This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

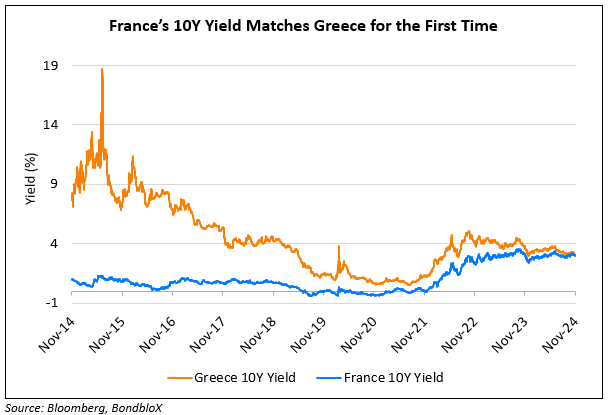

France’s 10Y Yield Matches Greece’s on Political Concerns

November 29, 2024

US markets were closed due to Thanksgiving holidays yesterday. US Treasuries are currently trading stable. Meanwhile in Europe, France’s 10Y yield traded at similar levels to Greece’s 10Y yield for the first time on record despite the difference in ratings. France is rated Aa2/AA while Greece is rated Ba1/BBB-. Political concerns have risen in France with the right-wing party, National Rally setting out further demands for changes to the 2025 budget bill after Prime Minister Michel Barnier dropped plans to raise taxes on electricity as a key concession. Thus, political uncertainty and the potential implications continue to weigh on French sovereign bonds. S&P is scheduled to update its assessment of France today. Last month, both Fitch and Moody’s provided a negative outlook on France.

European equities ended higher. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.5bp and 2.5bp respectively. Asian equities have opened higher this morning. Asia ex-Japan CDS spreads were 0.6bp tighter. The Headline and Core CPI YoY in Japan rose by 2.6% and 2.2% in November, higher than expectations of 2.2% and 2.0% respectively. Analysts noted that the inflation print might strengthen the BOJ’s conviction that inflation momentum is building and could lead to the central bank hiking its policy rate in the December meeting.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades ratings of GreenSaif Pipelines and TMS Issuer to Aa3 from A1; outlook stable

-

Moody’s Ratings upgrades EIG Pearl’s senior secured bond ratings to Aa3 from A1; outlook stable

-

Moody’s Ratings upgrades Saudi banks following the upgrade of sovereign rating

-

Moody’s Ratings changes Nissan’s outlook to negative from stable; affirms Baa3 ratings

-

Fitch Revises Outlook on Azure Power Energy’s Debt Rating to Negative; Affirms at ‘B’

-

Skandinaviska Enskilda Banken Outlook Revised To Positive On More Predictable Earnings; ‘A+/A-1’ Ratings Affirmed

Term of the Day: Sovereign Risk Premium

Sovereign risk premium refers to the additional implied spread that a country’s sovereign bonds offer vs. a benchmark for a particular currency. Put differently, it is the incremental return (or yield) that investors demand from a country to buy its sovereign bonds vs. the benchmark.

Talking Heads

On Adani impact hurting but not derailing foreign investor faith in India

Steve Lawrence, Balfour Capital

“Foreign investors may grow more cautious about the transparency and governance practices of Indian companies”

Mike Sell, Alquity

“We consider (the Adani indictment) as a stock specific event. We don’t see any negative sentiment at all towards India as a result. Clients are continuing to seek higher allocations in India”

James Thom, abrdn

“The best way to position would be in high quality and defensive names with better balance sheets, cash flow generation capabilities, and backed by long-term structural tailwinds”

On ECB May Be Able to Cut Rates Gradually – GC member Pierre Wunsch

“It is possible and even maybe likely that we will have to discuss removing restriction… If you would suddenly accelerate the rate cuts while domestic inflation is still above 2.5%, I’m not sure we would give a very good signal”

On Yen Gains on Inflation Data as Korean Stocks Fall

Taro Kimura, Bloomberg Economics

“The CPI report will probably strengthen the BOJ’s conviction that inflation momentum is building, with its 2% target looking increasing secure”

Jordan Rochester, Mizuho

“The problem with France is it’s one of the largest issuers in Europe and now you’ve got a bit of a buyers’ strike… You’ve got other options, Italy and Spain, and their data’s actually fantastic”

Top Gainers and Losers- 29-November-24*

Go back to Latest bond Market News

Related Posts: