This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC Launches $ Perps; BNP, Petrobras, Ford, MGM, Indonesia and Others Price $ Bonds

September 4, 2024

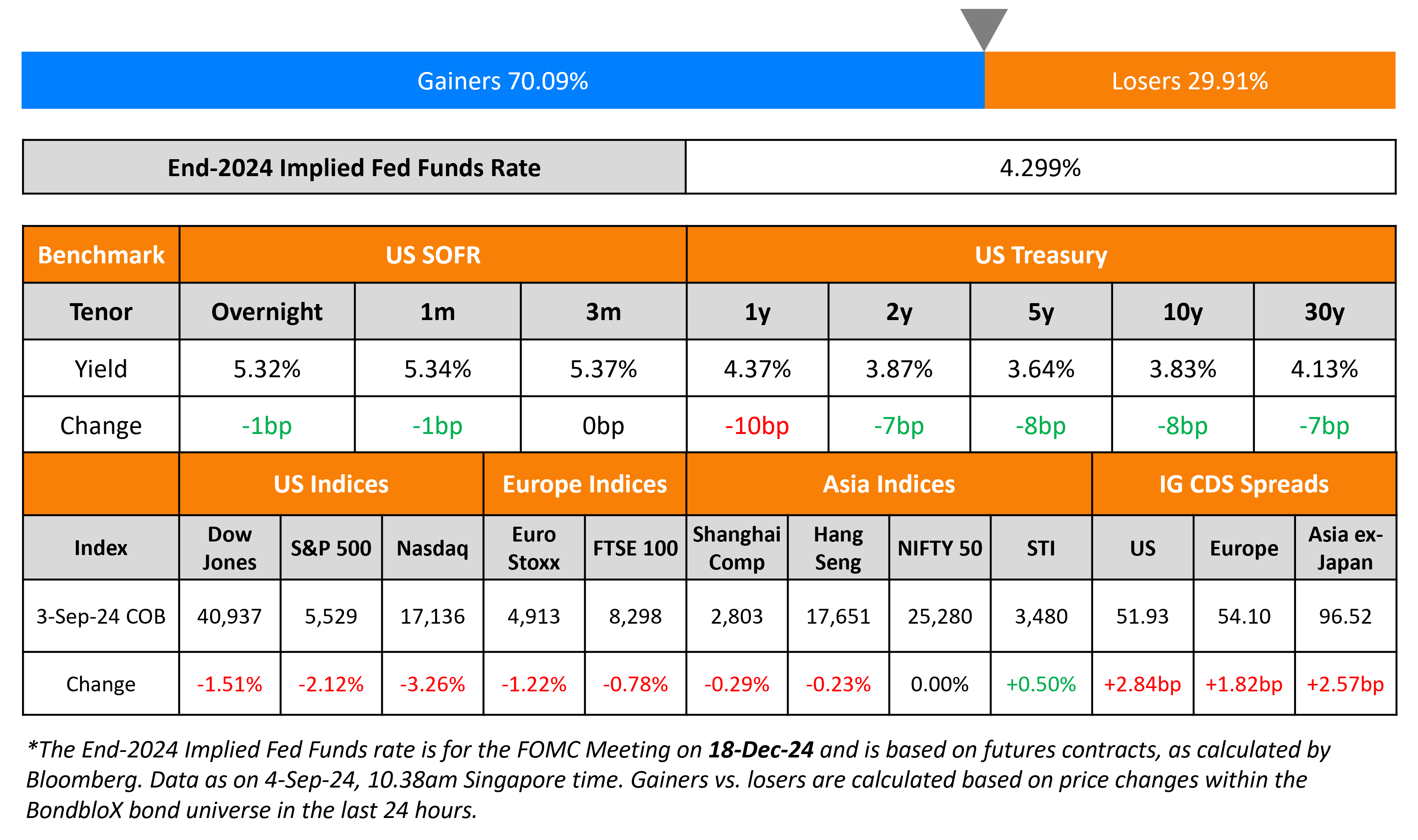

US Treasury yields fell by 7-10bp across the curve. The US ISM Manufacturing reading for August came at 47.2, slightly lower than expectations of 47.5. Among its sub-components, the Price Paid Index came at 54.0, higher than the surveyed 52.0 and prior 52.9 reading. The New Orders Index fell to 44.6 from 47.4 while the Employment Index rose to 46.0 from 43.4. US IG CDS spreads widened by 02.8bp and HY CDS spreads widened by 5bp. Looking at US equity indices, the S&P and Nasdaq were down by 2.1% and 3.3% respectively.

European equity markets ended lower. Looking at Europe’s CDS spreads, the iTraxx Main spreads were wider by 1.8bp while Crossover spreads widened by 8.2bp. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads widened by 2.6bp.

New Bond Issues

- HSBC Holdings $ PerpNC5.5/PerpNC10 AT1 at 7.625/7.625% area

- Canara Bank $ 5Y at T+155bp area

- Nanshan Life Pte. Ltd. $ 10Y at T+195bp

BNP Paribas raised $1bn via a PerpNC10 AT1 bond at a yield of 7.375%, 62.5bp inside initial guidance of 8% area. The junior subordinated notes are rated Ba1/BBB-/BBB. The coupon is fixed until 10 September 2034, and if not called, resets then and every five years thereafter to the prevailing 5Y CMT plus the initial margin 353.5bp. A trigger event would occur if the CET1 Ratio of the group is equal to or less than 5.125%. The new bonds are priced 43.5bp wider to UBS’ 9.25% Perp (callable in November 2033) that currently yields 6.94% to call. They are also priced 25.5bp wider to Santander’s 9.625% Perp (callable by November 2033) that currently yields 7.12% to call.

Petrobras raised $1bn via a long 10Y bond at a yield of 6.25%, 25bp inside initial guidance of 6.50% area. The senior unsecured notes are rated Ba1/BB/BB. Proceeds will be used to repurchase notes accepted for purchase in concurrent tender offers, and the remainder, if any, for general corporate purposes.

Ford Motor Credit raised $2.5bn via a three-part offering. It raised:

- $1.20bn via a long 2Y bond at a yield of 5.134%, 30bp inside initial guidance of T+155bp area. The new notes are priced at a new issue premium of 20bp over its existing 4.346% 2026s that yield 4.93%.

- $400mn via a long 2Y FRN at SOFR+145bp vs. initial guidance of SOFR equivalent area.

- $900mn via a 5Y bond at a yield of 5.303%, 30bp inside initial guidance of T+195bp area. The new notes are priced at a new issue premium of ~27bp over its existing 6.375% 2029s that yield 5.03%.

The senior unsecured notes are rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes.

GM Financial raised $1.75bn via a two-trancher. It raised $1bn via a 5Y bond at a yield of 4.909%, 30bp inside initial guidance of T+155bp area. It also raised $750mn via a 10Y bond at a yield of 5.496%, 30bp inside initial guidance of T+195bp area. The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used for general corporate purposes.

Indonesia raised $1.8bn via a two-part offering. It raised $1.15bn via a 10Y bond at a yield of 4.8%, 35bp inside initial guidance of 5.15% area. It also raised $650mn via a 30Y bond at a yield of 5.2%, 30bp initial guidance of 5.5%. The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used for general purposes of the Republic. The new 10Y bonds are priced at a new issue premium of 7bp over its existing 4.7% 2034s that yield 4.73%. The new 30Y bonds are priced at a new issue premium of 10bp over its existing 5.1% 2054s that yield 5.1%.

MGM Resorts raised $850mn via a 5NC2 bond at a yield of 6.125%, 12.5bp inside initial guidance of 6.25% area. The senior unsecured notes are rated B1/BB-/BB-. Proceeds will be used to repay existing debt, including its outstanding 5.75% 2025s. Any remaining net proceeds will be invested in interest-bearing accounts/securities/investments.

Yapi Kredi raised $500mn via a 5Y bond at a yield of 7.125%, 50bp inside initial guidance of 7.625% area. The senior unsecured notes are rated B1/B (Moody’s/Fitch). Proceeds will be used for general corporate purposes.

Saudi PIF raised $2bn via a two-trancher. It raised $1.5bn via a 3Y sukuk at a yield of 4.488%, 35bp inside initial guidance of T+110bp area. It also raised $500mn via a tap of its green 5.25% 2032s at a yield of 4.807%, 28bp inside initial guidance of T+135bp area. Proceeds will be used to finance/refinance, in whole/part, in one or more eligible green projects, as seen in the pricing supplement and Green Finance Framework.

Abu Dhabi Commercial Bank (ADCB) PJSC raised $500mn via a 10.5NC5.5 Tier 2 bond at a yield of 5.361%, 50bp inside initial guidance of T+210bp area. The junior notes are rated A- (Fitch). The bond is callable from 10 September 2029 to 10 March 2030 and on any interest payment date thereafter. If bond is not called, then its coupon will reset to the 5Y UST plus 170bp. Proceeds will be used for general corporate purposes and to further strengthen its capital base.

National Bank of Ras Al-Khaimah bank raised $250mn via 10.25NC5.25 Tier 2 bond at a yield of 5.875%, 42.5bp inside initial guidance of 6.3% area. The junior notes are rated BBB- (Fitch). The bond is callable from 10 September 2029 to 10 December 2029 and on any interest payment date thereafter, and if not called, its coupon will reset to 5Y UST plus 221.4bp.

UBS raised $1.5bn via a 21NC20 bond at a yield of 5.379%, 33bp inside initial guidance of T+150bp area. The senior unsecured bonds are rated A3/A-/A.

Santander Holdings raised $1bn via a 6NC5 bond at a yield of 5.353%, 25bp inside initial guidance of T+195bp area. The senior unsecured notes are rated Baa2/BBB+/BBB+. The new notes are priced at a new issue premium of 13bp over its existing 6.174% 2030s that yield 5.22%.

New Bonds Pipeline

- Vedanta hires for $ 5NC2/7NC3 bond

- Al Ahli Bank of Kuwait hires for $ PerpNC5.5 bond

- Uber Technologies hires for $ bond

- Wuhan Metro hires for $ bond

Rating Changes

- Moody’s Ratings upgrades Meituan’s ratings to Baa2; outlook remains positive

- American Tower Corp. Upgraded To ‘BBB’ From ‘BBB-‘ On Improved Credit Quality; Outlook Stable; Debt Rating Also Raised

- Fitch Affirms ams-OSRAM at ‘B+’; Downgrades Senior Unsecured to ‘B+’

- The Manitowoc Co. Inc. Outlook Revised To Positive On Expectation Of Better Resiliency In A Downturn; Notes Rated ‘B’

- Moody’s Ratings affirms Whirlpool’s Baa2 unsecured ratings; changes outlook to negative

Term of the Day

Tier 2 Bonds

Tier 2 bonds are debt instruments issued by banks to meet their regulatory tier 2 capital requirements. Tier 2 capital (and thus tier 2 bonds) rank senior to tier 1 capital, which consists of common equity tier 1 (CET1) and additional tier 1 (AT1) capital. CET1 consists of a bank’s common shareholders’ equity while AT1 consists of preferred shares and hybrid securities or perpetual bonds. Tier 2 capital consists of upper tier 2 and lower tier 2 wherein the former is considered riskier to the latter. From a bond investor’s perspective, tier 2 bonds are senior, and therefore less risky, compared to AT1 bonds as AT1s would be the first to absorb losses in the event of a deterioration in bank capital.

Talking Heads

On Bond Rally Turning ‘Dangerous to Chase’ With Bets on Big Rate Cuts

Ed Al-Hussainy, a rates strategist at Columbia Threadneedle

“If you missed the big rally, it’s going to be a little dangerous to chase it now. We are playing with the probability of the job market stabilizing here or deteriorating fast”

Leslie Falconio, UBS Global Wealth Management

“We think the market is pricing in too much, too soon… still view the soft landing as the likely outcome”

On Seeing BOJ Hike as Soon as January, Likes Long-Term JGB – Pimco

“The next rate hike will be as early as next January”… yield curve is still steep and there are “no duration needs” to buy longer-dated government bonds… This is an opportunity to take a little bit of risk”

On Fed policymakers agreeing on need for rate cuts, but reasons varying

Kristin Forbes, MIT Sloan School of Management

“It’s not one thing that causes everyone to move. It’s different people focus on different data, different indicators, different risks, and then they all end up in the same place”

Top Gainers & Losers-04-September-24*

Go back to Latest bond Market News

Related Posts: