This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

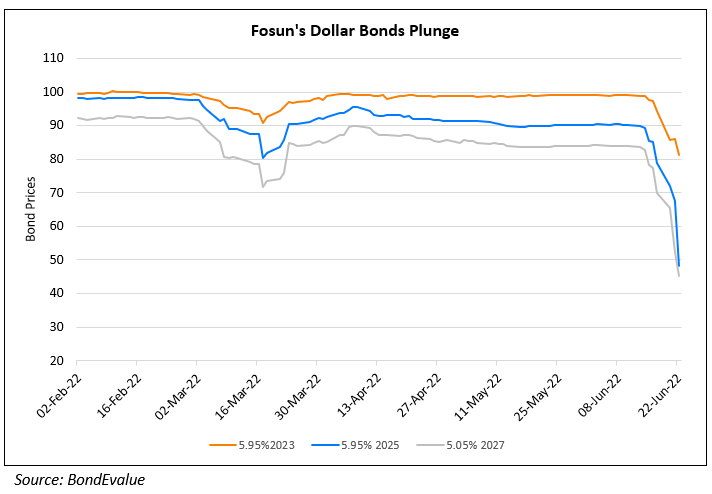

Fosun’s Dollar Bonds Jump on Plans of $2.1bn Asset Sales

October 18, 2022

Fosun Group’s dollar bonds jumped over 2.5 points on news that it has agreed to sell its stake in the parent company of Nanjing Iron & Steel Co. for RMB 15bn ($2.1bn), as per sources. Bloomberg notes that Jiangsu Shagang Group Co. will be buying a 60% stake in Nanjing Iron from Fosun, with sources noting that the three parties signed an initial agreement last week. Investors’ focus has been on the conglomerate’s asset sale plans given the recent negative news regarding regulatory scrutiny over Chinese banks and SOEs exposure to its debt. Post this, it was downgraded by S&P to BB- from BB citing a reducing liquidity buffer. Moody’s also noted that Fosun may face difficulties refinancing “sizable” short-term debt and would likely increase asset disposals to meet its obligations.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Fosun Launches Tender Offer; Redsun, Logan Buyback Bonds

October 12, 2021

Fosun Downgraded to B1 by Moody’s

August 24, 2022