This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC Launches S$ PerpNC5.5; OUE, IS Bank Price Bonds

June 6, 2024

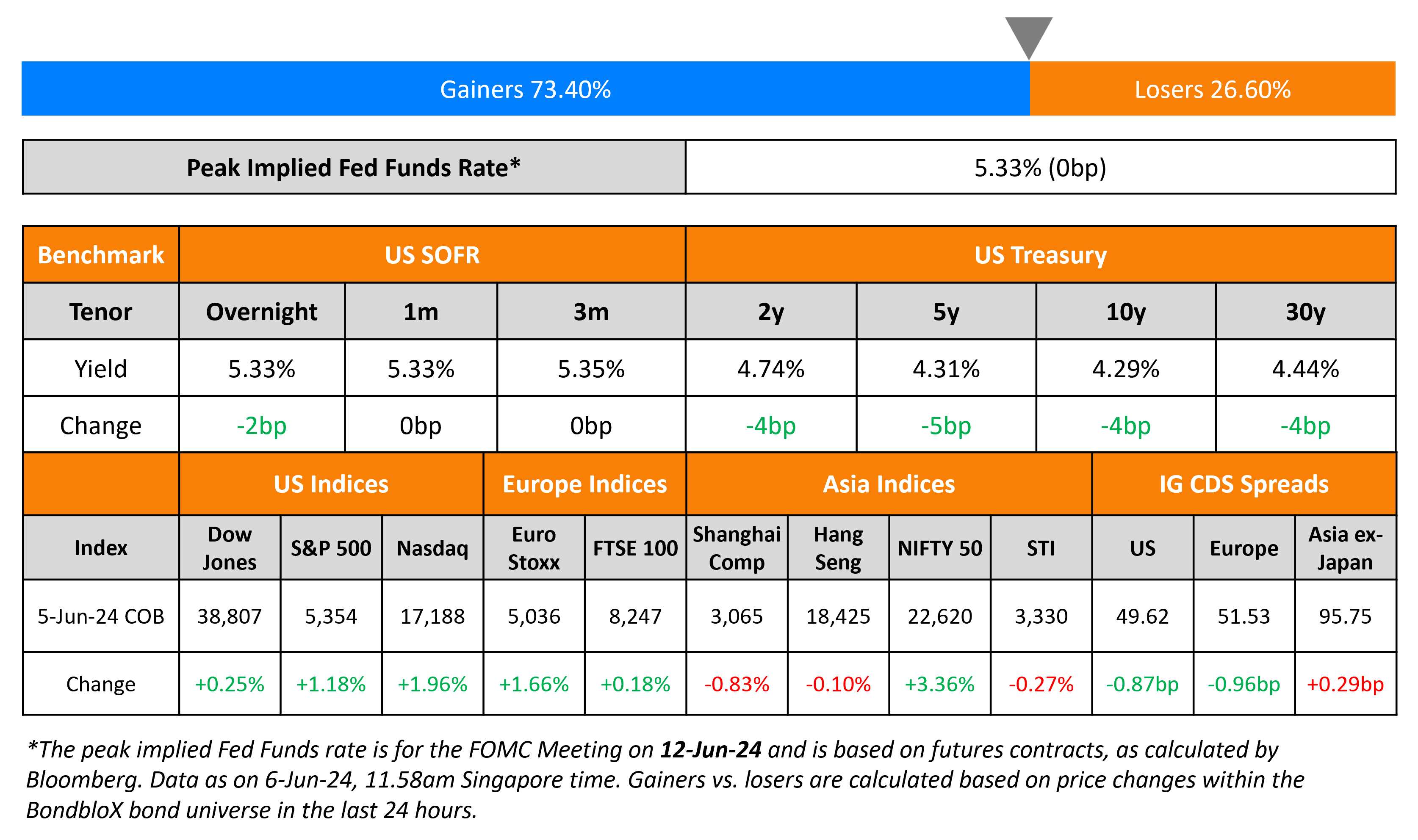

US Treasury yields continued to inch lower, by 4-5bp on Wednesday. Economic data was mixed, with initial employment indicators for May hinting at a softening in the labor market. US ADP Payrolls showed an increase of 152k, lower than expectations of 175k. The US ISM Services Index returned to expansionary territory at 53.8 in May vs. expectations of 51.0 and April’s 49.4 reading. Among its subcomponents, the New Orders Index rose to 54.1 vs. expectations of 53.2 and the prior 52.2 reading. The inflationary Prices Paid component declined slightly to 58.1 vs. expectations of 59.0 and the prior 59.2 reading. The Employment Index continued to stay in contractionary territory at 47.1, albeit higher than April’s 45.9 print and almost inline with expectations of 47.2. Equity markets jumped higher, with the S&P and Nasdaq up by 1.2% & 2% respectively. US IG CDS spreads tightened 0.9bp and HY spreads were 5.6bp tighter.

European equity markets ended higher too. Europe’s iTraxx main CDS spreads were 1bp tighter and crossover spreads were tighter by 5.3bp. Asian equity indices have opened in the green this morning. Asia ex-Japan CDS spreads widened 0.3bp. China’s Caixin Services PMI rose to 54.0 in May vs. expectations of 52.5 and the prior 52.5 reading, the highest level in 10 months.

New Bond Issues

- HSBC S$ PerpNC5.5 at 5.625% area

OUE Reit raised S$250mn via a 3Y bond at a yield of 4.1%, 25bp inside initial guidance of 4.35% area. The bonds are rated BBB- (S&P). Proceeds will be used to finance/refinance, in whole or part, new or existing eligible green projects under its Green Bond Principles 2021 and Green Loan Principles 2023. Private banks received a concession of 15 Singapore cents. The new bonds were priced roughly inline with its existing 3.95% 2027s that yield 4.06%.

Turkiye IS Bank raised $500mn 5Y via a sustainability bond at a yield of 7.75%, 25bp inside initial guidance of 8% area. The senior unsecured notes are rated B by Fitch. Proceeds will be used for for loans in the Green Categories and/or loans in the Social Categories. The new bonds are priced 22bp tighter to its existing 8.1% 2029s that yield 7.97% currently.

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

Rating Changes

-

Fitch Affirms Braskem’s Ratings at ‘BB+’; Removes Negative Watch; Outlook Negative

- Fitch Revises Outlook on Yuexiu Property to Negative; Affirms at ‘BBB-‘

- Fitch Revises Outlook on China Jinmao to Negative; Affirms at ‘BBB-‘

- Moody’s Ratings upgrades Camposol’s ratings to B3; stable outlook

-

AMC Entertainment Holdings Inc. Upgraded To ‘CCC+’ From ‘SD’ Following Debt Exchange; Outlook Negative

Term of the Day

Sustainability-linked bonds (SLBs)

Sustainability-linked bonds (SLBs) are bonds wherein the issuer commits to sustainability outcomes within a timeline set in the bond document based on five elements:

– Selection of Key Performance Indicators (KPIs)

– Calibration of Sustainability Performance Targets (SPTs)

– Bond Characteristics

– Reporting

– Verification

Here however, the proceeds can be used for general purposes but the characteristics of the bond can change depending on the issuer meeting their KPIs set in the document. SLBs come with a coupon step-up if the issuer fails to meet its goal(s) within the specified time period in its framework.

Talking Heads

On Bullish on Indian Bonds After Narrow Modi Win – Neeraj Seth, BlackRock

“It’s actually a good time to be long duration in India… wouldn’t change my view on the back of the election outcome”. Prefers the more liquid 7Y and 10Y bonds… “structural inflows on the back of index inclusion, which will happen over the next 10 months, will provide a technically positive backdrop”

On ECB to Begin Cuts But Path Beyond Gets Murkier

Soeren Radde, an economist at Point72

“If they were consistent with their reaction function, they should actually be holding this week… tells you that it’s a political compromise they came up with.”

On Rising US Debt Load Posing a Growing Risk for Treasury Market

Jason Granet, CIO at BNY Mellon

“No matter what the election result is, when you fast forward five to 10 years, the fiscal direction is not comfortable”

lex Schiller, head of cross-asset strategies at Bridgewater

“You have two candidates that have different spending priorities, but their overall fiscal stance is not all that different”

Subadra Rajappa, head of US rates strategy at SocGen

“Debt and deficits are front and center for investors… there is very little willingness at both parties to address spending.”

Top Gainers & Losers- 06-June-24*

Go back to Latest bond Market News

Related Posts: