This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

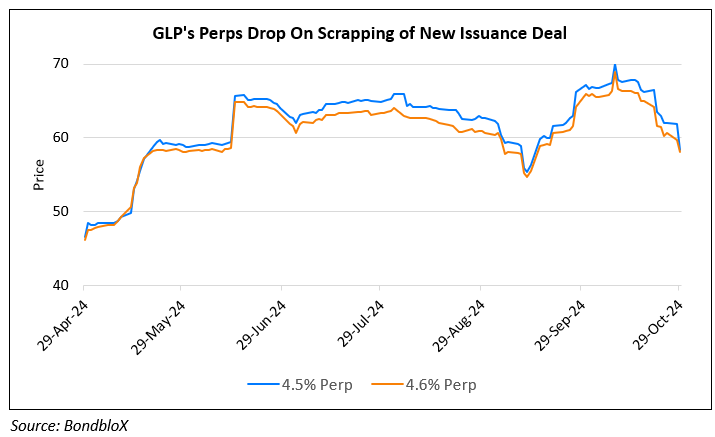

GLP Bonds Drop on Scrapping of New Issuance Deal

October 29, 2024

GLP’s bonds especially its Perps dropped by 1-3 points after the company decided not to proceed with the 3.5Y bond issuance announced yesterday at an IPTs of 10.375%. It also called off the concurrent tender process for its June 2025 bond launched last week. GLP mentioned that demand for the new bond was strong but still insufficient to achieve its size and pricing targets. However, the company reiterated that its liquidity position remains strong after it recently completed a sale of its GLP Capital Partners Ltd’s international business to Ares Management Corp for $3.7bn and expects to exceed its $10bn monetization target in the coming months.

Go back to Latest bond Market News

Related Posts: