This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Gatwick Marketing Junk GBP 5Y Bond at 4.74-5.00%

March 30, 2021

London’s Gatwick Airport launched a new junk bond offering denominated in sterling on Monday. Gatwick is looking to raise £400mn via a 5Y bond at a yield of 4.75-5.00%, as per Bloomberg. One of Europe’s busiest airport, Gatwick plans to use proceeds from the bond issue to survive through another summer without major travel. As per S&P, the airport’s passenger numbers are expected to end the year at just 40% of 2019 levels. Gatwick is not rated by any of the three major rating agencies; its Class A debt however is rated BBB by S&P. The yield on offer on the new bonds is juicier compared to peer Heathrow (Ba2), whose GBP 6.25% 2025s and 4.375% 2027s are currently yielding 3.58% and 3.99% on the secondary market.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

YPF Revises Offer for The Third Time

February 2, 2021

Bombardier’s Bonds Slump on Halted Learjet Production

February 15, 2021

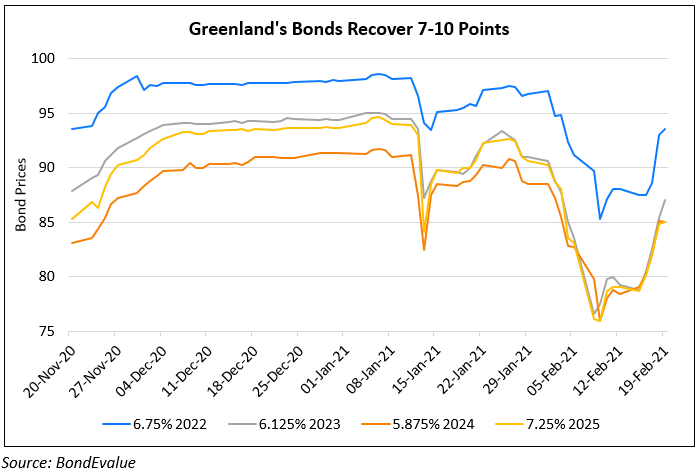

Greenland’s Dollar Bonds Recover 7-10 Points from Lows

February 19, 2021