This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ghana Downgraded to Ca from Caa2 by Moody’s

November 30, 2022

Moody’s downgraded Ghana to Ca from Caa2 on Tuesday, revising its outlook to stable and concluding its review for downgrade that was initiated on September 30. The rating agency sees “substantial losses” for private creditors as a result of the African nation’s planned local and foreign currency debt restructuring, which led to the downgrade. The rating action comes less than a week after Ghana’s Deputy Minister of Finance John Kumah proposed a 30% haircut for international bondholders as Ghana seeks to secure a $3bn IMF loan. Ghana has been grappling with elevated debt levels, expected at 104% of GDP by end-2022, coupled with high interest costs, at 58% of revenues in 2022. The stable outlook is on the back of an expected “coordinated and orderly” restructuring “under the umbrella of a funding program with the IMF”.

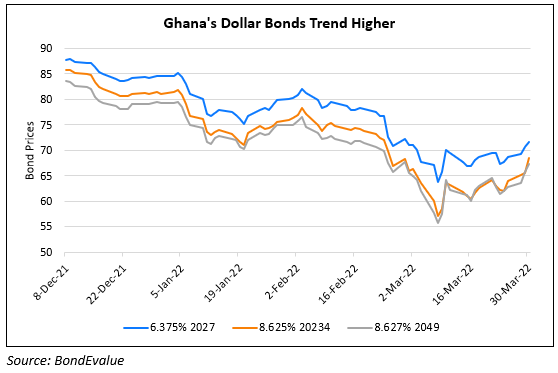

Ghana’s 7.875% bonds due August 2023 are currently trading at 56.4 cents on the dollar, while its dollar bonds due from 2025 through 2061 are trading at 30-40 levels.

Go back to Latest bond Market News

Related Posts:

Ghana Downgraded to Caa1 by Moody’s

February 7, 2022