This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

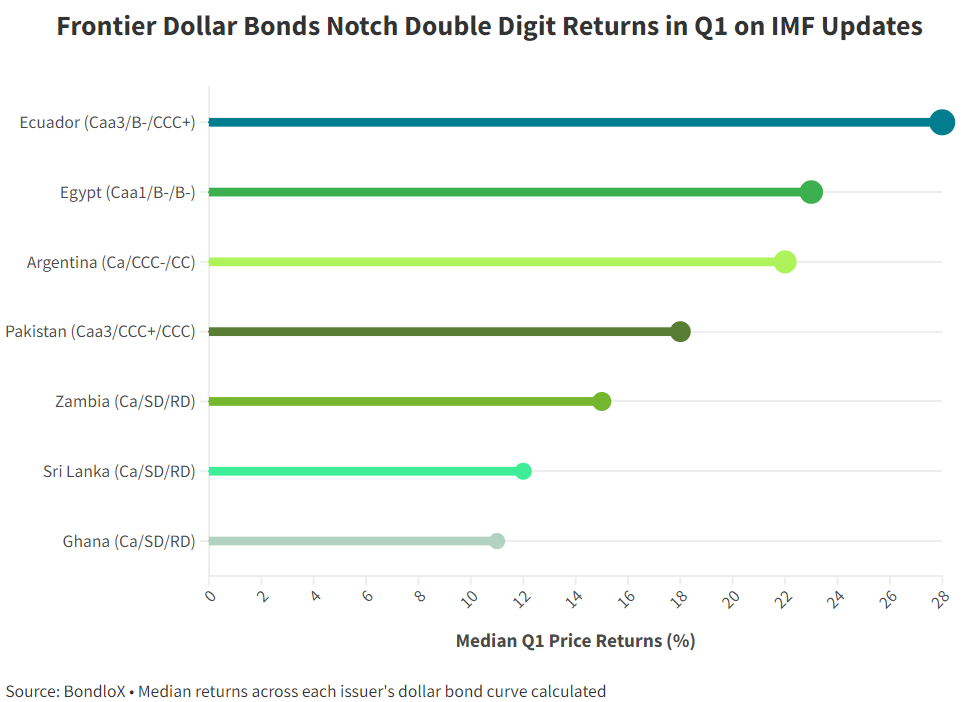

Frontier Markets’ Dollar Bonds Lead Sovereign Gainers in Q1

April 2, 2024

The first quarter of 2024 saw sovereign dollar bonds of several frontier and risky emerging markets top the gainers list. A common theme observed was that most of these nations were either close to striking or struck deals with the IMF during the quarter for their bailout funds. We took the median price returns across the dollar bond curve of these sovereigns (chart above).

Amongst them, the largest gains were seen in Ecuador’s dollar bonds having risen ~28% after the new president Daniel Noboa’s planned austerity measures saw the nation come closer to reaching an IMF agreement. Second on the list were Egypt’s dollar bonds after several positive updates. This included striking an investment deal with the UAE for $35bn, followed by its 30% currency devaluation and subsequent 600bp rate hike that saw it secure an $8bn IMF deal. Argentina’s dollar bonds were higher by ~22%, beginning the year with a $4.7bn IMF funding being struck, followed by positive sentiment over the president’s austerity measures. Pakistan’s dollar bonds also featured among the top gainers, up ~18% as it came closer to securing an IMF loan facility. Zambia and Ghana agreed to restructuring deals with creditors regarding their offshore debts with their dollar bonds rising 15% and 10% respectively. Sri Lanka’s dollar bonds too rose ~12% as they began restructuring talks with creditors and were reported to have reached a staff level agreement with the IMF for the release of the next loan tranche from the $3bn bailout program. In the table below, we compare dollar bonds of the above sovereigns with a maturity closest to 2030 in the issuer’s curve.

Go back to Latest bond Market News

Related Posts: