This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

GMR Hyderabad and Delhi International Airport Upgraded by S&P

May 8, 2024

GMR Hyderabad International Airport (GMR) and Delhi International Airport (DIAL) were both upgraded by a notch each to BB and BB- respectively. Both the upgrades come on back of rising tariffs and robust recovery in traffic leading to improvement in cash flows for the companies. S&P expects GMR to double its both EBITDA and cash flow to INR 15.8bn ($0.19bn) and INR 6bn ($0.07bn) in 2025 from the 2023 levels. For DIAL, S&P expects the new tariffs will be implemented in April 2025 for the 2024-2029 period which will help improve its cash flows. Both the airports have seen robust recovery in passenger traffic, which is expected to increase further by 8-10% per annum over the next few years.

GMR’s 4.75% 2026s traded stable at 97.3, yielding 6.42% while DIAL’s 6.125% 2026s was stable at 99.2, yielding 6.48%.

Go back to Latest bond Market News

Related Posts:

DIAL Downgraded to B1 by Moody’s

June 14, 2021

Delhi Airport Downgraded to BB- by Fitch

July 5, 2021

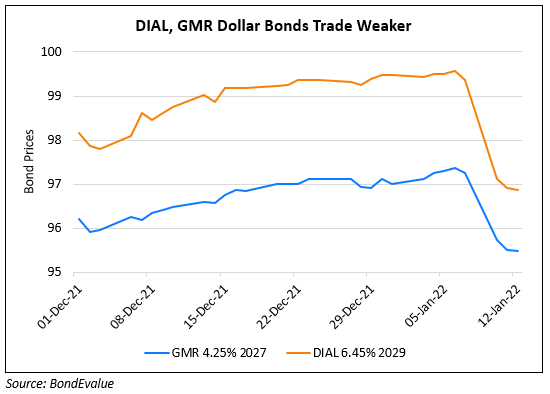

DIAL, GMR Airport Bonds Down 3-4 Points

January 12, 2022