This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hong Kong Land Launches $ 10Y; US Yield Curve Steepens Post NFP Data

July 10, 2023

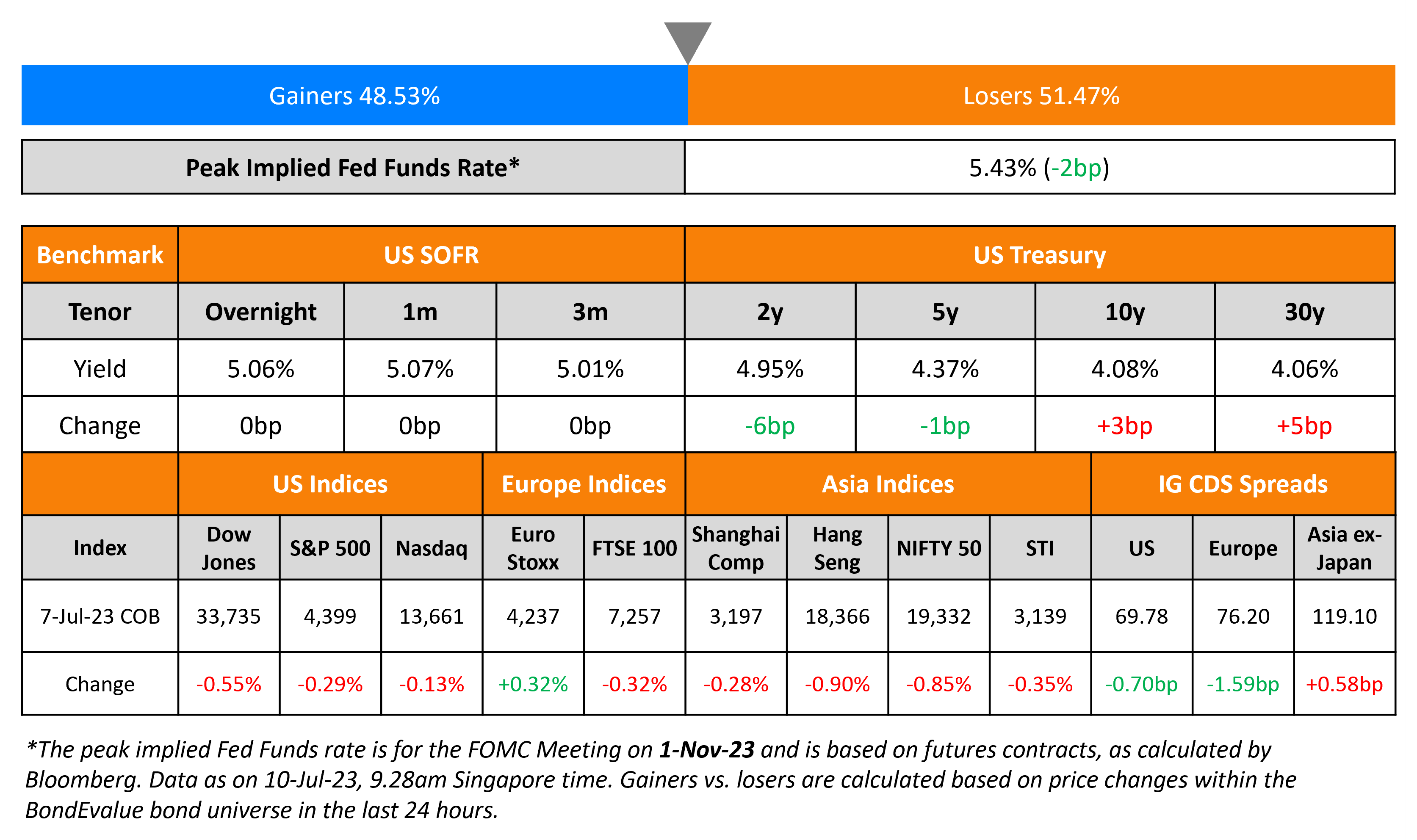

US Treasury yields were mixed with short-end yields lower while long-end yields picked up. The 2Y yield fell 6bp while the 10Y yield was up 3bp as the yield curve steepened again. Only last week, the 2s10s curve hit its lowest since 1981 at -109bp. The move has now retraced by over 20bp to levels of -87bp currently. The peak Fed Funds rate fell 2bp to 5.43%. US Non-Farm Payrolls (NFP) came at 209k for June, lower than the surveyed 230k and last month’s 339k print. Unemployment was at 3.6% in-line with the surveyed 3.6%. Average Hourly Earnings YoY was at 4.4%, higher than the surveyed 4.2% and unchanged from last month’s revised 4.4% print. Broadly, the data indicated continuing strength in the economy with was inflation not trending significantly lower. US equity indices were lower with the S&P and Nasdaq down 0.1% and 0.3% respectively. US IG and HY CDS spreads tightened 0.7bp and 1.4bp respectively.

European equity indices closed lower with European main CDS spreads tighter 1.6bp and Crossover CDS tighter by 7.4bp. Asia ex-Japan CDS spreads were 0.6bp wider and Asian equity markets have opened marginally higher today.

New Bond Issues

- Hong Kong Land $ 10Y at T+160bp area

- Doosan Enerbility $ 3Y Green at T+135bp area

New Bond Pipeline

- Korea Hydro & Nuclear Power mandates for $ 5Y green bond

-

Hanhwa Q Cells hires for $ 5Y green bond

-

Shinhan Financial hires for $ 5Y social bond

Term of the Day

Non-Farm Payrolls (NFP)

Non-Farm Payrolls (NFP) is a key data point that is released by the US Bureau of Labor Statistics (BLS) usually on the first Friday of every month. NFP measures net changes in employment excluding agricultural, local government, private household and not-for-profit sectors over the past month and is a key economic indicator in the United States. A high reading of the NFP is considered a positive sign for the US economy while a negative reading is considered a sign of a slowdown in the US jobs market. The NFP indicator is closely watched by traders, especially as it is one of the first monthly economic indicators to be released, and because of the direct relationship between job creation and economic growth.

Talking Heads

On Wall Street Soothsayers Rarely Been So Bewildered About What’s Next

Bespoke co-founder Paul Hickey

“With consensus being so bearish to kick off the year, rather than needing a positive catalyst to spark a rally, all the market needed was a lack of bad news. Whenever we are faced with conflicting messages from the news and the markets, we always defer to the markets.”

Steve Sosnick, chief strategist at Interactive Brokers

“Being bullish on equities in the face of the sharpest rate hikes in a generation alongside persistent quantitative tightening flies in the face of that logic… premature to say that the bearish end-of-year calls are truly wrong”

On Ex-AQR Quant Saying Inverted Yield Curve Won’t Crush Bond Returns

Israelov, a former principal at AQR Capital Management

“Those who are considering investing in 10-year bonds are concerned about the curve normalization occurring from 10-year yields rising – triggering losses in their bond portfolios… What was most striking in our analysis of the historical data was how little actually tended to happen in the 10-year yield during curve normalization… Overall, an inverted yield curve in and of itself is not a strong enough signal that bond returns are going to be negative”

George Goncalves, head of US macro strategy at MUFG

“Bear steepeners are kind of like unicorns; they are really hard to find. They are very rare. When they happen they are short lived – but they are very painful. So a rise in long-term rates? We haven’t really seen that happen on a consistent basis. So it would have to come from the front end”

On Bonds on the Brink Rewarding EM Investors With Double-Digit Returns

Pierre-Yves Bareau, JPMorgan Asset Management

“We are not in a regular cycle… restructuring talks that we’re seeing in front of our eyes now are a bit more favorable than what the market had been pricing in”

Pankaj Bukalsaria, IB director at Acuity Knowledge Partners

“It’s a significant turning point. This deal has opened up the possibility and practicality of negotiating similar agreements with creditors, even in cases of large debts and challenging economic situations.”

On ECB Rate Hikes to End Soon at ‘High Plateau – ECB GC member Francois Villeroy

“In the euro area, I believe we will soon reach the high point of interest rates… when I say high point this isn’t a peak, rather it will be a high plateau, on which we will have to remain for a sufficiently long time to fully transmit all the effects of monetary policy”

Top Gainers & Losers – 10-July-23*

Go back to Latest bond Market News

Related Posts: