This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Greenland’s Financial Troubles and SOE Bailout Come to Light; R&F Sells London Asset at 42% Discount

March 16, 2022

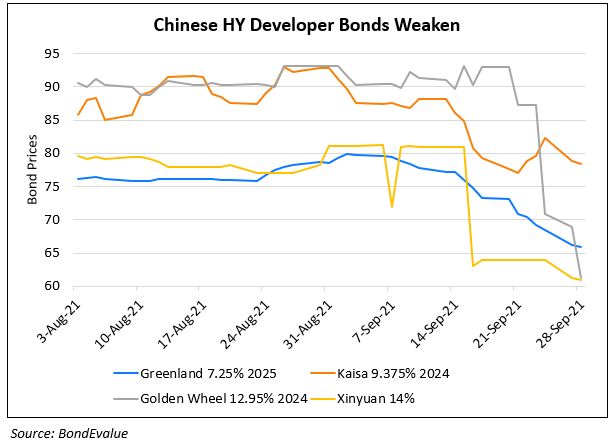

Greenland Holdings’ financial troubles have come to light as people with direct knowledge of the matter have spilled the beans on the developer. They said that Greenland was it was in danger of defaulting on a $500mn puttable dollar bond in December when it was rescued by state-owned enterprises (SOEs) at the behest of Shanghai authorities. After rating agencies downgraded the developer coupled with weak market sentiment owing to defaults across the sector, Greenland was in financial difficulty. However, on December 14, Greenland announced that it raised $350mn via a 7.974% dollar bond due August 2022. Being a rare issuance by a Chinese developer at the time, 7 SOEs stepped in and bought its debt, sources say. The added that that these 7 SOEs were the only buyers of Greenland’s new debt. Three days later, Greenland said it redeemed 85.9% of the puttable bond. Sources add that it was the first known example where ‘Chinese SOEs were directly ordered to participate in a property sector bond offering’. The sources said that its peer Shimao also had a helping hand from Shanghai municipal authorities – 27 of its creditors were asked to maintain lending positions and not publicly undermine Shimao’s creditworthiness. While the reasons for particularly supporting Greenland are not known, some sources said that it was state-backed and has high-profile projects. What remains to be seen is how far governments go ahead to help the company in the future.

Greenland’s dollar bonds were down with its 6.75% 2023s down 4 points to 40.24.

Separately, R&F Properties has agreed to sell a plot of mixed-use land in London at a loss to Far East Consortium International. The sale has been agreed at £95.7mn ($124.8mn), a 42% discount to market valuation. SCMP notes that the move shows its ‘haste to raise cash to pare its debts’.

Go back to Latest bond Market News

Related Posts: