This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC Launches $ Five-Tranche TLAC

February 26, 2025

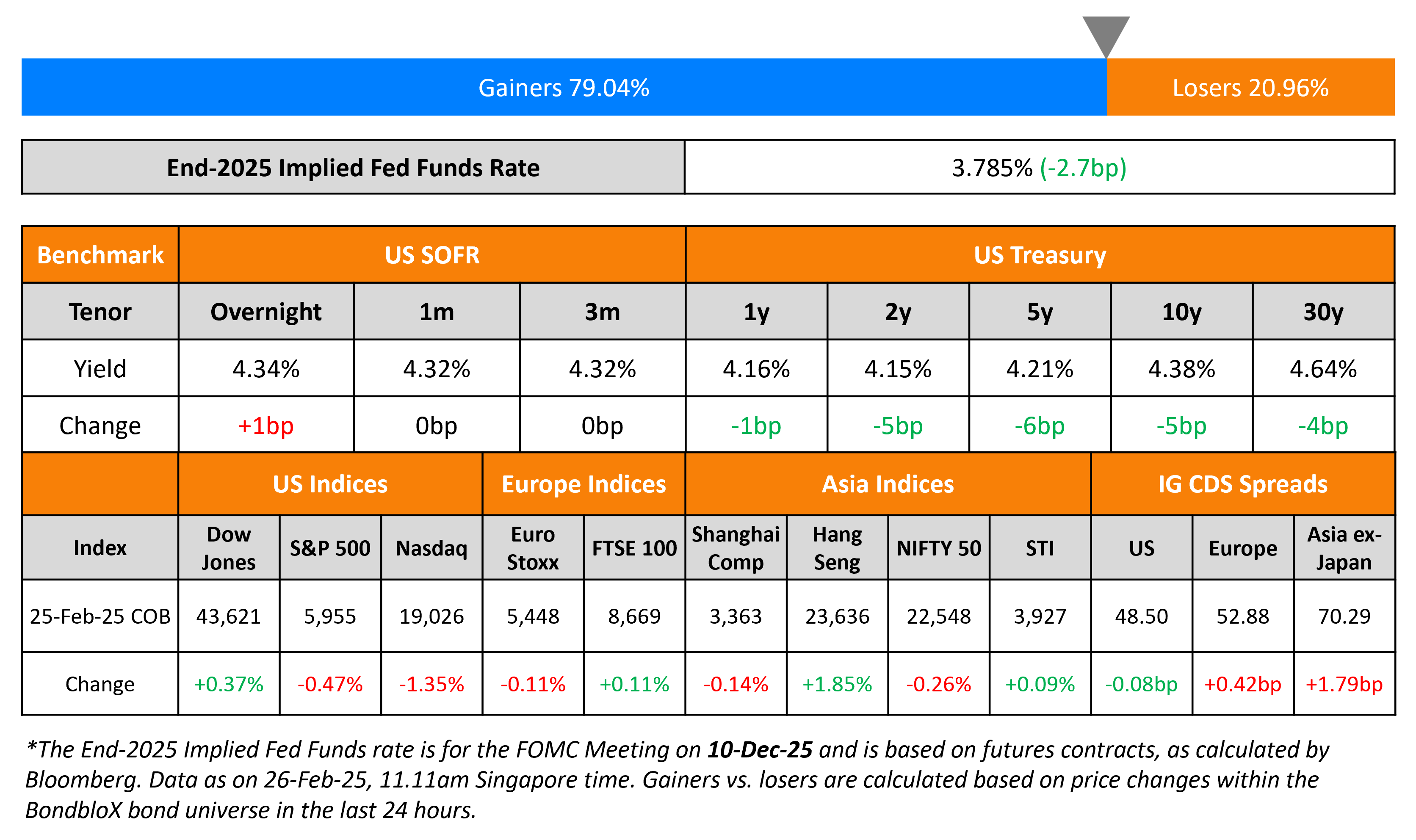

US Treasuries yields continued to ease, lower by 5-6bp across the curve. The US Conference Board Consumer Confidence Index slipped to 98.3 in February vs. 105.3 in January and expectations of 102.5. This was its largest monthly decline in over three years, since August 2021. The index for future expectations of consumer confidence fell below 80 for the first time since June 2024. Separately, US President Donald Trump said that his proposed 25% tariff on Canada and Mexico were “going forward on time, on schedule”.

US equity markets saw the S&P and Nasdaq ending lower by 0.5% and 1.4% respectively. Looking at credit markets, US IG CDS spreads were 0.1bp tighter while HY spreads were 1bp wider. European equity markets ended mixed. The iTraxx Main and and Crossover CDS spreads widened by 0.4bp and 1.9bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 1.8bp.

New Bond Issues

-

HSBC $ 4NC3/4NC3 FRN/6NC5/6NC5 FRN/11NC10 at T+110bp/SOFR eq/T+130bp/SOFR eq/T+145bp area

Saudi Arabia raised €2.25bn via a two-part deal. It raised €1.5bn via a 7Y green bond at a yield of 3.458%, 40bp inside initial guidance of MS+155bp area. It also raised €750mn via a 12Y bond at a yield of 3.871%, 30bp inside initial guidance of MS+175bp area. The bonds are rated Aa3/A+ (Moody’s/Fitch). Proceeds from the 7Y bond will be used to finance or refinance green projects or expenditures in the nation, while funds from the 12Y bond will be used for general domestic budgetary purposes. The 7Y note is the first euro-denominated green issuance by a sovereign from the MENA region.

Citigroup $5bn via a three-trancher. It raised:

- $2.25bn via a 4NC3 bond at a yield of 4.786%, 25bp inside initial guidance of T+95bp area

- $750mn via a 4NC3 FRN at SOFR+87bp vs. inside initial guidance of SOFR equivalent area

- $2bn via a 31NC30 bond at a yield of 5.612%, 15bp inside initial guidance of T+100bp area

The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

State Street raised $2.75bn via a three-trancher. It raised:

- $1.35bn via a 3Y bond at a yield of 4.536%, 20bp inside initial guidance of T+65bp area

- $650mn via a 5Y bond at a yield of 4.729%, 15bp inside initial guidance of T+75bp area

- $750mn via a 11NC10 bond at a yield of 5.146%, 15bp inside initial guidance of T+100bp area

The senior unsecured notes are rated Aa3/A/AA-. Proceeds will be used for general corporate purposes.

Varanasi Aurangabad raised $316mn via a 9NC3 bond at a yield of 5.9%, 47.5bp inside initial guidance of 6.375% area. The senior secured notes are rated Baa3/BBB- (Moody’s/Fitch), and guaranteed by Indus Concessions India Pvt Ltd and Indus Concessions Infra Pvt Ltd. Proceeds will be used to repay existing term debt, prepayment expenses and for capex including major maintenance.

New Bonds Pipeline

- Kenya hires for $ 11Y bond

- Doha Bank hires for $ 5Y bond

Rating Changes

-

Moody’s Ratings upgrades TUI AG’s CFR to Ba3 from B1, outlook changed to stable from positive

-

Fitch Upgrades Cheniere Energy, Inc and Cheniere Energy Partners, L.P. to ‘BBB’; Outlook Stable.

-

Thames Water Downgraded To ‘D’ And Its Class A And B Debt Downgraded To ‘D’

-

AXA Group Outlook Revised To Positive On Expected Capital Strengthening And Profitability Growth; ‘AA-‘ Ratings Affirmed

-

Fitch Revises Occidental Petroleum Corp.’s Outlook to Positive; Affirms Ratings at ‘BBB-‘

-

Fitch Revises Costa Rica’s Outlook to Positive; Affirms IDR at ‘BB’

-

Fitch Revises Suzano’s Outlook to Positive; Affirms IDR at ‘BBB-‘

Term of the Day: Guaranteed Bond

A guaranteed bond is a type of bond that has a guarantee wherein interest and principal payments will be made by a third party if the issuer defaults. The third party/guarantor could be the parent company or a JV, an insurance company, government based entity etc. Since the bond is guaranteed, the risks in investing in the bond are lower vs. non-guaranteed bonds and thus generally offer lower yields. From the issuer’s perspective, this also eases the cost of raising debt, though it is partially offset by paying some premiums to the guarantor.

Talking Heads

On the Need for Simpler Regulation by the Fed.

Brian Moynihan, BofA

“Get us the rational regulatory structure and have it stick to the ribs…If [the Fed keeps] swinging like this [between presidential administrations], our clients can’t depend on us when they need us.”

On ECB Rates Approaching Neutral

Joachim Nagel, Bundesbank

“We are coming closer to a level [of ECB rates] where we are more or less leaving the restrictive territory, getting more into the neutral term.”

On the Importance of Monetary Policy and Regulation to Economic Stability

Michael Barr, US Federal Reserve

“Regulation [of financial markets, banks, federal deposit insurance] and laws to protect investors, consumers, and businesses…promote both financial stability and durable economic growth.”

“Monetary policy and financial stability are inextricably linked…the tools we use to conduct monetary policy and support financial stability work together.”

Top Gainers and Losers- 26-February-25*

Go back to Latest bond Market News

Related Posts: