This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

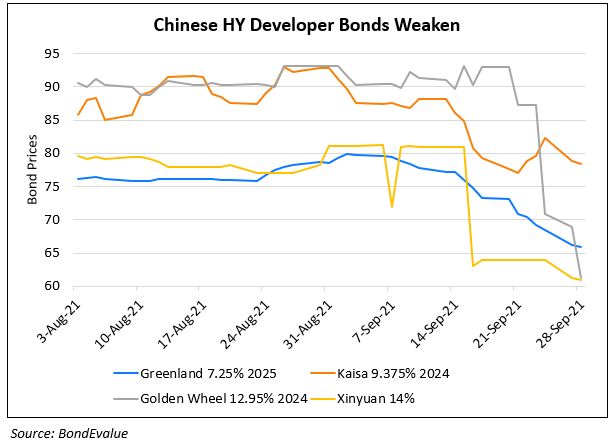

Greenland Downgraded to B+ by S&P on Impaired Funding and Weak Operating Conditions

October 14, 2021

Greenland Holding was downgraded two notches to B+ from BB and its senior unsecured notes to B from BB- by S&P. They also downgraded its subsidiary Greenland Hong Kong Holdings Ltd. to B from BB- with a negative outlook. The downgrade comes on the back of its impaired funding and weak operating conditions which are unlikely to improve in the near-term. S&P said, “Without an improvement in funding access, the company will need to heavily rely on onshore bank loans and internal cash flow to meet its debt maturities; any execution risk on this front could weigh on its liquidity”. Given expectations of tight mortgage conditions, soft purchasing sentiment and limited room to cut construction and capex, its cash generation and contracted sales will weaken.

S&P believes Greenland’s upcoming bond maturities are still manageable given its cash balance and cash from offshore projects. It has ~RMB 83.7bn ($13bn) of unrestricted cash and liquid investments as of end-June 2021, mainly situated onshore. It has $500mn and $1.82bn of offshore bonds due in the remainder of 2021 and in 2022 which accounts for only 5% of total debt at the end-June 2021. They also expect cash collection from Greenland’s offshore projects to reach RMB 5-7bn ($800mn-1.1bn) by end-2022, covering 30-45% offshore bond repayments. Given Greenland’s high concentration on bank funding that account for 80% of total borrowings, any weaknesses in bank support represents a key risk. However, S&P expects access to bank financing to be unaffected thanks to its “established relationships and a gradual improvement in meeting the three red lines requirements”.

Greenland’s dollar bonds were traded lower with its 7.25% bonds due March 2022 down 3.5 points to 69.5 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Ronshine Downgraded by Moody’s to B2

September 17, 2021

Other Chinese Developers’ Dollar Bonds Move Further Lower

September 28, 2021