This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

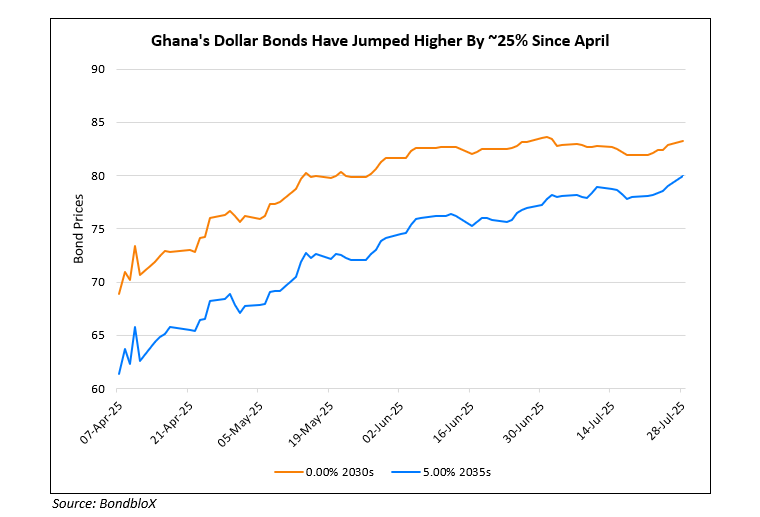

Ghana’s Dollar Bonds Surge on Trimming of Fiscal Deficit

July 28, 2025

Ghana’s dollar bonds surged to record highs after the government lowered its 2025 budget deficit target. The country’s Finance Minister Cassiel Ato Forson cut the fiscal-shortfall goal for the year to 2.8% of GDP from 3.1% in a mid-year budget review, boosting investor confidence. The improved fiscal outlook is driven by higher fuel tax revenues, lower spending, and a sharp drop in treasury-bill rates. Mid-year fiscal performance was stronger than expected, with a budget deficit of just 0.7% of GDP and a primary surplus of 1.1%. Public debt also fell nearly 16% to GHC 613bn ($58.5bn), further supporting market optimism.

Ghana has seen a recent string of positive developments, and its dollar bonds have trended higher in the last 3 months, as can be seen in the chart above. In April, it reached an IMF deal for a $370mn disbursement, followed by an upgrade to CCC+ by S&P. More recently, it was upgraded to B- by Fitch, on the improvement of its debt metrics.

Ghana’s 5% 2035s surged by 1 point to 79.9 cents on the dollar, yielding 9.4%.

For more details, click here

Go back to Latest bond Market News

Related Posts: