This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fosun, FAB, SocGen, Banca Monte Price € Bonds

November 14, 2025

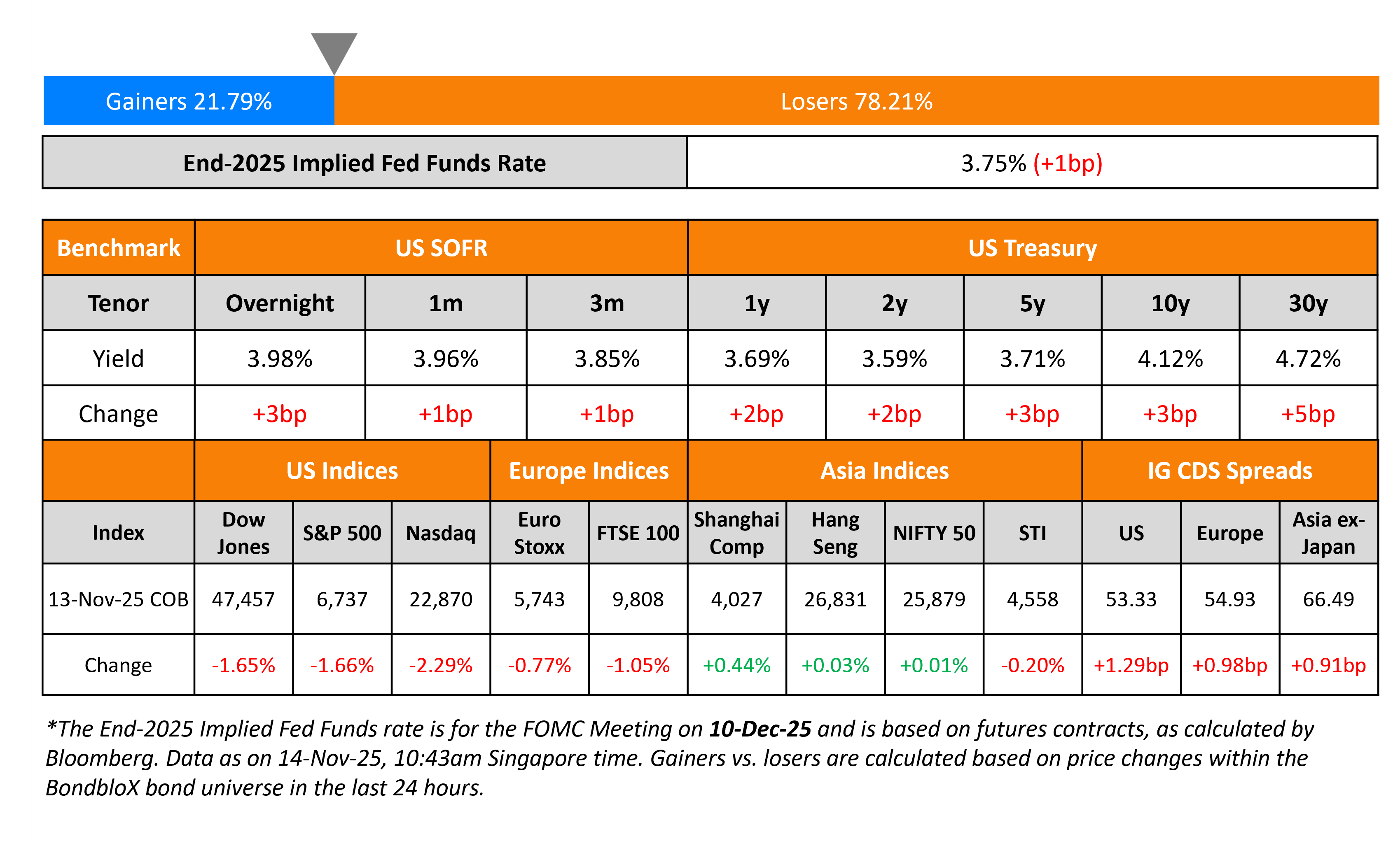

US Treasury yields were higher by ~3bp across the curve. After the October CPI data was not published yesterday, the US National Economic Council Director Kevin Hassett, noted that the unemployment rate for October may not be published at all. San Francisco Fed President Mary Daly said that it would be “premature” to decide on a December rate decision, noting that the direction of change in policy appeared “neutral”. The probability of the Fed cutting interest rates in December now stands at about 50% vs. over 65% earlier this week.

Looking at the equity markets, the S&P and Nasdaq closed lower by 1.7% and 2.3% respectively. US IG and HY CDS spreads were wider by 1.3bp and 9bp respectively. European equity indices ended lower too. The iTraxx Main CDS spreads were 1bp wider and the Crossover CDS spreads were wider by 4.2bp. Asian equity markets have opened in the red today. Asia ex-Japan CDS spreads were wider by 0.9bp.

New Bond Issues

Fosun International raised €400mn via a 5NC2 bond at a yield of 5.875%, 25bp inside initial guidance of 6.125% area. The senior unsecured note is rated BB- (S&P), and received orders of over €1.2bn, 3x issue size. The note has a change of control put at 101. Proceeds will be used to refinance some of its existing offshore debts, including any payment in connection with its concurrent buyback offer, for working capital and for general corporate purposes.

SocGen raised €1bn via a 10NC5 Tier-2 bond at a yield of 3.904%, ~32.5bp inside initial guidance of MS+180/185bp area. The subordinated note is rated Baa3/BBB-/BBB (Moody’s/S&P/Fitch), and received orders of over €3.4bn, 3.4x issue size.

Kuwait Finance House raised $850mn via a PerpNC5.5 AT1 sukuk at a yield of 6.25%, 42.5bp inside initial guidance of 6.625% area. The junior subordinated note is unrated, and received orders of over $1.7bn, 2x issue size. If not called by 20 May 2031, the coupon will reset to the US 5Y Treasury yield plus 250.2bp. KFH Tier 1 Sukuk 2 Ltd is the issuer.

FAB raised €850mn via a long 5Y green bond at a yield of 3.122%, 30bp inside initial guidance of MS+100bp area. The senior unsecured note is rated Aa3/AA-/AA- (Moody’s/S&P/Fitch). Proceeds will be used to finance/re-finance eligible green projects in accordance with their framework.

Monte Paschi raised €500mn via a 6.25NC5.25 green bond at a yield of 3.321%, 30bp inside initial guidance of T+120bp area. The senior unsecured note is rated Baa3/BBB- (Moody’s/Fitch), and received orders of over €1.95bn, 3.9x issue size. Proceeds will be used to finance/re-finance eligible green activities in accordance with their framework.

China Resources Land raised $300mn via a 3Y green bond at a yield of 4.28%, 32bp inside initial guidance of T+120bp area. The senior unsecured note is rated Baa1 by Moody’s, and has a change of control put at 101. Proceeds will be used to re-finance debt and eligible green activities in accordance with their framework.

New Bonds Pipeline

- Buenos Aires investor calls

- China plans €4bn bond offering

- Hyundai Capital Services investor calls

Rating Changes

- Fitch Upgrades Boparan to ‘B+’, Outlook Stable

- Boparan Holdings Ltd. Upgraded To ‘B+’ On Robust Operating Performance And Debt Repayment; Outlook Stable

- Shanghai Electric Holdings, Subsidiary Upgraded To ‘BBB+’ On Improving Cash Flow And Leverage; Outlook Stable

- Fitch Downgrades Aston Martin to ‘CCC+’

- Fitch Downgrades Tupy’s Ratings to ‘BB-‘; Outlook Stable

- Moody’s Ratings downgrades NIKE’s senior unsecured rating to A2 from A1

- Moody’s Ratings downgrades Kosmos Energy notes to Caa3, outlook remains negative

- Petrofac Ltd. Downgraded To ‘D’ On Administration Filing

- Fitch Places Baytex on Rating Watch Negative Following Announced Sale of U.S. Assets

- Fitch Revises Seagate Technology’s Outlook to Positive; Affirms Ratings at ‘BB+’

- Moody’s Ratings places Starbucks’ Baa1 ratings on review for downgrade

Term of the Day: Crossover CDS Spreads

The iTraxx Crossover Index is a credit default swap (CDS) based index compiled by IHS Markit (now part of S&P Global) which consists of the 75 most liquid sub-investment grade entities in Europe. The index helps track credit risk in the European high yield market, akin to the Markit HY CDS Index in the US. Performance is tracked in terms of the index’s value and the move in the spreads of the index. A tightening (a move lower) in its CDS spreads implies an easing of credit conditions in the European junk-bond markets which leads to an increase in the value of the index. On the other hand, a widening in its spread (a move higher) implies a worsening in credit conditions, which would lead to a fall in the index’s value. While the iTraxx Crossover Index helps track European high yield spreads, the iTraxx Main index helps track European investment grade spreads. The iTraxx Main index consists of 125 of the most liquid European entities with IG-ratings as published by Markit from time to time.

Talking Heads

On Funding Market Strains Calling for Action From Fed

Gennadiy Goldberg, TD Securities

“The Fed seems to only gradually be changing balance-sheet policy given recent stresses. Some investors believe the Fed may be moving too slowly to prevent reserves from becoming scarce.”

Zachary Griffiths, CreditSights

“What we’ve observed lately in the funding markets has been more of a controlled signal of reserves having essentially fallen to where it makes sense to stop reducing the size of the balance sheet”

On Fed’s December rate cut looking like a coin flip

Minneapolis Fed President Neel Kashkari

“We have inflation that’s still too high, running at about 3%”

Boston Fed President Susan Collins

“Absent evidence of a notable labor market deterioration, I would be hesitant to ease policy further”

On Risk Aversion Sinking Market High Flyers as Fed Rate-Cut Hopes Dim

Matt Maley, Miller Tabak + Co

“The promise of lower interest rates had been a reason why many investors were willing to disregard the high valuation readings on the momentum stocks”

Michael O’Rourke, JonesTrading

“If interest rates are not going to come down as quickly as investors believed, then the expectations reset prompts selling to contract the P/E multiple”

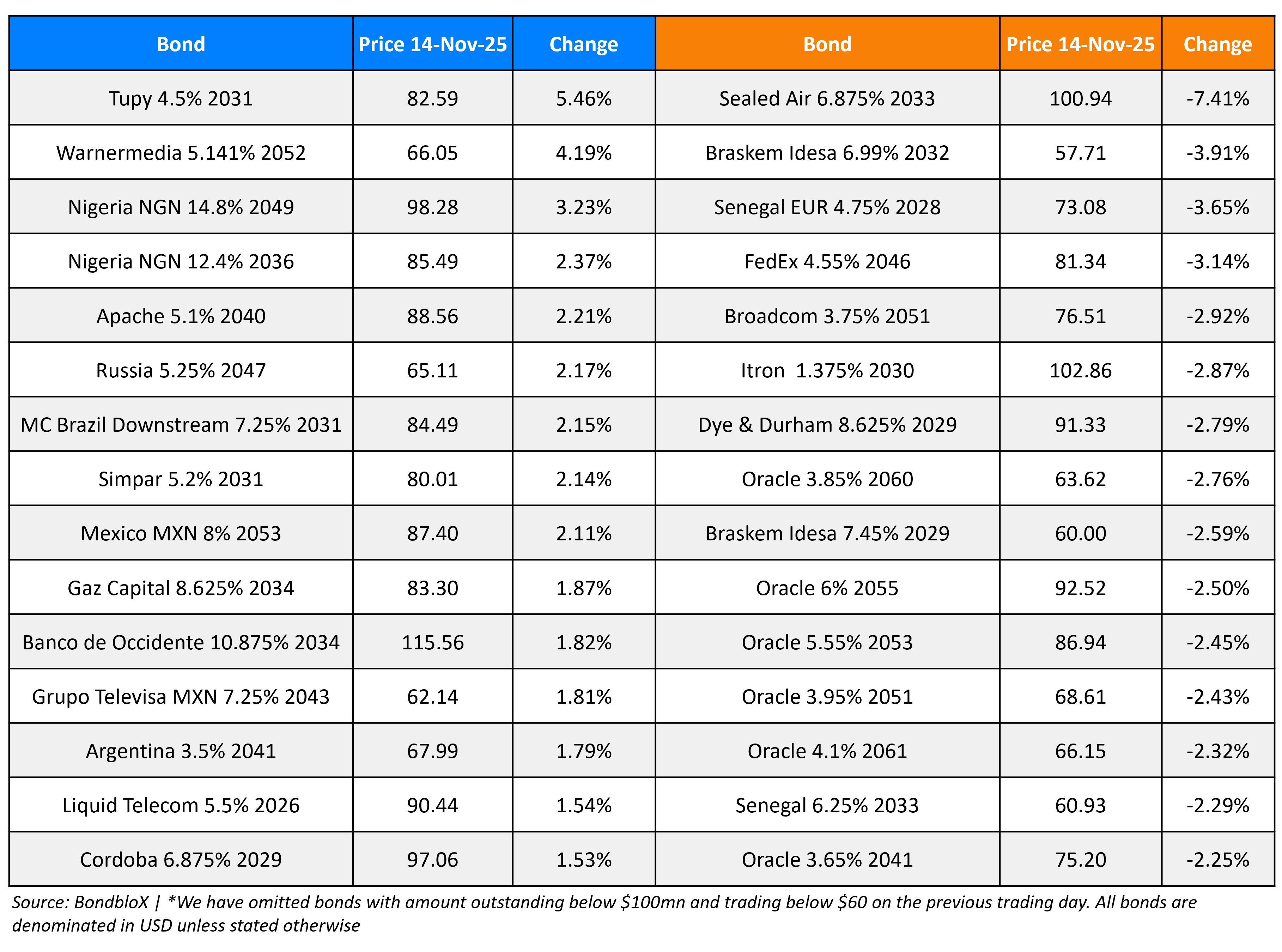

Top Gainers and Losers- 14-Nov-25*

Go back to Latest bond Market News

Related Posts: