This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Guacolda Energia’s Dollar Bond is Among the Top Performers this Year

July 18, 2023

Chilean coal-fired power generator Guacolda Energia’s 4.56% 2025s are among the best performing dollar bonds this year having rallied by 56% since the start of the year. This trend is largely attributed to an oversaturation of the solar and wind market that is plagued by pricing distortions and transmission problems. This caused thermoelectric generators like Guacolda to benefit from being perceived as vital backups amidst Chile’s efforts towards carbon neutrality. Furthermore, Guacolda enjoys lower coal costs and weakening calls to cease all coal-fired plants by 2025 as a result of strains on a regulated power system. Confidence in the company was also renewed after Capital Advisors, which acquired Guacolda in mid-2021, managed to significantly reduce debt and improve profitability. In April, the company concluded a tender offer that paid out about $60mn for $132.5mn of the notes, highlighting the owners’ optimism for the company.

Guacolda’s 4.56% 2025s are currently trading at 46.7 cents on the dollar.

For more information, click here

Go back to Latest bond Market News

Related Posts:

Guacolda Energia Downgraded To B+ From BB-

June 2, 2021

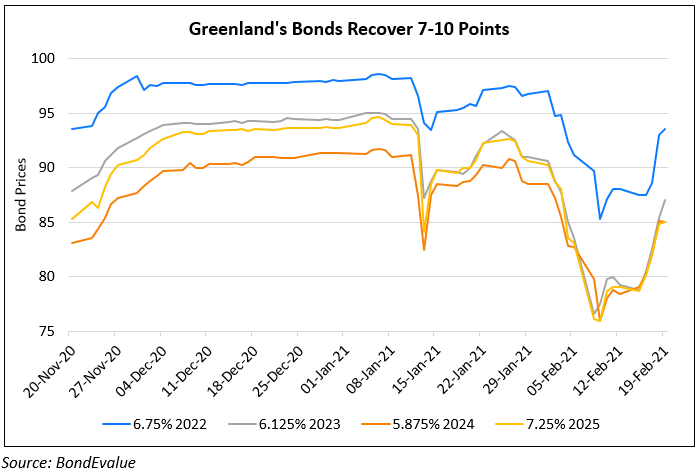

Greenland’s Dollar Bonds Recover 7-10 Points from Lows

February 19, 2021