This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

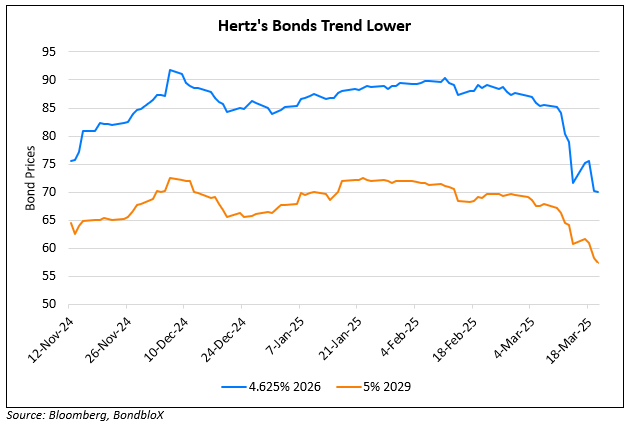

Hertz Planning to Raise Debt to Boost Liquidity; Bonds Rally

April 21, 2025

Hertz is seeking to raise debt to strengthen its balance sheet liquidity amid a potential $300mn bankruptcy payout to bondholders and other upcoming liabilities. The car rental company is working with Ducera Partners to secure new financing and extend the maturity of a revolving credit facility (RCF) due next year. These efforts began before hedge fund, Pershing Square Capital disclosed a 19.8% stake in Hertz, sending shares up 44% on Thursday. As per analysts, Pershing’s involvement has boosted investor confidence, potentially lowering Hertz’s borrowing costs. Emerging from bankruptcy in 2021, Hertz suffered a $2.9bn loss in 2023 after a failed investment in Tesla electric vehicles, which proved costly to maintain. Hertz has since sold 30,000 EVs and is working to resolve bankruptcy-era litigation. The company, has over $6bn in debt and is also collaborating with AlixPartners on its financial strategy. Its CFO Scott Haralson stated earlier this year, that Hertz expects its lowest liquidity mid-year but is confident in managing upcoming debt maturities. The company is said to plan moving collateral to protect assets from existing creditors while negotiating new terms.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Hertz Downgraded to B by S&P; Raises

June 21, 2024

Hertz Bondholders Raise Concerns Over Repayment Ability

December 9, 2024