This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hawkish Federal Reserve Advances First Rate Hike To 2023

June 17, 2021

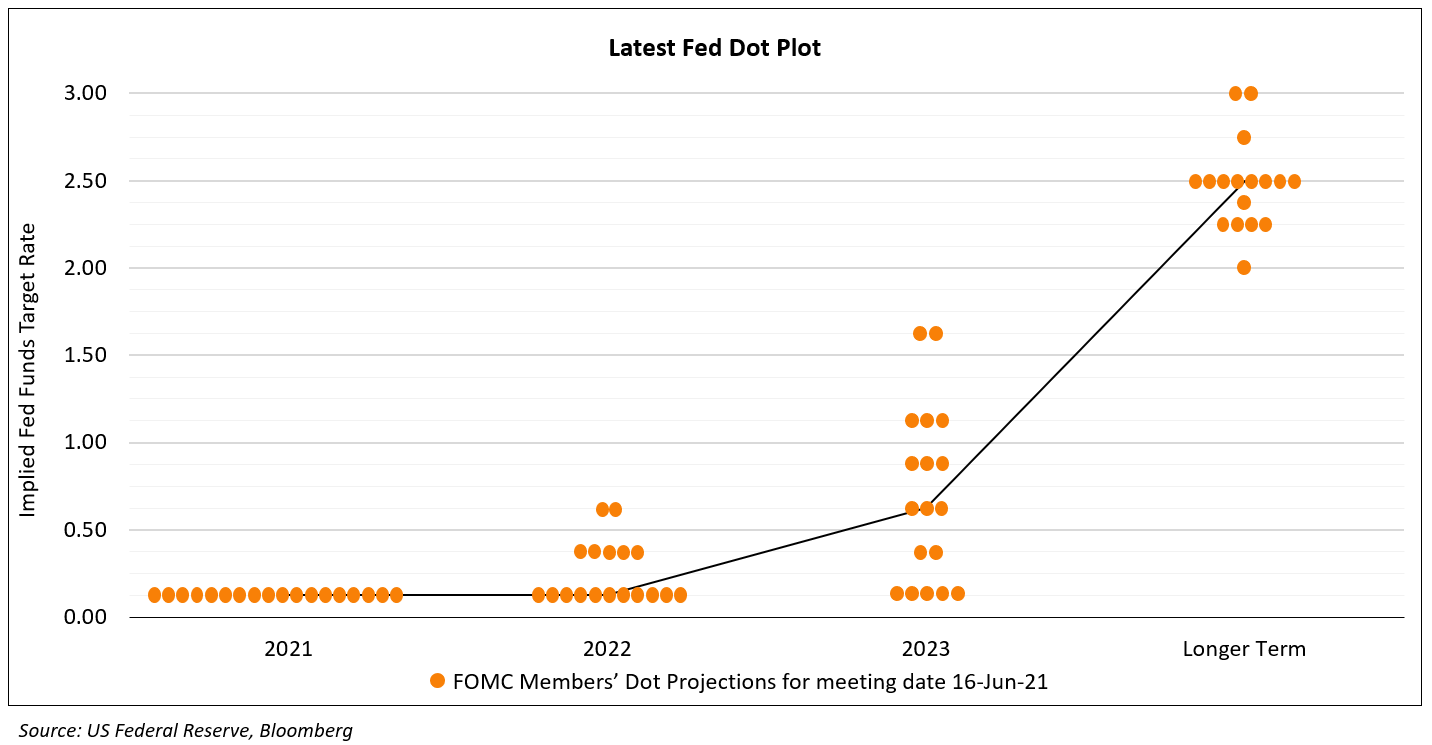

The FOMC took a hawkish tilt in Wednesday’s monetary policy meeting. The Fed brought forward its path of interest rate hikes. The latest dot plot (Term of the day, explained below) saw the median signaling at least two rate hikes in 2023, as compared to its March meeting where the dot plot showed that they were not planning to hike rates until 2024.

The median Fed Funds Rate for 2023 is now projected at 0.6% vs. 0.1% in March. In the Summary of Economic Projections (SEP), the FOMC bettered its growth projection by 0.5% to 7% for 2021 and 0.2% higher to 2.4% for 2023. Core PCE inflation was projected at 3% for 2021 vs. 2.2% in March and at 2.1% for 2022. Regarding reducing bond purchases or talks of tapering, Chairman Jerome Powell said that they have not made any decisions on ending bond purchases. For quotes from Fed Chair Powell, see Talking Heads below.

US10Y Treasury yields jumped 9bp to 1.58% on the news and the 2s10s curve steepened ~6bp to 137bp.

For the full story, click here

Go back to Latest bond Market News

Related Posts: