This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hertz’s Bonds Rally after Better Than Expected Q2 Results

August 8, 2025

Hertz’s bonds rallied across the curve by nearly 2 points after reporting its Q2 results. Hertz saw its EPS loss narrow to $0.34 vs. estimates of a $0.42 loss. Only a year ago, Hertz had reported a much larger net EPS loss of $1.44, with the latest results showing a marked improvement. Its EBITDA stood at $1mn, its first positive reading in nearly two years. While the deprecation rates on its vehicles improved, revenues and rental pricing both fell. The company is said to be looking at various ways to reduce debt over time, including a potential equity issuance.

Hertz’s shares closed 7.5% higher and have rallied by over 50% YTD. Looking at its bonds, Hertz’s 5% 2029s are up over 10% YTD and over 45% since April, currently trading at 73 cents on the dollar, yielding 13.3%. This was partly owing to Pershing Square Capital acquiring a near 20% stake in the company in mid-April.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

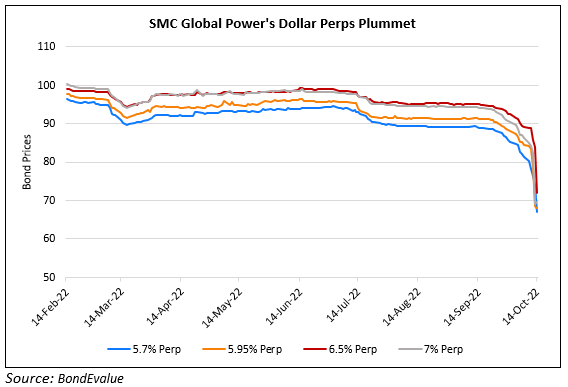

SMC Global’s Dollar Perps Drop Over 10%

October 14, 2022

Fitch Expects Mexican Government to Continue Supporting Pemex

August 17, 2023