This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Petron, KEXIM Launch $ Bonds

September 15, 2025

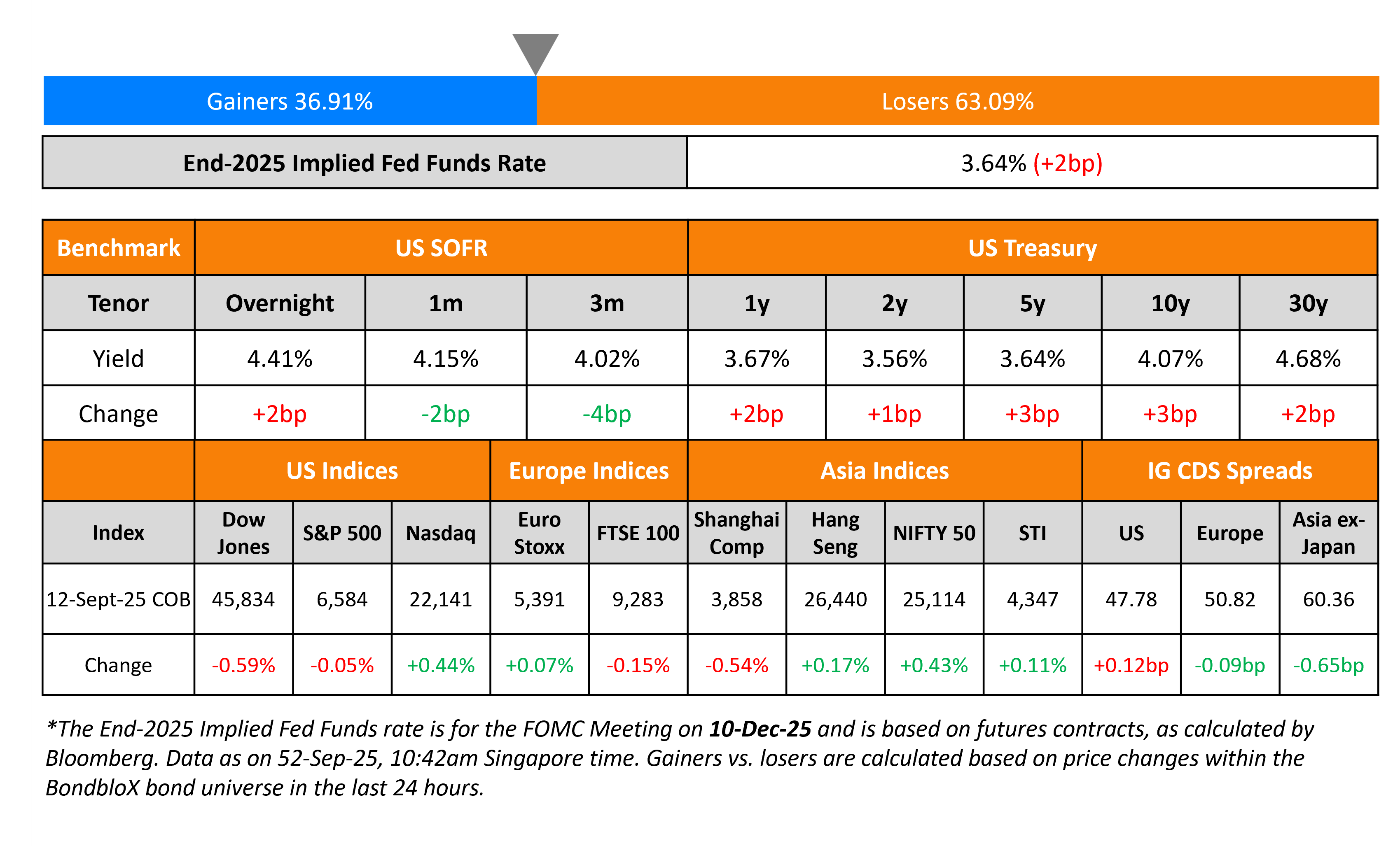

US Treasury yields moved higher by 2-3bp on Friday. The preliminary Michigan Consumer Sentiment Index for September came-in at 55.4, worse than expectations of 58.0. Separately, the US budget deficit in August came-in at $345bn, a record high for the month. Markets await the outcome of FOMC decision this Wednesday, with expectations of a 25bp rate cut.

Looking at US equity markets, the S&P ended flat while the Nasdaq closed higher by 0.4%. US IG and HY CDS spreads were wider by 0.1bp and 0.6bp respectively. European equity markets ended mixed too. The iTraxx Main and Crossover CDS spreads were tighter by 0.1bp and 0.4bp respectively. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were 0.7bp tighter.

New Bond Issues

-

FWD Group $ 5Y/10Y at T+210/230bp areas

- Petron $ 475mn PerpNC3 7.6% area

- KEXIM $ 3Y FRN/5Y at SOFR+70bp/T+50bp areas

TD Bank raised $750mn via an 60NC5 bond at a yield of 6.35%, 40bp inside initial guidance of 6.75% area. The SEC registered note is rated Baa2/BBB-/BBB+. Net proceeds will be used for general corporate purposes, which may include the redemption of outstanding capital securities. The proceeds are expected to qualify as AT1 capital of the bank for regulatory purposes.

New Bond Pipeline

- Transurban $ Long 10Y

- Bank AlJazira $ PerpNC5.5 AT1 Sukuk

Rating Changes

-

Spain Upgraded To ‘A+’ On Strengthening External Financial Position; Outlook Stable

-

Fitch Downgrades Eramet to ‘BB-‘; Places on Rating Watch Negative

-

Fitch Revises Outlook on SJM Holdings to Negative; Affirms Ratings at ‘BB-‘

-

Fitch Revises Ambipar’s Outlook to Negative; Affirms IDRs at ‘BB-‘

-

Fitch Revises Vesta’s Outlook to Positive; Affirms Ratings at ‘BBB-‘

Term of the Day: Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt. It can either use retained earnings to fund the purchases without affecting the liquidity position of the company, or finance the purchase via an issuance of new bond. Tender offers have a deadline date before which holders must tender their bonds back to validly participate.

Talking Heads

On Wall Street Riding a $1tn Money Wave as Fed Test Looms

David Solomon, Goldman Sachs

“It just doesn’t feel to me like the policy rate is extraordinarily restrictive when you look at risk appetite.”

Vincent Deluard, StoneX Financial

“We invented the perpetual machine…We direct about 1% of GDP every month into index funds, regardless of valuations, sentiment, or macro.”

Peter Tchir, Academy Securities

“The market is so conditioned to ‘easier money is great for stocks’ and the path has been clear on easier money…People are betting on lower yields and that lower yields will help the economy and offset policy uncertainty.”

On Markets Gearing Up for Series of Fed Cuts With Bullish Bets at Risk

Jack McIntyre, Brandywine Global

“My gut tells me 25 this week…The issue is does the statement see the Fed emphasize labor more than inflation?”

Gareth Ryan, IUR Capital

“But if the dot plot is less clear about first-quarter rate cuts, then that opens the door for a bigger market move”

Vineer Bhansali, LongTail Alpha

“The market is now actually pricing in a fairly political Fed that’s going to overease”

On Catastrophe Bonds Worth $17.5bn Land in EU’s Crosshairs

Peter DiFiore, Neuberger Berman

“Investors have been drawn to the bonds’ ostensible ability to sail through all kinds of upheaval in recent years, which has helped underpin record growth. But it would be dangerous to assume those conditions will last

Eveline Takken-Somers, PGGM

“Even though the track record seems great over the last couple of years…A big San Francisco earthquake could cause a 30% to 40% loss in your portfolio”

Top Gainers and Losers- 15-Sep-25*

Go back to Latest bond Market News

Related Posts: