This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

GMR Hyderabad Announces Tender Offer for Two Dollar Bonds

February 23, 2023

GMR Hyderabad Airport announced a tender offer for two of its dollar bonds where it is offering to purchase for cash up to $100mn of its 5.375% 2024s and its 4.75% 2026s.

- For the 2024s, bondholders that accept the tender before the early deadline of March 6, will receive $1,010 per $1,000 in principal. Tenders submitted before March 21, will receive $980 per $1,000 in principal. The early tender by GMR comes at a premium to its current price at 99.25.

- For the 2026s, bondholders that accept the tender early will be paid $947.50 per $1,000 in principal and late tenders will receive $917.50. The early tender by GMR comes at a premium to its current price at 93.44.

GMR Hyderabad will also pay the accrued interest in March. In the event that the tendered amount exceeds the maximum acceptance amount, the 2024s tendered early will receive first priority, followed by the 2026s that are tendered early. Post this, the late tender for the 2024s and 2026s will follow respectively. S&P said that the tender is likely opportunistic as GMR Hyderabad is managing its bond maturities well in advance of their maturity dates.

Go back to Latest bond Market News

Related Posts:

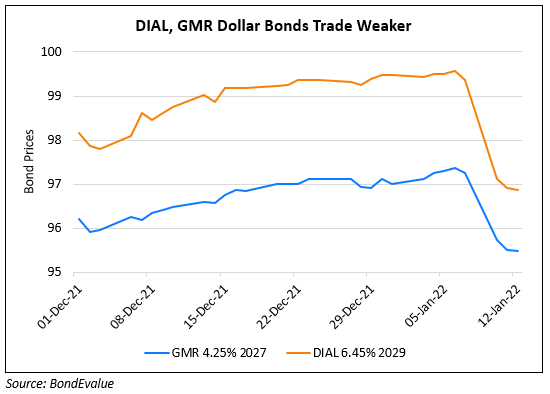

DIAL, GMR Airport Bonds Down 3-4 Points

January 12, 2022

GMR Hyderabad Buyback Tender Offer for 2024s and 2026s

December 5, 2022

GMR Hyderabad Accepts $139.125mn of 2024s, 2026s for Buyback

December 13, 2022