This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Goldman, KEB Hana Bank Price $ Bonds

October 15, 2025

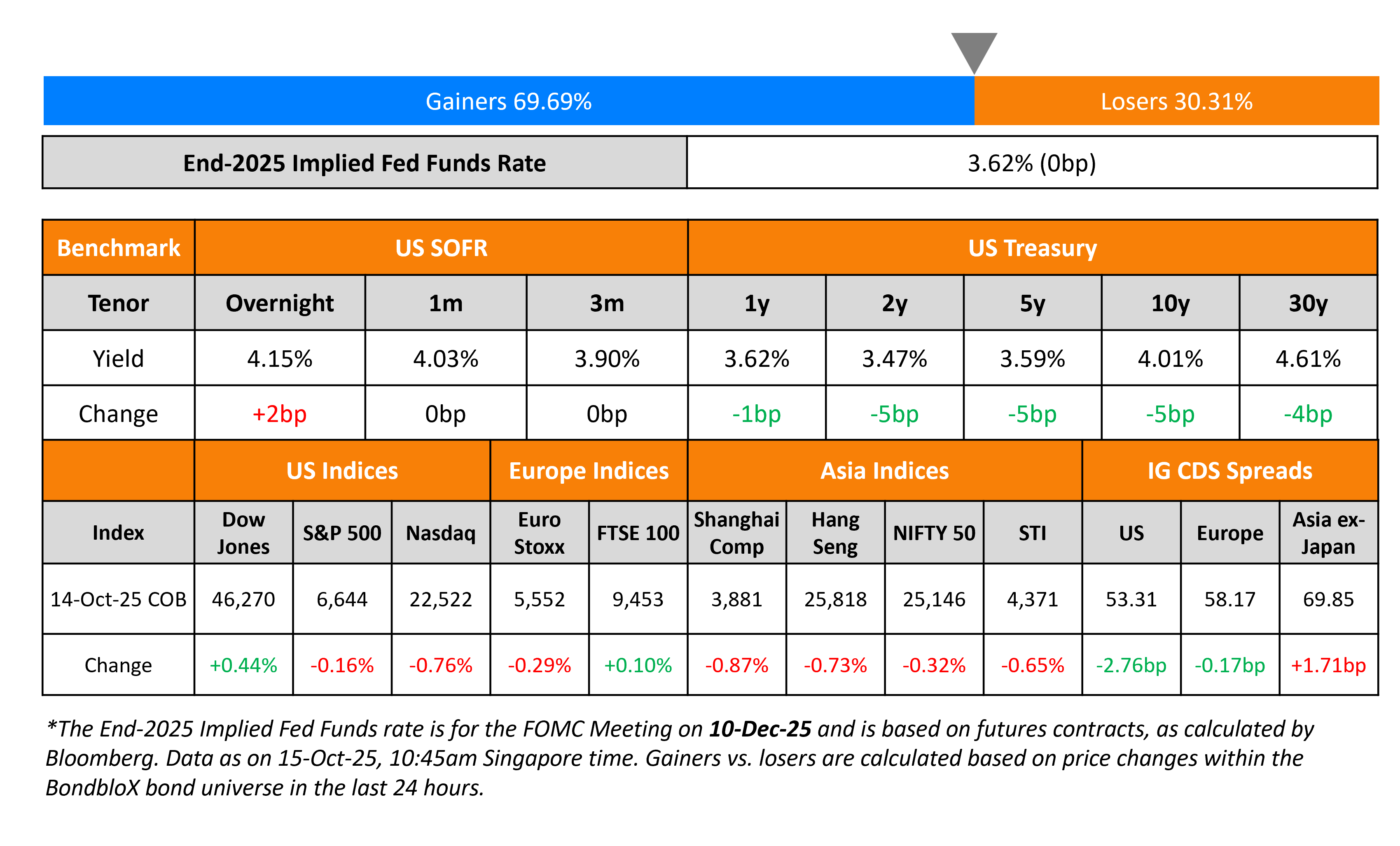

US Treasury yields eased by 4-5bp across the curve. Release of CPI data for the month of September was postponed to 24 October due to the ongoing US government shutdown. Fed Chairman Jerome Powell in his remarks signaled that the economic outlook appeared unchanged since policymakers met in September. He pointed to the low pace of hiring and noted that it may weaken further, which might show up in unemployment. The lack of key economic data owing to the shutdown is also reducing Fed’s read on the economy, he added. Separately, Boston Fed Susan Collins reiterated that rising risks to the job market support additional interest rate cuts in what remains an uncertain economic environment.

Looking at equity markets, both the S&P and Nasdaq ended lower by 0.2% and 0.8% respectively. The US IG and HY CDS spreads tightened by 2.8bp and 14bp respectively. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.2bp tighter while the Crossover spreads were 4.8bp tighter. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 1.7bp wider.

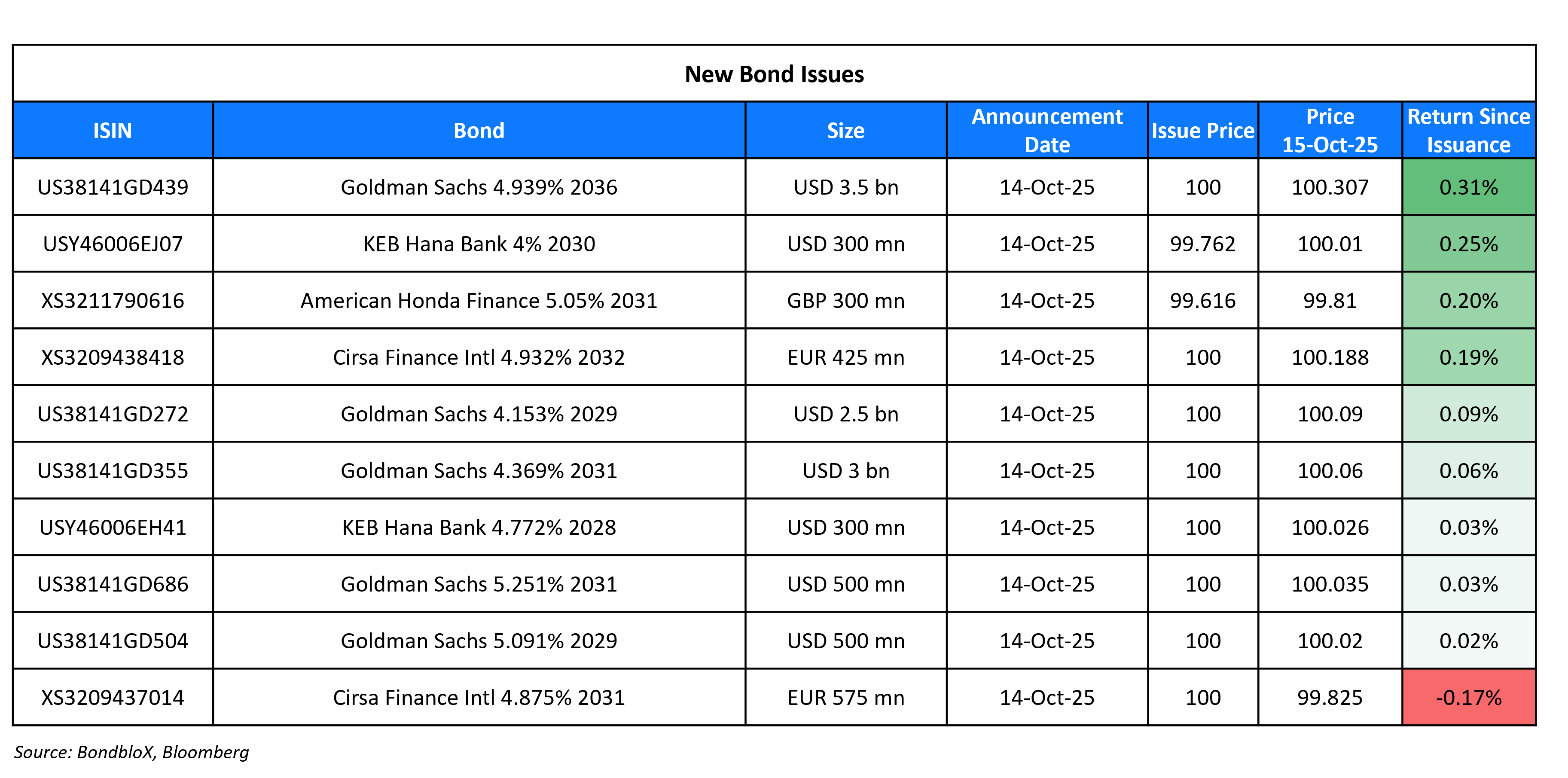

New Bond Issues

- Terawulf $3.2bn 5NC2 at 8% area

-

China Water Affairs $5NC3 at 6.375% area

-

Weir Group A$ 5.25Y at ASW+170-175bp area

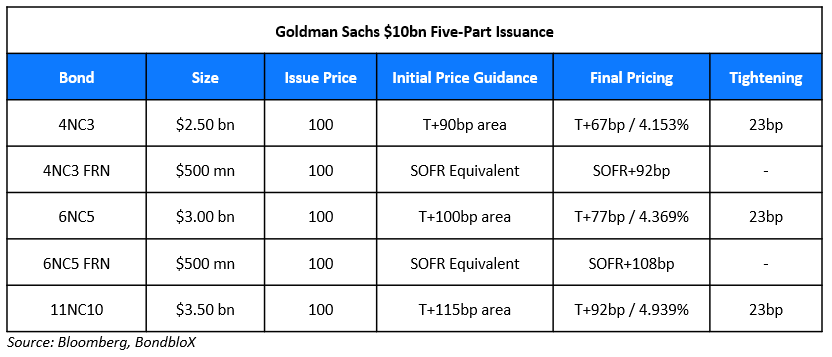

Goldman Sachs raised $10bn via a five-trancher.

The senior unsecured bonds are rated A2/BBB+/A. Proceeds will be used for general corporate purposes.

KEB Hana Bank raised $600mn via two tranches. It raised:

- $300mn via a 3Y FRN at SOFR+60bp vs. initial guidance of SOFR+95bp area

- $300mn via a 5Y bond at a yield of 4.053%, 37bp inside initial guidance of T+80bp area

The senior unsecured notes are rated Aa3/A+(Moody’s/S&P). The proceeds will be used to finance or refinance new and/or existing projects from Eligible Green Categories in accordance with KEB Hana Bank Sustainability Financing Framework dates March 2023.

New Bonds Pipeline

- Avation $300-400mn, up to 5.5NC2 Bond

-

Republic of Korea $5Y bond

Rating Changes

- Fitch Upgrades AXO’s IDRs to ‘BB+’; Outlook Stable

- Fitch Upgrades Guatemala to ‘BB+’; Outlook Stable

- Fitch Revises SCOR’s Outlook to Positive; Affirms IFS Rating at ‘A+’

- Sasol Ltd. Outlook Revised To Negative On Weak Oil And Chemical Prices; ‘BB+/B’ Ratings Affirmed

- Moody’s Ratings changes Embraer’s outlook to positive; Baa3 rating affirmed

- Kosmos Energy Ltd. ‘CCC+’ Rating Affirmed On Partial Refinancing; Outlook Remains Negative; Debt Ratings Raised

- Eastman Kodak Co. Outlook Revised To Negative On Heightened Refinancing Risk; ‘CCC+’ Rating Affirmed

Term of the Day

Viability Event

This is an event when the regulators/relevant authorities determine that the company under consideration may be non-viable or may not remain a going concern unless measures are taken to revive its operations given financial difficulties. Once the regulators determine that the company would be non-viable, it would trigger an action where for example, the company would have a right to irrevocably write-off (partly or fully) the outstanding principal of the bonds and make this portion non-payable henceforth. It could also include accrued and unpaid interest/dividends being unpayable. Thus, in this case, the regulator determines that without a write-off, the issuer would become non-viable and without a public sector injection of capital or other equivalent support, the issuer would become non-viable. Such an event is also known as point of non-viability (PONV).

Talking Heads

On Long Term Treasuries Staying Elevated

Collin Martin, Schwab Center for Financial Research

“We don’t expect long-term yields to fall much further, if at all. Ten-year Treasuries can still hold above 4% even as the Fed cuts rates, mainly due to inflation being sticky and the overall resilient economy. Also, we don’t think monetary policy is very restrictive right now. We disagree with the implied pricing and think the Fed will cut one more time this year as opposed to markets pricing in closer to two… which would probably result in an upside surprise for yields.”

On Erosion of Trust in Central Banks

Pierre-Olivier Gourinchas, IMF

“Trust in central banks helps anchor inflation expectations, and this credibility needs to be protected. As trust erodes, inflation and inflation expectations always rise, macroeconomic stability deteriorates and everyone loses out.”

On Auto sector Bankruptcies Sparking Credit Risks

Andrew Sheets, Morgan Stanley

The third quarter earnings become a very interesting litmus test for how this shakes out – people will be very closely following the bank reporting. There will be big questions about where auto loan trends are, (and) other consumer credit charge-off trends are.”

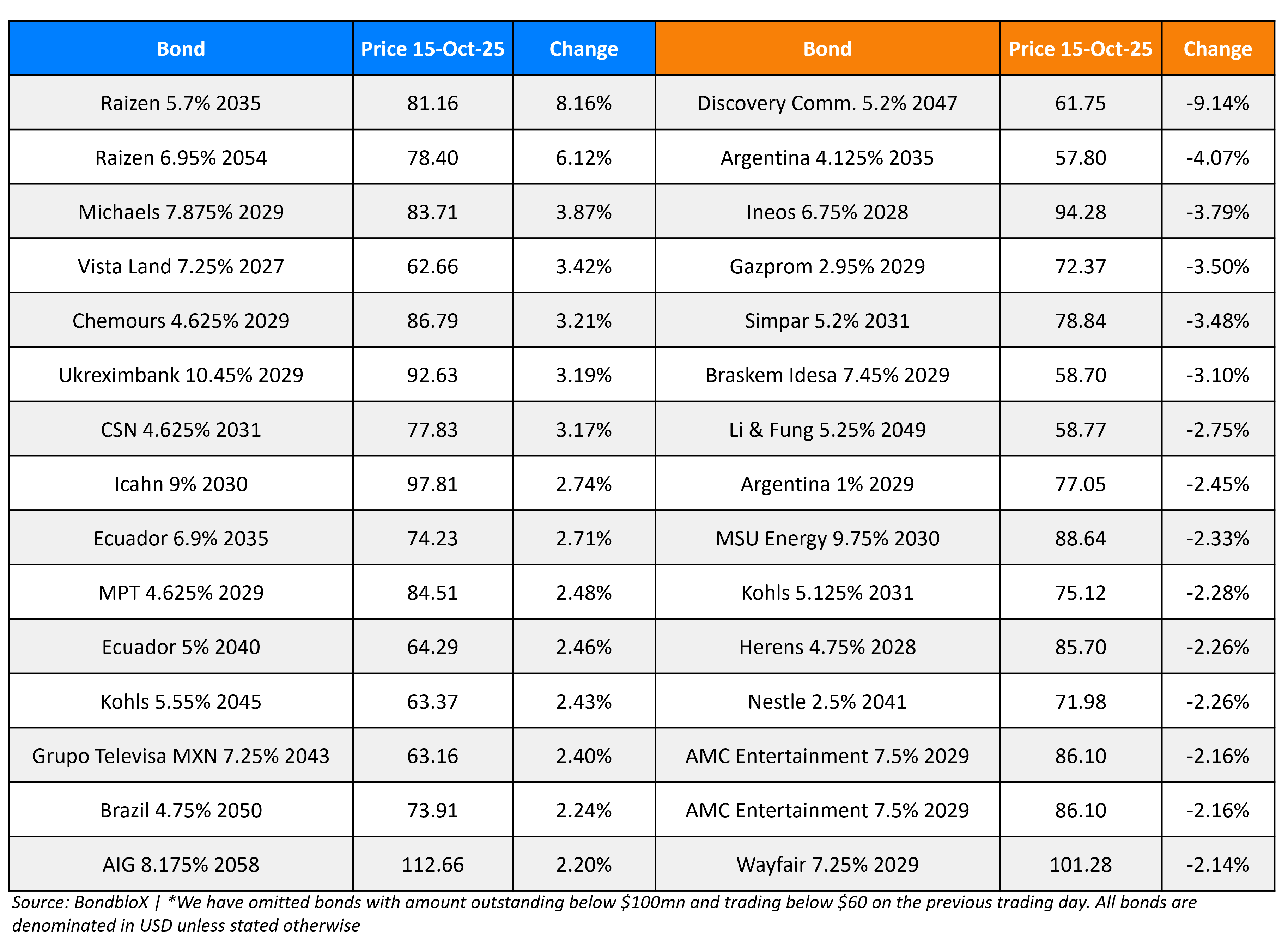

Top Gainers and Losers- 15-Oct-25*

Go back to Latest bond Market News

Related Posts: