This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

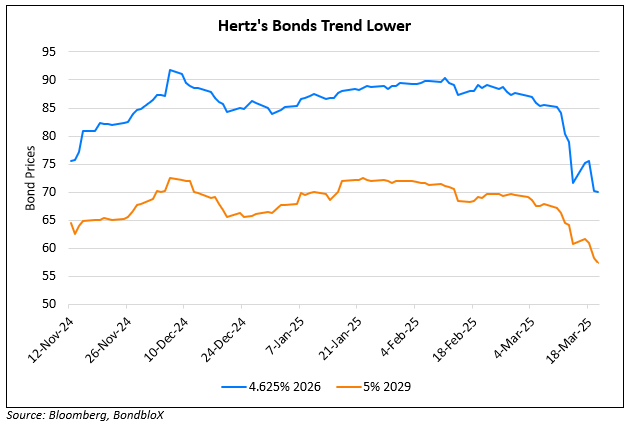

Hertz, Avis Bonds Rally on 25% Tariff Imposition

March 28, 2025

Shares and bonds of Hertz and Avis Budget Group surged, following US President Donald Trump’s proposal to impose a 25% tariff on imported vehicles. Some analysts suggest that the potential tariff hike may increase the price of new cars in the US, leading consumers to consider car rentals instead of purchasing expensive vehicles. As a result, Hertz and Avis’ shares jumped 20-23%, despite both companies losing nearly half of their value over the past year. JPMorgan analysts noted that auto parts and services companies could also benefit from the tariffs, as consumers may keep their cars longer, increasing the need for repairs. In contrast, car manufacturers like Ford and General Motors saw their stock prices fall 4-7% and their bonds ticked lower.

Hertz’s 4.625% 2026s were up 5.7 points to trade at 68.8 cents on the dollar. Avis’ 8.25% 2030s were up 1.4 points to trade at 96.8, yielding 9.1%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Hertz Downgraded to B by S&P; Raises

June 21, 2024

Hertz Bondholders Raise Concerns Over Repayment Ability

December 9, 2024