This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Gol Planning $1.5bn Equity Raise and $2bn Debt Refinancing

May 28, 2024

Brazilian carrier Gol is planning to raise $1.5 billion in fresh equity capital to repay its existing DIP financing and boost its balance sheet, as per its new five-year plan. It also plans to refinance $2bn in secured debt. Regarding unsecured debt, the company said that it faces a “substantial reduction from par value”. Gol has been rumored to be in talks for a merger with Azul after both companies announced a codeshare agreement to integrate their networks and frequent flyer programs.

Gol’s dollar bonds were stable with its 8% 2026s at 63.8.

For more details, click here

Go back to Latest bond Market News

Related Posts:

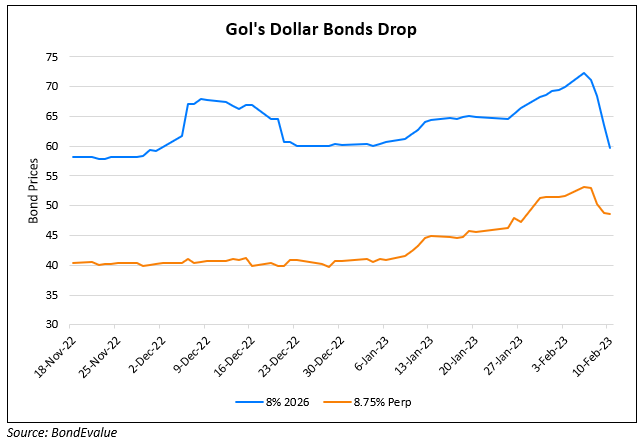

Gol’s Dollar Bonds Drop on Downgrade to CC by S&P

February 10, 2023

Gol Downgraded to Caa2 by Moody’s

February 14, 2023