This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

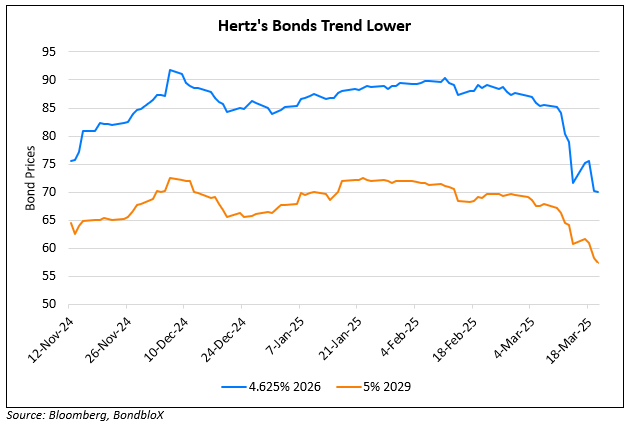

Hertz’s Bonds Hurt Upon News of Easing Auto Tariffs

April 30, 2025

Hertz’s bonds were lower by as much as 3 points, following news that US President Donald Trump is set to ease the 25% auto tariffs through a new executive order. Automakers that build cars in the US will get tax credits worth up to 15% of the car’s value, which they can use to reduce the cost of importing parts. This is meant to give them time to shift their supply chains back to the US. Tariff-free imports will be limited and decrease over three years. Parts made in North America under USMCA rules will stay duty-free, and affected vehicles will not be hit with other Trump-era tariffs on steel, aluminum, or goods from Canada and Mexico. However, Chinese parts continue to remain heavily taxed. Automakers welcomed the relief, but they are still uncertain due to sudden policy changes. Industry groups warned that sudden tariffs on parts would raise car prices, hurt sales, and threaten jobs and businesses.

In late March, bonds of Hertz surged, following Trump’s proposal to impose a 25% tariff on imported vehicles. Separately, in a recent update, Hertz has sought to raise around $500mn in secured debt to strengthen its balance sheet.

Hertz’s 5% 2029s were down 2.3 points to trade at 68.9 cents on the dollar, yielding 14.5%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Hertz Downgraded to B by S&P; Raises

June 21, 2024

Hertz Bondholders Raise Concerns Over Repayment Ability

December 9, 2024