This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HDB Launches S$ Bond; Barclays, Pampa Energia, Verizon Price Bonds

November 11, 2025

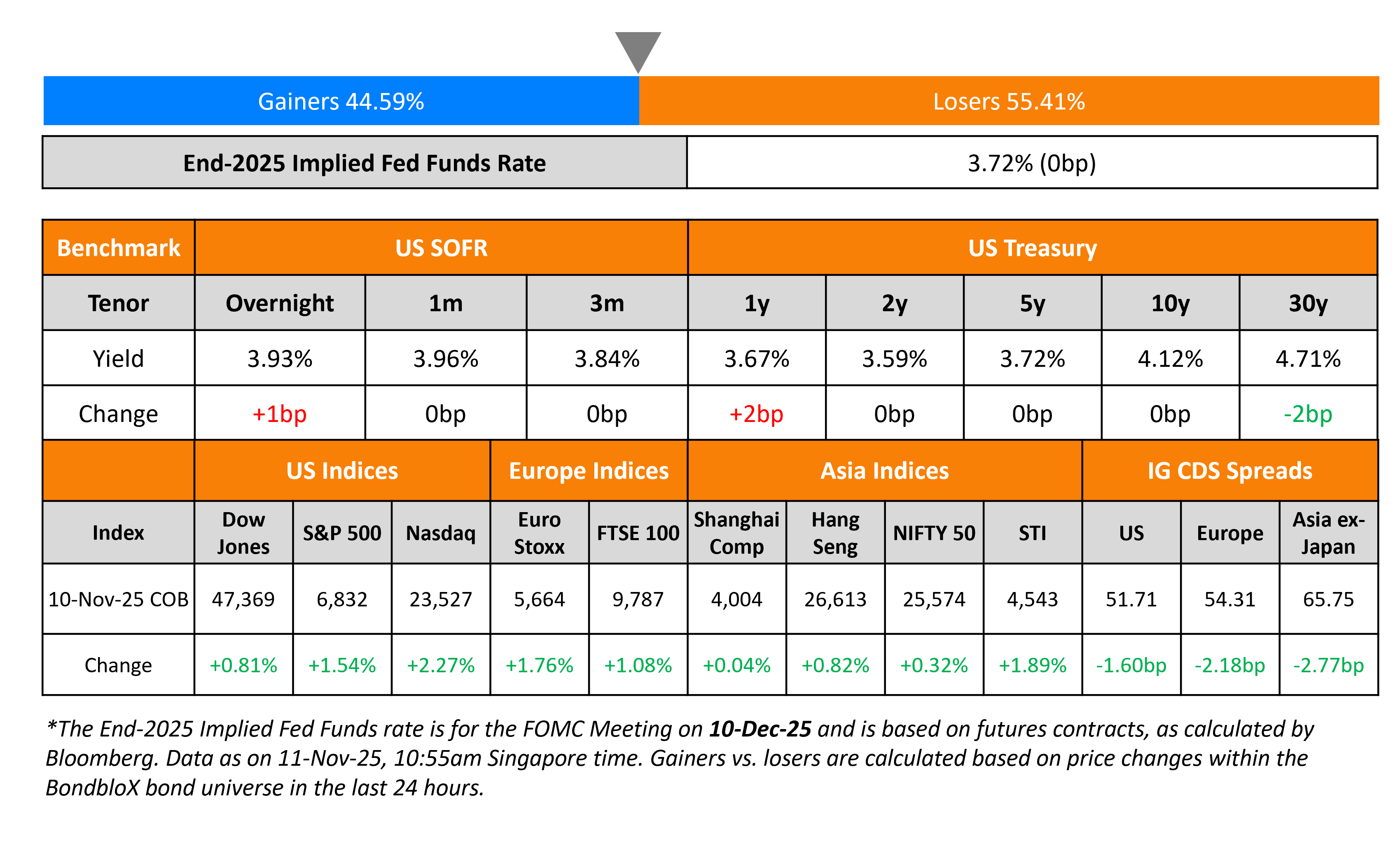

US Treasury yields were steady across the curve. A group of senators, including Senate Democrats are said to have agreed to support a deal to reopen the US government alongside funding certain departments and agencies for the next year. This is likely to lead to an end of the government shutdown that has continued for 41 days. Separately, Fed Governor Stephen Miran reiterated his stance for more rate cuts, noting that he would favor a 50bp cut in December.

Looking at the equity markets, the S&P and Nasdaq closed higher by 1.5% and 2.3% respectively. US IG and HY CDS spreads tightened by 1.6bp and 9.2bp respectively. European equity indices ended higher too. The iTraxx Main CDS spreads were 2.2bp tighter and the Crossover CDS spreads were tighter by 10.7bp. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads tightened by 2.8bp.

New Bond Issues

- HDB S$ 7Y at 2.022% area

- Bank of Queensland 3Y FRN/3Y at 3m BBSW+82bp/ASW+82bp areas

Barclays raised €1.5bn via a PerpNC10.5 AT1 bond at a yield of 6.125%, ~43.75bp inside initial guidance of 6.5-6.625% area. The junior subordinated note is rated Ba1/BB-/BBB-. If not called by 15 June 2036, the coupon will reset to the 5Y Mid-Swap plus 356.1bp. Proceeds will be used for general corporate purposes and to further strengthen its capital base.

Pampa Energia raised $450mn via a 12NC7 bond at a yield of 8.125%, inside initial guidance of mid-high 8% area. The senior unsecured note is rated B-/B. Proceeds will be used for debt repayment or refinancing, capital expenditures, working capital, operating expenditures, capital contributions and other general corporate purposes.

Hong Kong raised $300mn via a 3Y digital green note at a yield of 3.633%, inline with initial guidance of T+3bp area. The bond is rated Aa3/AA+/AA-. Proceeds will be used to finance and/or refinance eligible projects.

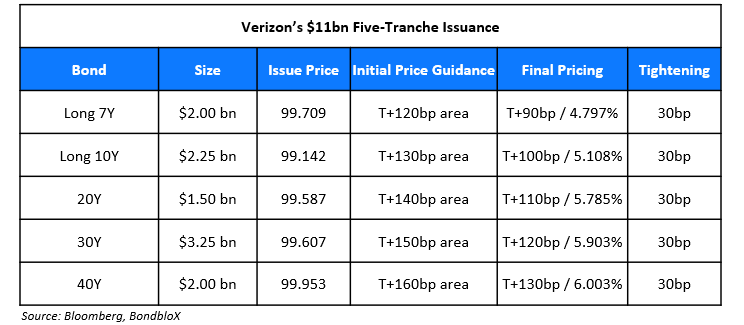

Verizon raised $11bn via a five-tranche deal.

The senior unsecured notes are rated Baa1/BBB+/A-. Proceeds will be used to fund the acquisition of Frontier Communications Parent Inc., including related costs and expenses, and to refinance debts of Frontier. Any remainder will be used for general corporate purposes.

CDL Hospitality REIT raised S$150mn via a PerpNC5 bond at a yield of 3.7%, 30bp inside initial guidance of 4.0% area. The subordinated note is unrated. If not called by 18 November 2030, the coupon will reset to the 5Y SORA plus 214.8bp. Proceeds will be used to repay existing debt and/or for onward lending to CDL Hospitality Business Trust to repay its existing borrowings.

New Bonds Pipeline

- Bank of Sharjah $ 5Y bond

- Dubai Islamic Bank (DIB) $ sustainability sukuk

-

Pluspetrol holds investor calls

-

National Bank of Oman $ PerpNC5.5 AT1

-

Resolution Life $ PerpNC7

Rating Changes

- Fitch Upgrades Carpenter Technology to ‘BBB-‘; Rates New Notes ‘BBB-‘; Outlook Stable

- Fitch Upgrades TUI Cruises to ‘BB’; Outlook Stable

- Marriott Vacations Worldwide Corp. Downgraded To ‘B+’ On Elevated Leverage Through 2026; Outlook Negative

- Fitch Downgrades Brighthouse’s Ratings; Outlook Stable

- Moody’s Ratings downgrades PeopleCert to B2; outlook negative

- Moody’s Ratings places Husky Technologies Limited’s ratings on review for upgrade

Term of the Day: Contingent Value Rights (CVRs)

Contingent Value Rights (CVRs) are contractual instruments used in M&A transactions where a promise of an additional compensation to the target company’s shareholders is made if specific future events or performance milestones are met within a set timeframe. CVRs are typically used to bridge differences in valuation between the acquiring and target companies.

Biotech company Metsera recently accepted a $10bn takeover offer from Pfizer. The latter’s offer consists of $86.25/share in cash, comprising of a $65.60/share base offer plus a CVR of up to $20.65/share.

Talking Heads

On Dollar Carry Trades Set to Trounce Booming Stock Markets

Yuxuan Tang, JPMorgan Private Bank

“The dollar will end up being one of the highest carry currencies again. Whether it’s from a directional or carry perspective, it’s still going to be about a strong dollar.”

Jacky Tang, Deutsche Bank

“As the Fed may still cautiously reduce policy rates in the near term, the dollar could remain an attractive carry asset… there’s uncertainty next year as the Fed may change its pace of rate cuts with the new Fed chair”

Aroop Chatterjee, Wells Fargo

“Dollar carry trades may remain attractive as long as the macro and financial market backdrop remains resilient”

On Yen slips to 9-month low as traders eye end to US shutdown

Brent Donnelly, Spectra Markets

“Reopening by November 15 is just about fully priced in for now, so any deviation or delays from that could be viewed as risky for this rebound in liquidity”

On Fed policymakers divided over need for more rate cuts

St. Louis Fed President Alberto Musalem

“It’s very important that we tread with caution here: I think there is limited room to ease policy further without policy becoming overly accommodative”

San Francisco Fed President Mary Daly

“We don’t want to make the mistake of holding on too long for rates, only to find out we injured the economy”

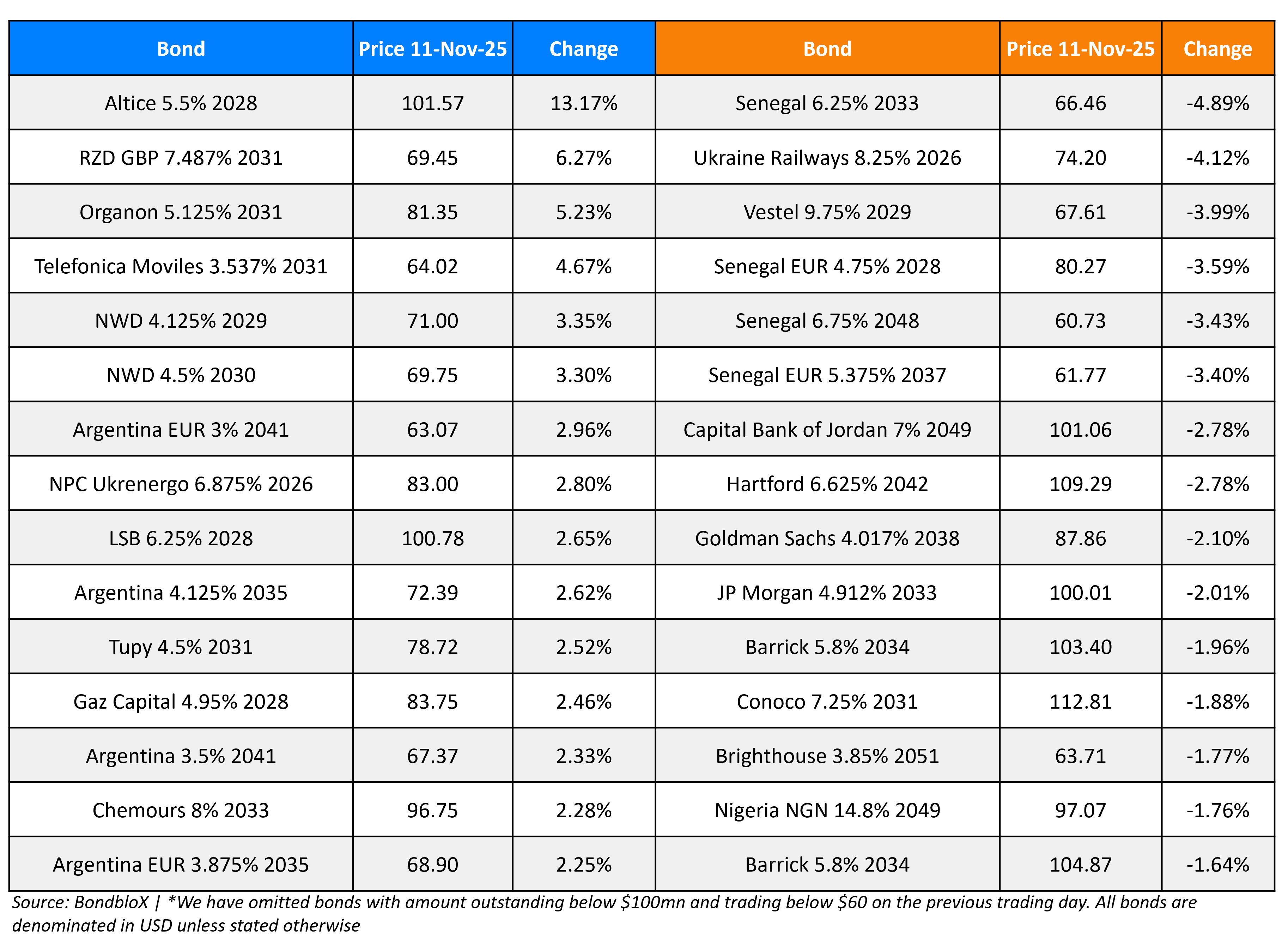

Top Gainers and Losers- 11-Nov-25*

Go back to Latest bond Market News

Related Posts: