This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

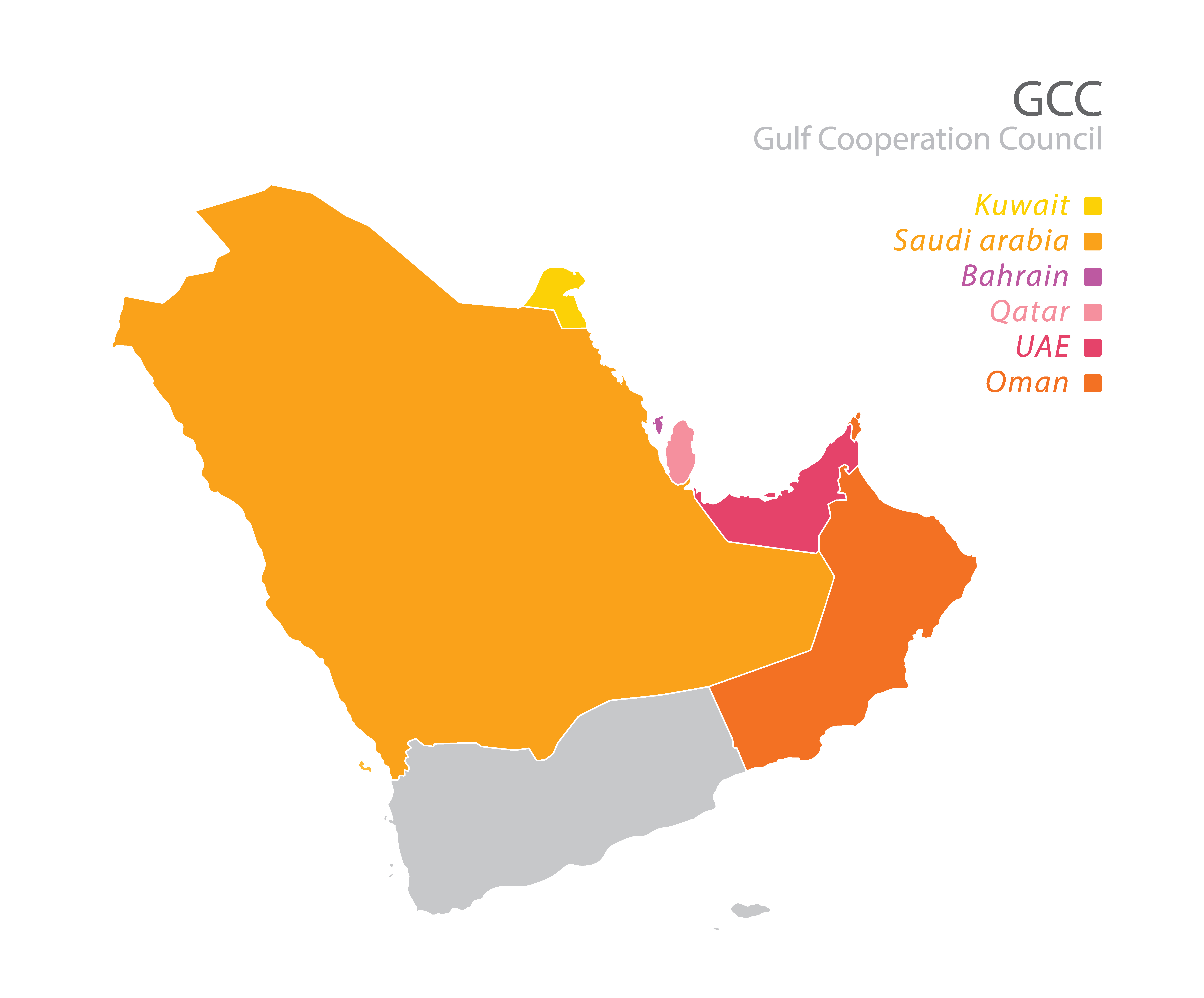

GCC Banks Have a Sluggish Outlook for 2021 with Some Banks Expected to Post Losses

March 15, 2021

S&P in a report noted that GCC sovereigns will be slow to recover from the impact of the pandemic. In particular, the banking sector is expected to have a sluggish outlook with the impact not spread equally. They note that Saudi and Qatar banks will be less impacted than peers in UAE, Oman, Bahrain and Kuwait with some of them expected to post losses this year. Higher provisioning is expected to see the cost of risk stay higher after jumping 60% in 2020. They expect loan growth to stay muted across, except for Qatar and Saudi with government projects helping growth in the former and increased mortgage lending to expand house ownership in the latter. They expect asset quality indicators to deteriorate and credit losses to remain elevated as the true impact of the pandemic and forbearance measures get lifted this year. S&P also noted the possibility of a second wave of M&As to come once weaker operating characteristics become visible with the scope of consolidation across GCC countries and different emirates in the UAE, for example. Overall, they note that their negative outlook bias has increased.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Barclays Reports 38% Fall in 2020 Profits

February 19, 2021

Lloyds Bank Profits Down 72% For 2020

February 24, 2021