This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Goldman Prices $8.5bn Four-Trancher

January 22, 2025

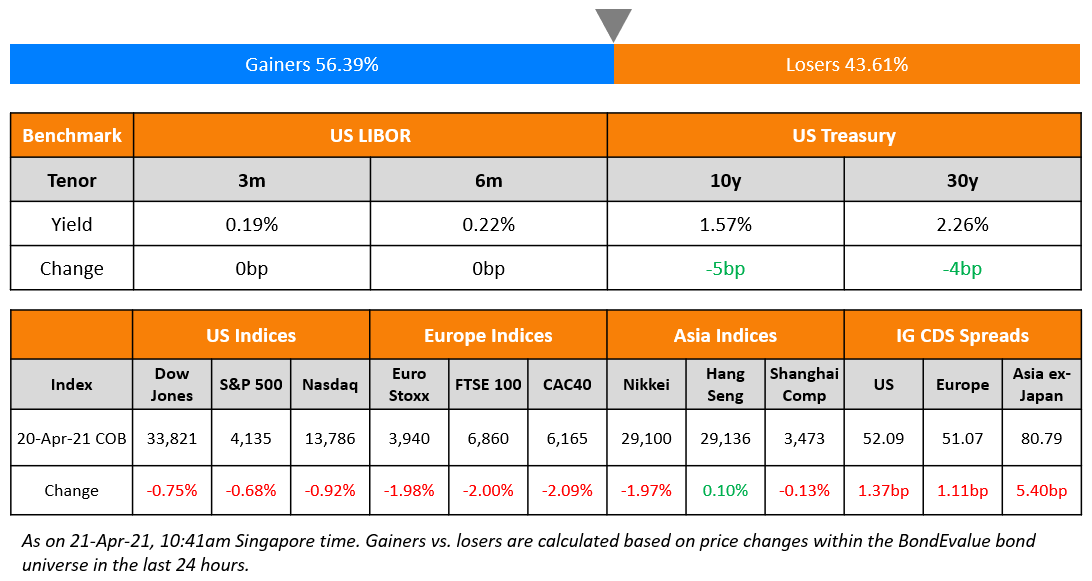

US Treasury yields ticked marginally higher by 3-5bp across the curve, partially reversing the move seen after Donald Trump’s Presidential inauguration ceremony. There were no major macro developments from the region. US IG and HY CDS spreads tightened by 1bp and 8.1bp respectively. US equity markets ended higher, with the S&P and the Nasdaq up by 0.9% and 0.6% respectively. European equities ended higher too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.2bp and 1.7bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads were 3.2bp tighter.

New Bond Issues

Goldman Sachs raised $8.5bn via a five-part deal.

The senior unsecured notes are rated A2/BBB+/A. Proceeds will be used for general corporate purposes.

Rating Changes

- Consol Energy Inc. Upgraded To ‘BB-‘ From ‘B+’ Upon Completion Of Merger With Arch Resourcers Inc.; New Company Named Core Natural Resources; Outlook Stable

- Fitch Upgrades 10 Sri Lankan Banks’ National Ratings and Affirms Five after Scale Recalibration

- Moody’s Ratings upgrades Oglethorpe Power’s senior secured ratings to A3 from Baa1; outlook is stable

- Moody’s Ratings upgrades Novo Nordisk’s rating to Aa3 and changes its outlook to stable

- Moody’s Ratings downgrades Selecta to Caa3, negative outlook

- Moody’s Ratings downgrades Eutelsat’s CFR to B2 from Ba3; outlook stable

- Fitch Revises INEOS Group’s Outlook to Negative; Affirms IDR at ‘BB‘

Term of the Day: Subordinated Bonds

Subordinated bonds refer to bonds that rank below senior debts on the capital structure. In the event of liquidation, holders of subordinated debt would only be paid after all the senior debt is repaid. Thus, the ratings and yield of subordinated debt tend to be lower and higher respectively, to account for the greater risk associated with subordinated vs. senior debt. There are different kinds of subordinated debt that can include perpetuals/AT1 CoCos, payment-in-kind notes, mezzanine debt, convertible bonds, vendor notes etc. Subordinated debt rank higher to preferred equity and common equity in the capital structure.

Talking Heads

On the unsustainable US fiscal path despite improved budget forecasts – DoubleLine

“If you tweak those rate assumptions by very small amounts, the debt dynamic deteriorates quite dramatically … the unsustainable debt dynamics still remain in place… Given that the entire curve right now is above 4%, it might be a bit challenging to get there, especially if you have this more optimistic growth outlook that should feed through into higher interest rates”

On ECB to Near Inflation Target by Middle of Year – ECB GC member, Joachim Nagel

“We are on a good path to our target and it looks like that by the middle of this year we could be close to our target… (neutral rate) is achievable”

On EU Set to Cut Back ESG Reporting Rules Amid French Demands

“There is a common diagnosis of the need to lighten the burden on businesses to make them commensurate with the challenges we face. Differences are more in the magnitude and timing of what should be done.”

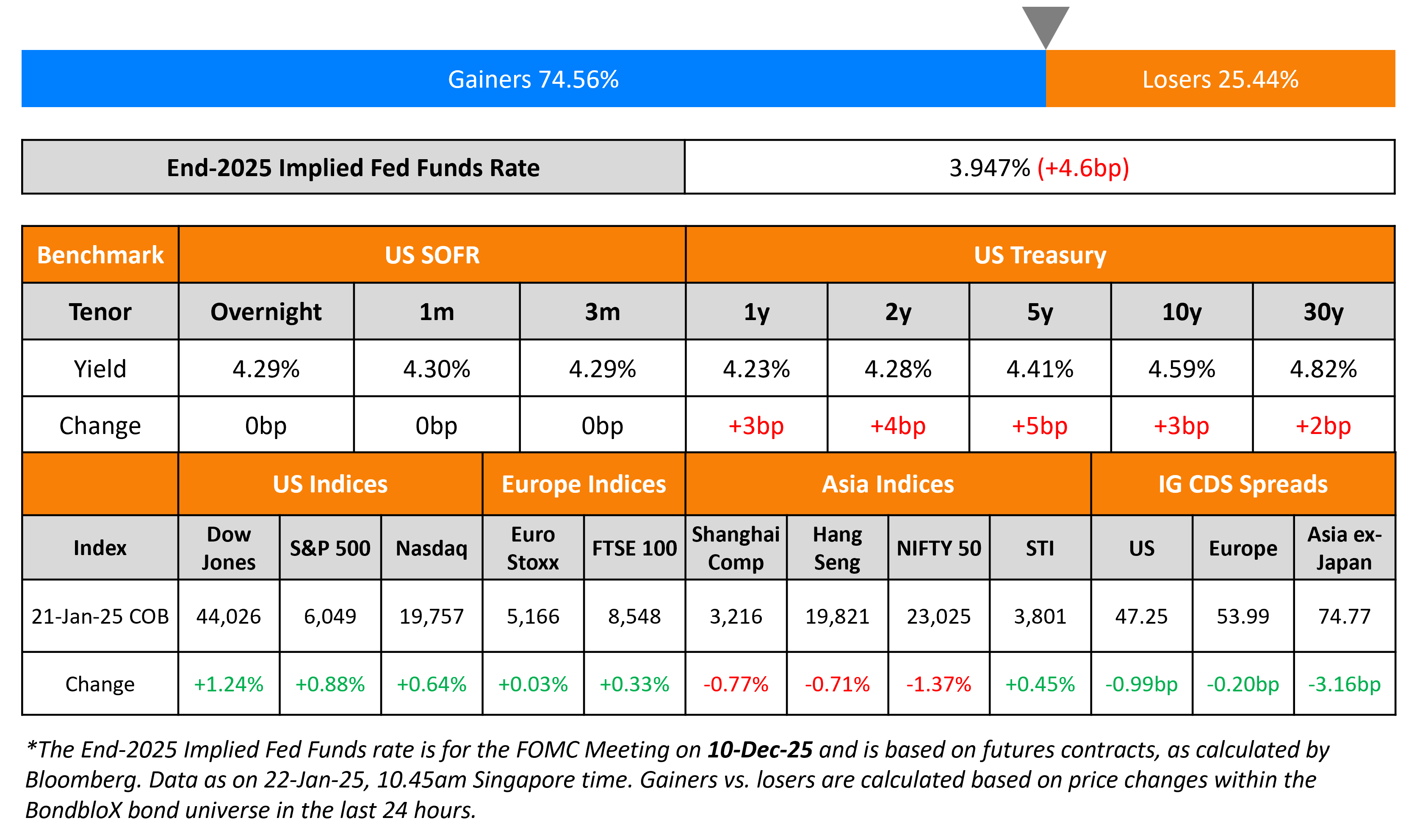

Top Gainers and Losers- 22-January-25*

Go back to Latest bond Market News

Related Posts: