This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

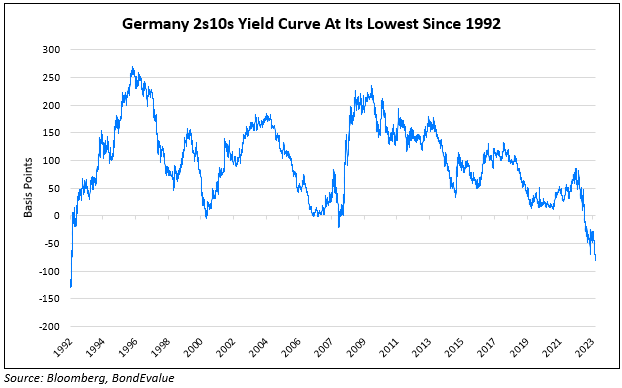

Germany 2s10s Curve At Its Lowest Since September 1992

June 28, 2023

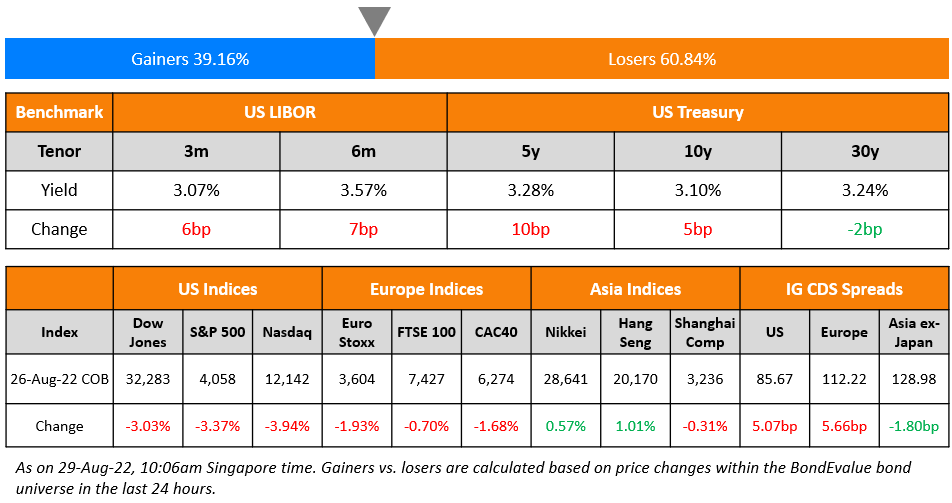

US Treasury yields rose across the curve led by the 2Y and 5Y yields up 6-8bp as economic data continued to highlight strength in the economy. Durable goods orders in May increased by 1.7%, higher than the 1.2% increase seen in April and better than forecasts of a 1% fall. Also, new home sales jumped to 763k from 683k, as opposed to expectations of a fall to 675k. The peak Fed Funds rate was unchanged at 5.32%. US equity indices ended in the green with the S&P and Nasdaq up 1.2-1.7%. Credit spreads tightened with the US IG and HY CDS spreads tighter by 2.7bp and 13.2bp respectively.

European equity indices closed higher, with European main and Crossover CDS tighter wider by 1.2bp and 6.6bp. The German 2s10s yield curve inverted to its lowest levels since September 1992, with the spread at -88.3bp. Asia ex-Japan CDS spreads widened by 3.8bp. Asian equity markets have opened mixed this morning to begin the week.

New Bond Issues

Credit Agricole raised $2.5bn via a three-tranche deal. It raised:

- $1.25bn via a 3Y bond at a yield of 5.589%, 25bp inside initial guidance of T+145bp area. The new notes are priced 27.9bp wider to its existing 2.015% 2027s that yield 5.31%.

- $500mn via a 3Y FRN at a yield of SOFR+129bp, 129bp wider than initial guidance of SOFR Equivalent area.

- $750mn via a 10Y bond at a yield of 5.514%, 25bp inside initial guidance of T+200bp area.

The senior preferred notes have expected ratings of Aa3/A+/AA-. Proceeds will be used for general corporate purposes.

Republic of Chile raised $2.25bn via a two-tranche sustainability-linked bond (SLB) deal. It raised $1.15bn via a 12Y SLB at a yield of 4.998%, 37bp inside initial guidance of T+160bp area. It also raised $1.1bn via a 30Y SLB at a yield of 5.335%, 37bp inside initial guidance of T+185bp area. The senior unsecured bonds have expected ratings of A2/A/A-. The new 30Y SLB was priced at a new issue premium of 17.5bp to its existing 3.5% 2053s that yield 5.16%. Proceeds will be used for general purposes of the government. In accordance to the issuer’s Sustainability Performance Targets (SPTs), the interest rate payable on the 2036s shall be increased by 25bp if either of its SPSPT 1a or SPT 1b is not achieved, and shall be separately increased by 25bp if SPT 3 is not achieved. The a maximum aggregate annual step-up is by 50bps. The interest rate payable on the 2054s shall be increased by 5bp if either SPT 1a or SPT 1b is not achieved, and shall be separately increased by 5bp if SPT 3 is not achieved. The maximum aggregate annual step-up is by 10bps. The step-up date for both notes are on 5 July 2034. This is Chile’s second sustainability-linked bond deal after its 20Y note issuance in March 2022. the first SLB issuance by a sovereign.

Rating Changes

- Emaar Properties Upgraded To ‘BBB’ On Strong Performance And Healthy Balance Sheet; Stable Outlook

- Moody’s downgrades Sino-Ocean Group’s ratings to Caa1; outlook negative

- Moody’s downgrades Central China Real Estate’s ratings to Ca/C; outlook remains negative

Term of the Day

Sustainability-Linked Bonds

Sustainability-linked bonds (SLBs) are bonds wherein the issuer commits to sustainability outcomes within a timeline set in the bond document based on five elements:

- Selection of Key Performance Indicators (KPIs)

- Calibration of Sustainability Performance Targets (SPTs)

- Bond Characteristics

- Reporting

- Verification

Here however, the proceeds can be used for general purposes but the characteristics of the bond can change depending on the issuer meeting their KPIs set in the document. SLBs come with a coupon step-up if the issuer fails to meet its goal(s) within the specified time period in its framework.

Talking Heads

On an Expected Fed Rate Hike in July – Morgan Stanley economist Ellen Zentner

“We now judge that the bar for a July hike is significantly lower than we had initially expected.”

On the ECB’s Stance on Interest Rates – ECB President Christine Lagarde

Christine Lagarde – ECB President

“It is unlikely that in the near future the central bank will be able to state with full confidence that the peak rates have been reached…Barring a material change to the outlook, we will continue to increase rates in July…How strong transmission turns out to be in practice will determine the effect of a given rate hike on inflation, and this will be reflected in the expected policy path.”

Seth Carpenter, Chief Global Ecnomist at Morgan Stanley

“Right now policymakers just have to err on the side of saying ‘we have lots of options, options are on the table and we will keep hiking if needed’…I don’t think they have a chance anytime soon to declare victory.”

On Brazil’s Potential Rate Cuts

Andres Abadia, chief Latin America economist at Pantheon Macroeconomics

“(Brazil’s inflation) continued to fall rapidly during Q2 and inflation expectations are now under control…(this will allow the central bank) to cut rates soon.”

William Jackson, chief EM economist at Capital Economics

“It’s hard to argue against the start of an easing cycle in August…We’ve now penciled in a 25-basis-point cut to 13.50% at the next meeting.”

Alexandre Padilha, Brazil’s Institutional Relations Minister

“It is a clear sign that the economy is being rebuilt…Everything is in place for our country to start lowering interest rates.”

“Not all Treasury securities are equally safe…Long-term Treasury bonds may have no default risk, but they have liquidity risk and interest-rate risk — when selling the bond prior to maturity, the sales price is sometimes uncertain, especially in times of financial market stress…Short-term US safe assets are the assets that are truly safe, and safe haven flows lead to an increase in these short-term inflows, even while long-term inflows fall.”

On the Drop in CCC Bond Prices

Adam Darling, fixed-income investment manager at Jupiter Asset Management

“Investors were believing in a Narnia world where central banks tightened enough to crush inflation but not to hurt growth…That’s nonsense and it’s never been done before. The only way to get rid of this kind of inflation is recession.”

Christan Hoffmann, portfolio manager at Thornburg Investment Management

“It was a lot about people being caught offside, worrying they were under-risked into a rally and then chasing it…It’s mostly been risk rallies where people participated in them begrudgingly and they were broadly-hated.”

Al Cattermole, senior credit analyst and portfolio manager at Mirabaud Asset Management

“You’re not getting paid to have a massive correction in CCCs…I’d rather be wrong in BBs than be wrong in CCCs.”

Top Gainers & Losers – 28-June-23*

Go back to Latest bond Market News

Related Posts: