This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Greenko, Allianz Price Bonds; Markets Trade Choppy

March 21, 2025

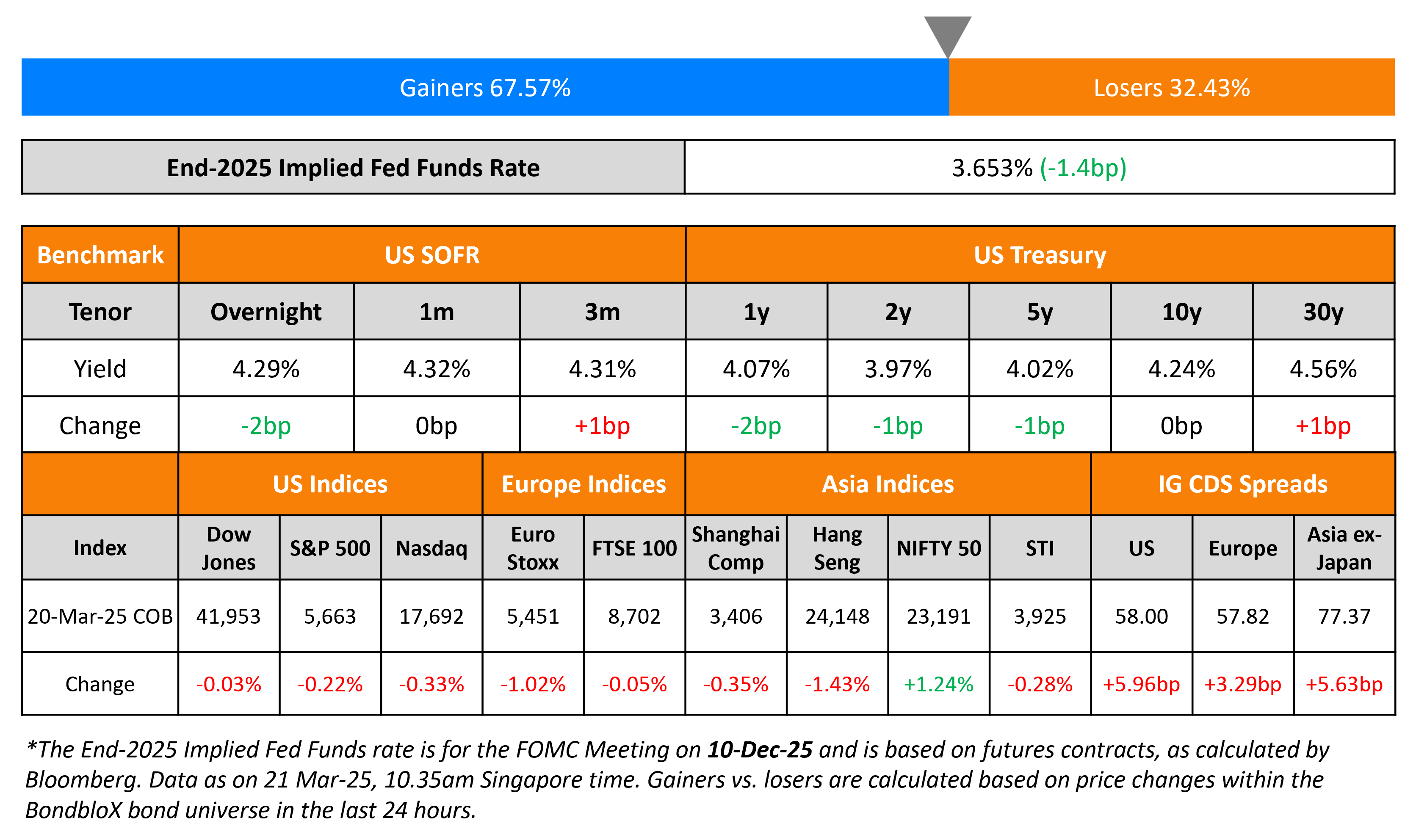

US Treasury yields were broadly unchanged after a choppy trading session yesterday. Weekly initial jobless claims remained stable at 223k, broadly in-line with expectations and at levels consistent with a resilient labor market.

US equity markets moved lower, with the S&P and Nasdaq down by 0.2-0.3%. Looking at credit markets, US IG and HY CDS spreads widened 6bp each. European equity markets ended lower too. The iTraxx Main and Crossover CDS spreads widened by 3.3bp and 8.5bp respectively. Turkey’s central bank hiked its overnight lending rate by 200bp to 46%. However it kept the one-week repo unchanged. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 5.6bp.

New Bond Issues

- Bausch Health $4bn 7NC3 at high 10% area

Greenko Energy raised $1bn via a 3.5NC2 bond at a yield of 7.25%, 37.5bp inside initial guidance of 7.625% area. The senior bond is rated Ba2/BB, and has a change of control put at 101. The amortizing bond has a weighted-average life of 3.36 years. Proceeds will be used to refinance its $750mn 5.50% 2025s, for general corporate purposes and subscribe to the potential rupee debt to be issued by Greenko AP01 IREP Pvt.

Allianz raised €1.25bn via a 30.3NC10.3 Tier 2 bond at a yield of 4.431%, 25bp inside initial guidance of MS+200bp area. The subordinated note is rated A1/A+. Proceeds will be used for general corporate purposes and to refinance existing debt.

Swiss Re raised €750mn via an 8NC7 Tier 2 bond at a yield of 3.89%, 25bp inside initial guidance of MS+160bp area. The subordinated note is rated A3/BBB+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Shinhan Bank hires for $ bond

- Morocco hires for € 4Y/10Y bond

Rating Changes

-

Fitch Upgrades Tenet Healthcare’s IDR from ‘B+’ to ‘BB-‘; Affirms Instrument Ratings; Outlook Stable

-

Spirit Airlines LLC Upgraded To ‘CCC+’ On Emergence From Bankruptcy; Outlook Stable

-

Herbalife Ltd. Upgraded To ‘B+’ On Deleveraging, Outlook Stable

-

Moody’s Ratings changes Murphy’s outlook to stable; affirms Ba2 CFR

-

Fitch Revises Amgen’s Outlook to Positive; Affirms Ratings at ‘BBB’/’F2’

Term of the Day: Sovereign Risk Premium

Sovereign risk premium refers to the additional implied spread that a country’s sovereign bonds offer vs. a benchmark for a particular currency. Put differently, it is the incremental return (or yield) that investors demand from a country to buy its sovereign bonds vs. the benchmark.

Talking Heads

On Wall Street Uncertain Over When Fed’s Balance-Sheet Unwind Will End

BofA – Fed stopping QT at the end of December 2025 from September previously

Barclays – Fed could end QT in June 2026 from September 2025

Deutsche Bank – Continue to anticipate Fed’s runoff will end in 1Q 2026

JPMorgan Chase – Now expect QT to run at the current pace through 1Q 2026

TD Securities – Expect Fed to discontinue QT altogether at the September FOMC

On Slowing Balance-Sheet Runoff Pace ‘Alarming’ Signal – Larry Summers, Fmr. US Treasury Secy.

“This should be getting people’s attention as an alarming development…. limited absorption capacity in the markets for long-term bonds… We’re finding it necessary, in order to place debt, to shorten up”

On German Bund Yield Hitting 4% Being Feasible – Aviva Investors

“A range of 3.5% to 4% is entirely feasible given the announcements and a realistic trajectory for growth, budget balance, inflation and monetary policy… Even in this doomsday scenario, however, I would struggle to see bund yields lower than current levels in around a year’s time”

Top Gainers and Losers- 21-March-25*

Go back to Latest bond Market News

Related Posts: