This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Great Eastern, Tata Capital Launch $ Bonds

January 14, 2025

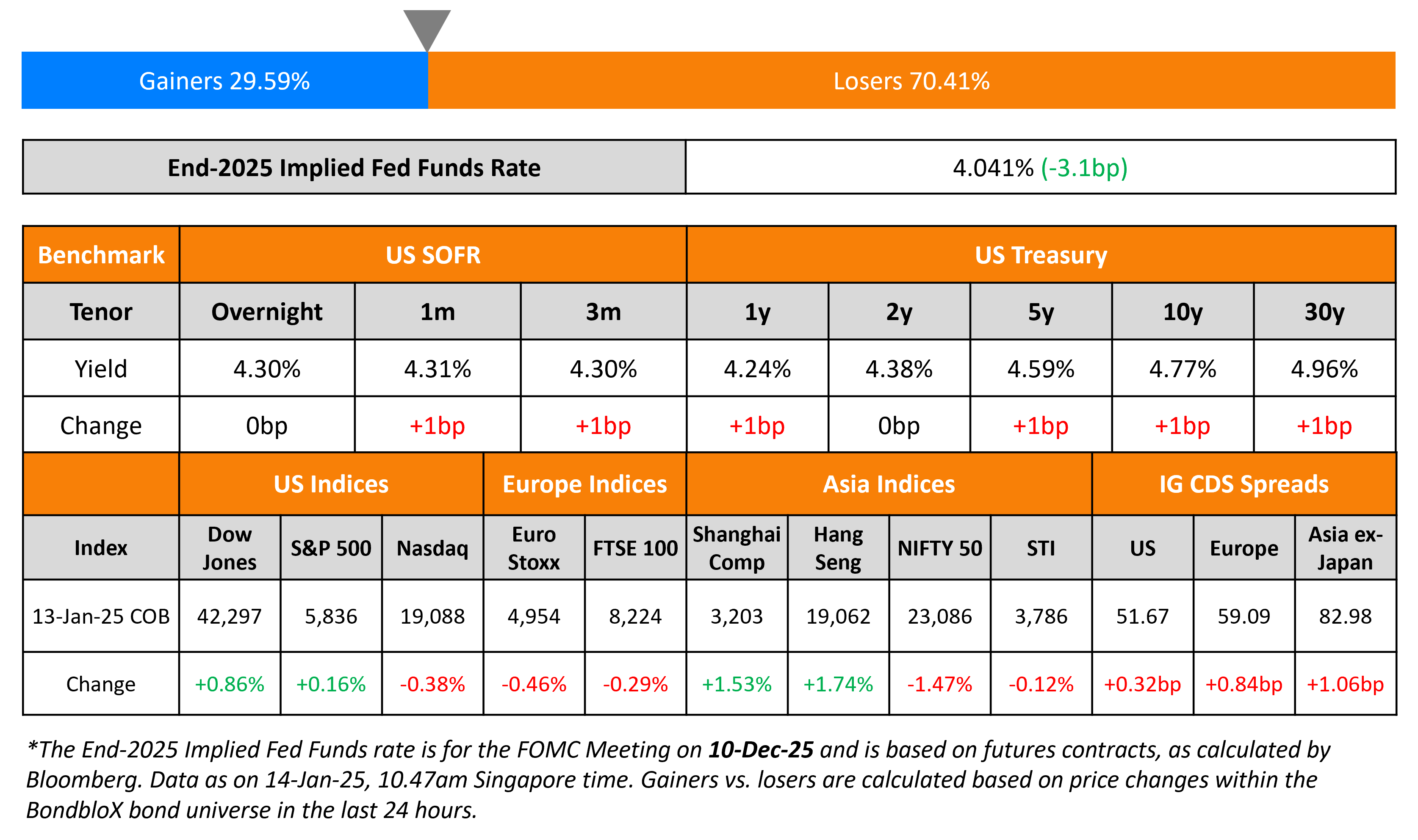

US Treasuries were broadly stable yesterday, with no major economic data, ahead of the inflation report due on Wednesday. The 10Y yield currently stands at 4.77% with markets having pushed out the next Fed rate cut to September/October from June earlier, following the strong jobs report.

US IG and HY CDS spreads widened by 0.3bp and 0.4bp respectively. US equity markets were mixed, with the S&P up 0.2% while the Nasdaq was down 0.4%. European equities ended lower. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.8bp and 5.2bp respectively. Asian equities are trading broadly mixed this morning. Asia ex-Japan CDS spreads were 1.1bp wider.

New Bond Issues

-

Great Eastern Life $ PerpNC7 AT1 at 5.9% area

-

Tata Capital $ 3.5Y at T+125bp area

-

Vedanta $ 5.5NC2.5/8.25NC3 at 9.875/10.25% area

-

Hyundai Capital Services $ 3Y at T+105bp area

StanChart raised $2.5bn via a three-trancher. It raised

- $1bn via a 4NC3 bond at a yield of 5.545%, 25bp inside initial guidance of T+130bp area. The new bonds are priced ~5.5bp tighter to its existing 6.310% 2029s (callable in 2028) that yield 5.6%.

- $500mn via a 4NC3 FRN at SOFR+104bp vs. initial guidance of SOFR equivalent area.

- $1bn via a 11NC10 bond at a yield of 6.228%, 27bp inside initial guidance of T+170bp area. The new bonds are priced roughly inline with its existing 3.265% 2036s (callable in 2035) that yield 6.2%.

The senior unsecured bonds are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

KHFC raised $800mn via a two-tranche issuance. It raised $500mn via a 5Y bond at a yield of 5.234%, 32bp inside initial guidance of T+95bp area. It also raised $300mn via a 5Y FRN at SOFR+90bp vs. initial guidance of SOFR equivalent area. The senior unsecured bonds are rated Aa2/AA. Proceeds will be used to finance and/or refinance a diverse range of mortgage loan products with regard to its sustainable financing framework.

BPCE raised S$300mn via a 10NC5 Tier 2 bond at a yield of 4.6%, 25bp inside initial guidance of 4.85% area. The subordinated notes are rated Baa2/BBB/BBB+.

New Bonds Pipeline

-

IIFL Finance hires for $ 3.5Y bond

- Turkcell hires for $ 5Y/7Y Sustainability bond

Rating Changes

-

Moody’s Ratings upgrades Vedanta Resources’ CFR to B1 and bonds to B2; outlook stable

-

Broadcom Inc. Upgraded To ‘BBB+’ As AI Momentum Drives Strong Growth Prospects; Outlook Positive

-

Fitch Downgrades Efes to ‘BB’; Outlook Stable

Term of the Day: Panda Bond

Panda bonds are renminbi denominated notes sold by a non-Chinese issuer in onshore China. The first of its kind was issued by the IFC and ADB in 2005. While these bonds attract Chinese investors, they have also gained traction among international investors. It also helps issuers diversify investor bases and reduce currency risk.

Pakistan’s Finance Minister said that the nation were preparing a debut Panda bond issuance.

Talking Heads

On EM Currencies at Central Banks’ Mercy as Fiscal Policy Lags

Brendan McKenna, Wells Fargo

“Central bank currency intervention is not a tool that can adequately or sustainably defend regional currencies”

Homin Lee, Lombard Odier

“We assume that Beijing will respond to any major tariff announcement from Trump’s team with a one-off devaluation of its currency”

Citigroup strategists

“Fiscal dominance has become an important discussion point among EM investors”

On Seeing No Risk to Fed Autonomy Under Trump – Fmr. Fed Vice-President, Randal Quarles

“There’s a fair bit of misunderstanding about what Fed independence is. Fed independence doesn’t mean that the president can’t express a view on Fed policy… while there’s certainly political pressure there’s not really political levers that someone can pull to affect their independence”

On More ECB Cuts Needed Irrespective of Fed Moves – ECB GC member, Olli Rehn

“Against the backdrop of disinflation being on track and the growth outlook having weakened it makes sense to continue rate cuts… direction is clear, the scale and speed of rate cuts depends upon the incoming data”

Top Gainers and Losers- 14-January-25*

Go back to Latest bond Market News

Related Posts:

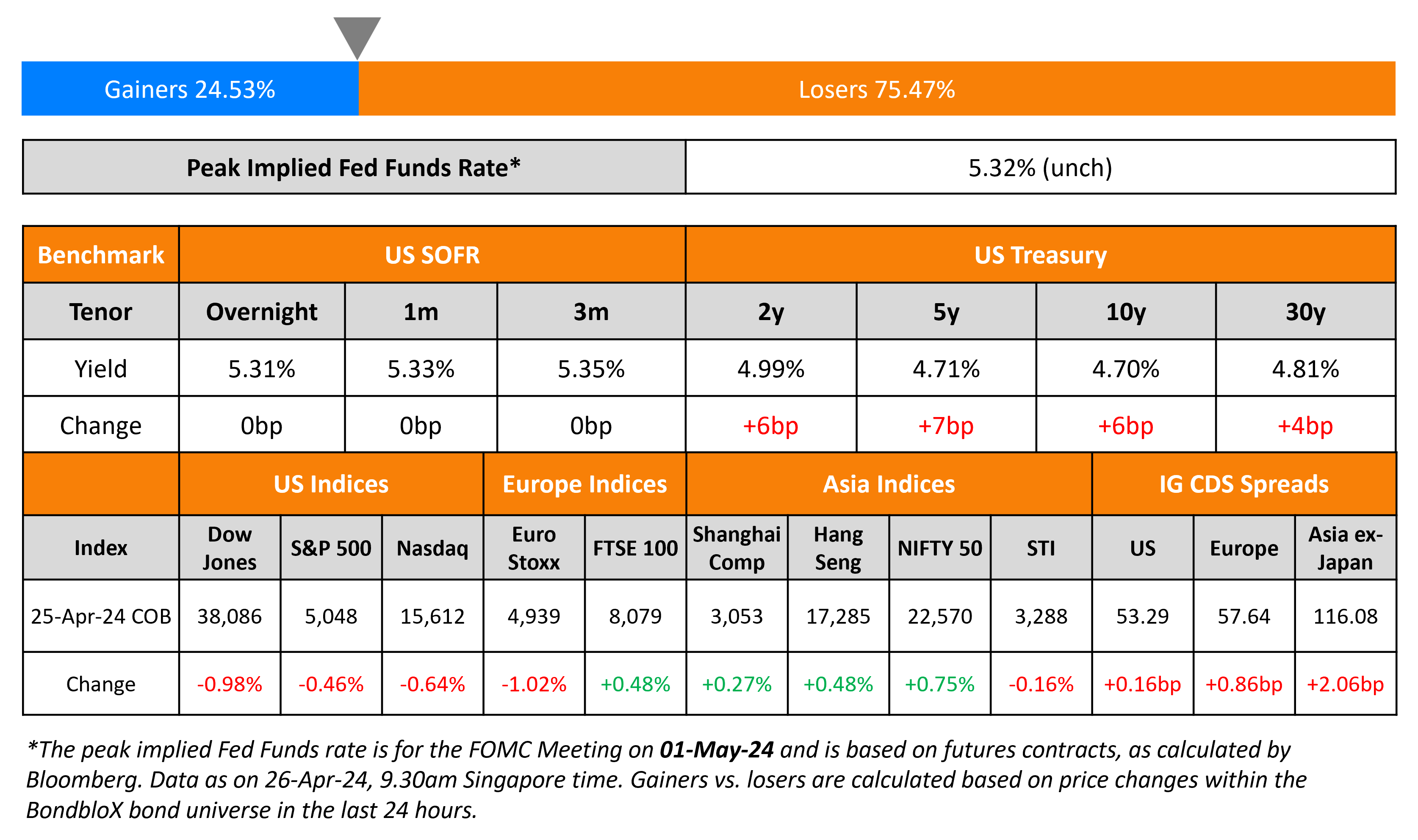

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024