This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hotel Properties, BOC Paris Launch $ Bonds

October 23, 2024

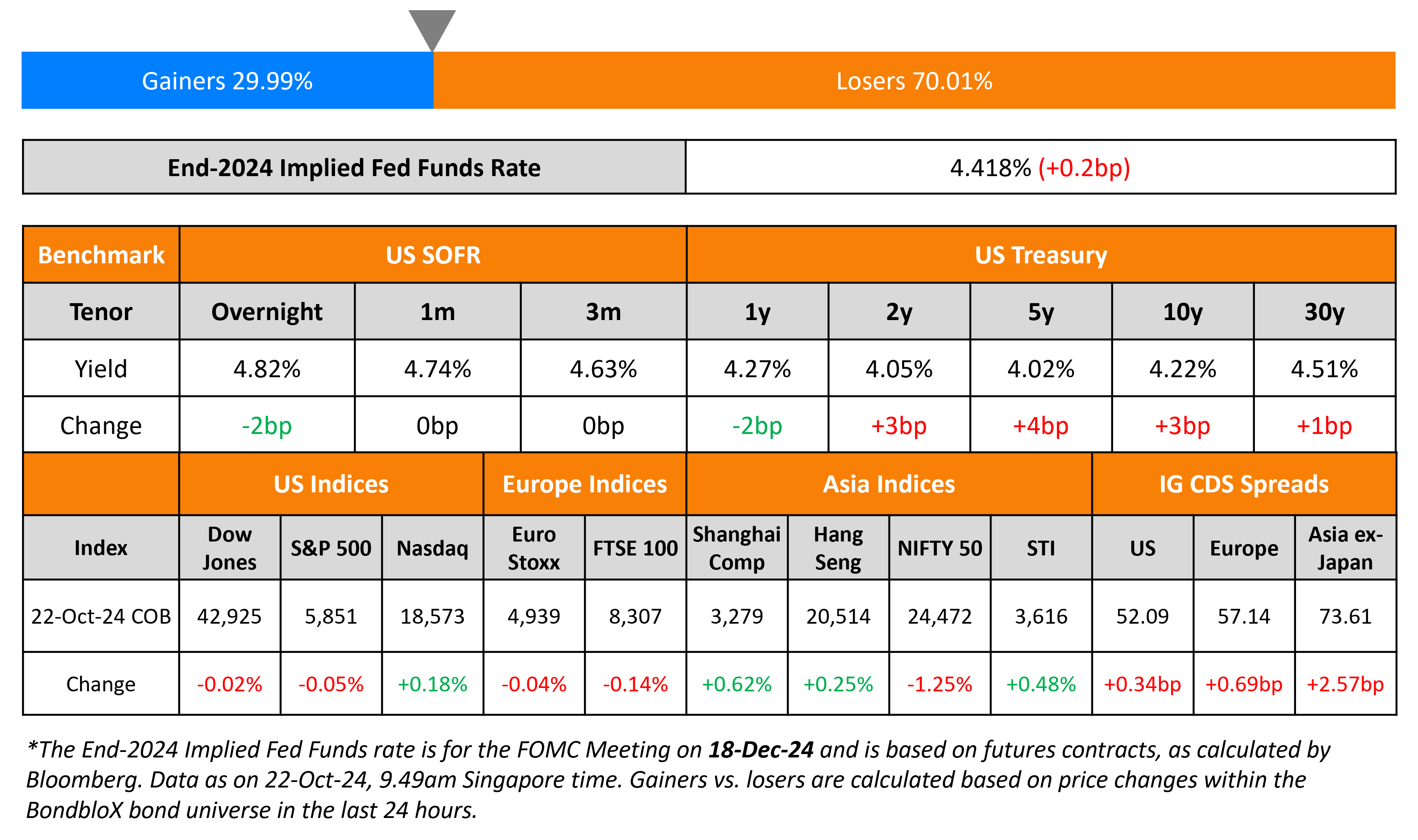

US Treasury yields ticked higher yesterday, by about 3-4bp across the curve. As per an analysis by Bloomberg, the rise in Treasury yields since the Fed’s 50bp rate cut in September draws parallels to the mid-1990s when the then Fed Chairman Greenspan managed to create a soft landing. For instance, the 2Y yield has risen 35bp since the rate cut in September with analysts noting that the move came on the back of investors pricing-in lower probabilities of an upcoming recession, and an improved likelihood of a soft landing. Markets are now pricing-in a slower pace of rate cuts of 128bp through September 2025, from 195bp about a month ago. With the US election nearing, some analysts note that investors are also hedging a potential Trump victory, that might imply lower tax rates and further spending, that would drive up the fiscal deficit. US IG and HY CDS saw a widening of 0.3bp and 2.2bp respectively. Looking at US equity markets, the S&P closed lower by 0.05% while the Nasdaq was up by 0.2%.

European equities continued their slump from yesterday, closing lower across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.7bp and 3.5bp respectively. Asian equities have opened broadly mixed this morning. Asia ex-Japan IG spreads were wider by 2.6bp.

New Bond Issues

- Hotel Properties S$ PerpNC5 at 5.75% area

- Bank of China Paris Branch $ 3Y green at T+105bp area

Bank of America (BofA) raised $3.5bn via a 11NC10 bond at a yield of 5.518%, 23bp inside initial guidance of T+155bp area. The SEC-registered subordinated notes are rated A3/BBB+/A. The new bonds are priced in-line with its existing 5.425% 2035s (callable on 15 October 2034) that are currently yielding 5.50%.

Rating Changes

- Moody’s Ratings upgrades Suriname’s ratings to Caa1 and changes outlook to positive

- Grupo Aeromexico Upgraded To ‘B+’ From ‘B’ On Stronger Credit Metrics And Profitability Margins; Outlook Stable

- Fitch Downgrades Intrum to ‘C’ on Chapter 11 Announcement

- Moody’s Ratings downgrades Intrum’s Corporate Family Rating to Ca, outlook developing

- Moody’s Ratings downgrades Accell’s CFR to Ca from Caa3 on proposed debt restructuring; stable outlook

- Fitch Revises CNP’s Outlook to Negative on LBP’s Outlook Change; Affirms IFS Rating

- Costa Rica Outlook Revised To Positive On Potential Improvement In External Profile; ‘BB-/B’ Ratings Affirmed

- Moody’s Ratings affirms OTP banka d.d.’s A3 long-term deposit ratings, outlook changed to positive

Term of the Day

SEC-Registered Bond

As the name suggests, these are bonds registered with the US Securities and Exchange Commission (SEC). These are not to be confused with 144A bonds, which are privately placed, not SEC registered and have lesser documentation and are traded among Qualified Institutional Buyers (QIBs). Given 144As are restricted securities, they have resale and transfer restrictions that are not applicable for SEC-registered securities. Besides these, they also have a few other differences like being eligible for inclusion in bond indices like Barclays Aggregate Bond Index, no investment restrictions and no private placement restrictions on communications.

Talking Heads

On Risk of 10% Drop in Euro If Trump Wins US Election – Goldman Sachs

“The approaching US election could change this big picture in a number of ways, but we continue to think the risks around different policy outcomes are also skewed towards more dollar strength”… EUR could depreciate “closer to 10%” if Washington slaps 20% tariffs on China and 10% on other countries.

On Favoring EM HY Bonds Being a Loser’s Game – Pimco

“That game may have worked two decades ago. But it is a difficult game to win today… The case for EM debt should not be anchored on spreads, yields, or some other valuation metric. It should be based primarily on diversification benefits… Investors who were leaning into risk and trying to time the market around macro events started to play a loser’s game”

On Credit Markets Largely Indifferent to US Election – JPMorgan

“Our take away from this is that markets are somewhat indifferent to the outcome”… a Republican sweep could push 10-year Treasury yields 0.4% higher… IG spreads are at two decade tights – wouldn’t be the case if any election outcomes were viewed as negative for credit markets.

Top Gainers and Losers- 23-October-24*

Go back to Latest bond Market News

Related Posts: