This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

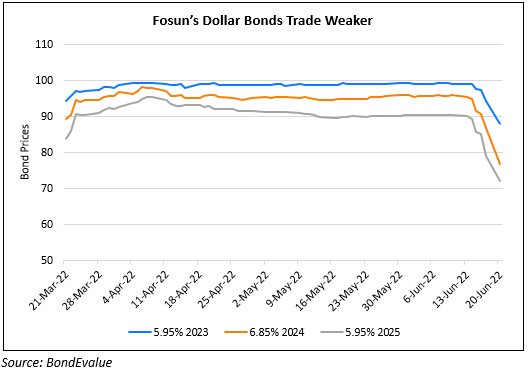

Fosun International Offers to Buy Offshore Bonds

June 20, 2022

China’s Fosun International is offering to purchase two offshore notes after launching a tender offer for a €384.2mn ($403mn) bond due October 9 and a $379.8mn dollar bond due August 2023, as per sources. The news comes just days after after Moody’s put the conglomerate on review for downgrade noting that Fosun’s liquidity was “very weak at the holding company level” and cash at end-March 2022 was “insufficient to cover its short-term debt maturing over the next 12 months.” Fosun’s dollar bonds have been trending lower ever since the rating agency’s update.

Go back to Latest bond Market News

Related Posts: