This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC Launches $ Perp; Frasers Launches S$ 7Y

February 24, 2025

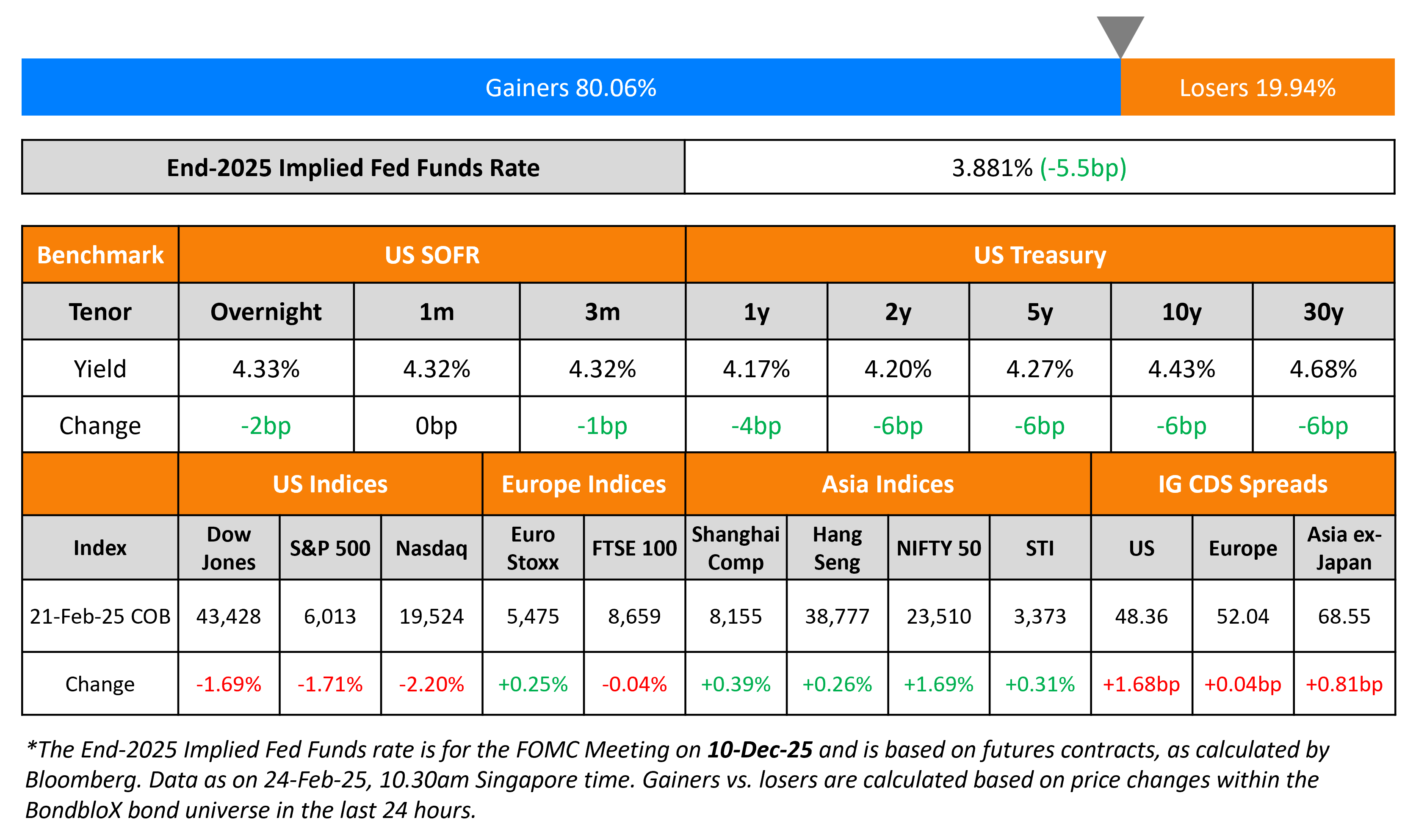

US Treasuries yields dropped by 6bp across the curve, following softer economic data and reports of a new bat coronavirus that could infect humans. While the preliminary S&P Manufacturing PMI was at 51.6 (vs. expectations of 51.4), the Services PMI contracted to 49.2 (vs. expectations of 53.0). Also, the Michigan consumer sentiment index came-in at 64.7, lower than the surveyed 67.8 print.

US equity markets saw the S&P and Nasdaq ending lower by 1.7% and 2.2% respectively. Looking at credit markets, US IG and HY CDS spreads were 1.7bp and 10.8bp wider respectively. European equity markets ended mixed. The iTraxx Main CDS spread was flat while the Crossover CDS spreads widened by 0.4bp. Asian equity markets have opened broadly mixed this morning. Asia ex-Japan CDS spreads were wider by 0.8bp.

New Bond Issues

- HSBC $ PerpNC7 at 7.5% area

- Frasers Centrepoint Trust S$ 7Y Green at 3.38% area

Rating Changes

- Moody’s Ratings upgrades AstraZeneca to A1; outlook stable

-

Cikarang Listrindo Upgraded To ‘BBB-‘ On Easing Refinancing Risk; Outlook Stable

-

Western Digital Corp. Upgraded To ‘BB+’ From ‘BB’ On Sandisk Spinoff; Outlook Stable

-

Moody’s Ratings downgrades Nissan to Ba1; outlook remains negative

-

Moody’s Ratings downgrades Nissan Motor Acceptance’s ratings (backed senior unsecured to Ba1 from Baa3), maintains negative outlook following similar actions on parent’s ratings

-

Moody’s Ratings downgrades Senegal’s ratings to B3 with a negative outlook, concluding its review

-

Fitch Affirms Romania at ‘BBB-‘; Outlook Negative

-

Fitch Revises Outlook on Intel’s ‘BBB+’ and ‘F2’ Ratings to Negative from Stable

-

The Dow Chemical Co. Outlook Revised To Negative From Stable On Challenging Industry Conditions Leading To Weakened Credit Metrics; Ratings Affirmed

Term of the Day: Fallen Angel

A fallen angel is a company or sovereign whose credit rating has been cut from investment grade to junk due to deteriorating financial conditions of the company. The downgrade to junk may have a negative impact on its bond prices as asset managers that are mandated to hold only investment grade debt may be forced to sell off their holdings in the fallen angels.

Talking Heads

On Pimco, Allspring Betting on Mortgage Bonds That Look Cheaper Than Corporate Debt

Lotfi Karoui, Goldman Sachs

You have an asset class that has zero credit risk and yet it’s paying you 40 to 45 basis points” more than IG bonds.

Noah Wise, Allspring Global Investments

“The relative value is starting to become even more favorable on the MBS side… Not because the valuations are becoming necessarily more attractive in an absolute sense, but compared to other opportunities”

Jason Callan, Columbia Threadneedle

“The spread behavior of corporate credit looks like the markets are very complacent”

Brian Quigley, Vanguard

“We think MBS looks attractive compared to Treasuries”

On Banks Pulling Debt Deals as Investors Push Back on Aggressive Terms

Michael Marzouk, Aristotle Pacific Capital

“A lot of the recent deals have been priced on the screws with spreads compressing… ith uncertainty out there with tariffs, investors are being selective”

Frank Ossino, Newfleet Asset

“The market is saying you need to be a well-known issuer, have a history of good operating performance, or be in a favorable industry to get the tightest pricing”

On Hard-to-Shock Markets Showing Tolerance for Trouble Isn’t Limitless

Marija Veitmane, State Street

“Institutional investors have started the year with a very pro-risk positioning”

Bruno Braizinha, BofA

“We are entering slightly complacent territory, and makes sense to hedge some of those tail risks”

Top Gainers and Losers- 24-February-25*

Go back to Latest bond Market News

Related Posts: