International

“As clarity emerges that this is not a war-like situation, foreign investors will again acknowledge the relative safe haven status of Indian equities… India has to be seen in a positive light and not negative — that should mean higher allocation than what it has had recently”

On China says it has full confidence in ability to manage US trade issues

“We have no fear… We have full confidence… We do not want any kind of war with any country. But we have to face up to the reality. As you can see, people have full confidence in our capability to overcome all the difficulties.”

Top Gainers and Losers- 9-May-25*

Go back to Latest bond Market News

Related Posts: