This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ford, Lloyds, Meituan Price $ Bonds

October 29, 2025

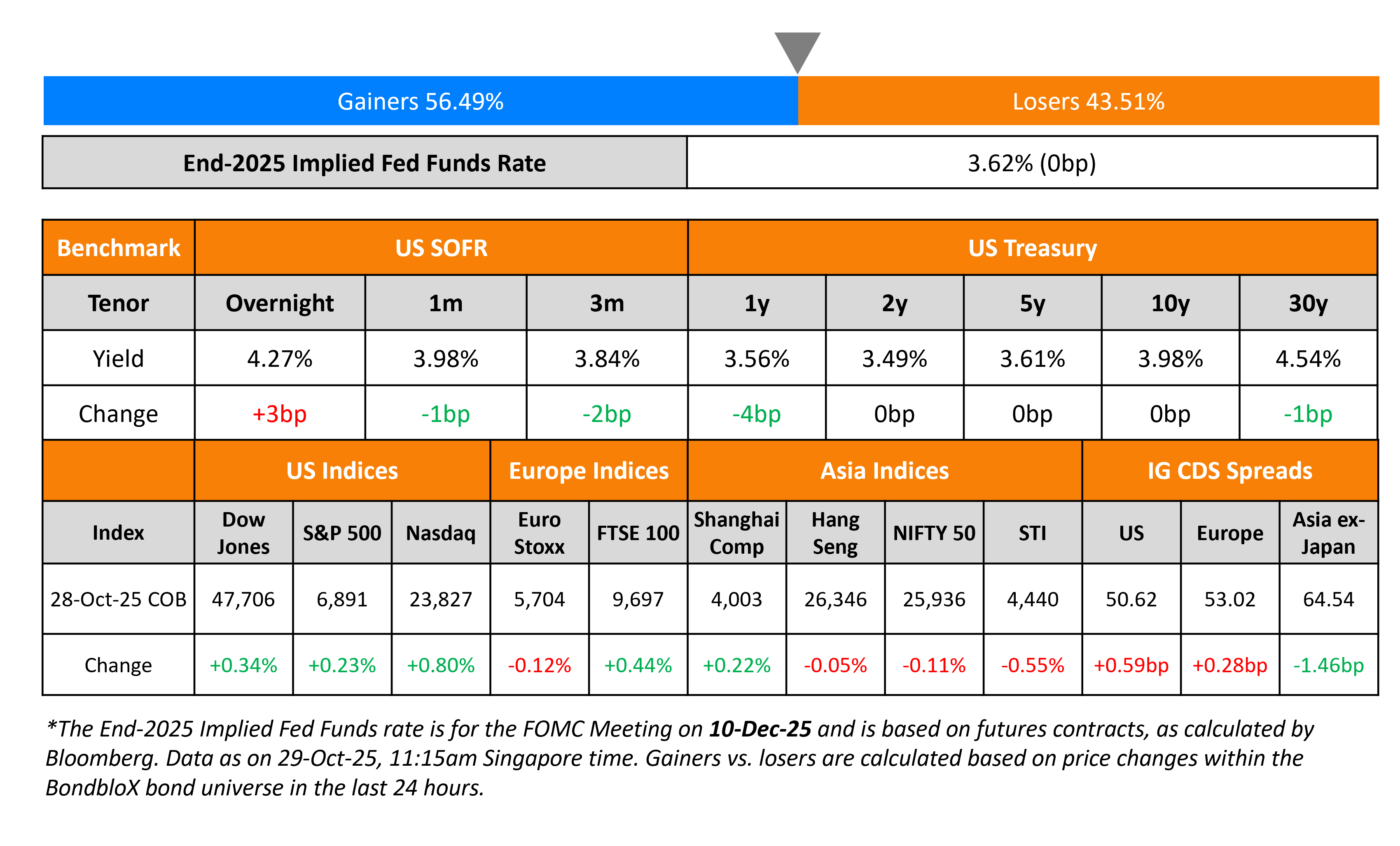

US Treasury yields were broadly unchanged across the curve, as markets await the FOMC decision later today. A 25bp rate cut has been priced-in and the focus is on Fed Chairman Jerome Powell’s guidance. The October Consumer Confidence Index in the US dipped slightly to 96.4 from the prior month’s 95.6, but better than expectations of 93.4. US President Donald Trump and Japanese Prime Minister Sanae Takaichi signed a framework agreement for securing the supply of rare earths alongside a deal on new-generation nuclear power reactors.

Looking at equity markets, the S&P and Nasdaq closed 0.2% and 0.8% higher. The US IG and HY CDS spreads widened by 0.6bp and 3.2bp respectively. European equity indices ended mixed. The iTraxx Main and Crossover CDS spreads were 0.3bp and 1.8bp wider respectively. Asian equity markets have opened broadly mixed today. Asia ex-Japan CDS spreads were 1.5bp tighter.

New Bond Issues

.png)

Ford Motor Credit raised $1bn via a 10Y bond at a yield of 5.869%, 27bp inside initial guidance of T+215bp area. The senior unsecured notes are rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes.

Lloyds raised $3.05bn via a three-part deal. It raised:

- $1.5bn via a 6NC5 bond at a yield of 4.425%, 28bp inside initial guidance of T+110bp area.

- $300mn via a 6NC5 FRN at SOFR+110bp vs. initial guidance of SOFR equivalent area.

- $1.25bn via a 11NC10 bond at a yield of 4.943%, ~37.5bp inside initial guidance of T+125/130bp area.

The senior unsecured notes are rated A3/A-/A+. Proceeds will be used for general corporate purposes.

Meituan raised $2bn via a three-part issuance. It raised:

- $600mn via a 5.5Y bond at a yield of 4.573%, 35bp inside initial guidance of T+130bp area.

- $600mn via a 7Y bond at a yield of 4.84%, 35bp inside initial guidance of T+140bp area.

- $800mn via a 10Y bond at a yield of 5.141%, 35bp inside initial guidance of T+150bp area.

The senior unsecured notes are rated Baa1/A-/BBB+. Proceeds will be used to refinance offshore indebtedness and other general corporate purposes.

RBC raised $2.25bn via a three-part issuance. It raised:

- $750mn via a 3NC2 bond at a yield of 3.995%, 20bp inside initial guidance of T+70bp area.

- $500mn via a 3NC2 FRN at SOFR+70bp vs. initial guidance of SOFR equivalent area.

- $1bn via a 6NC5 bond at a yield of 5.141%, 20bp inside initial guidance of T+90bp area.

The senior unsecured notes are rated A1/A/AA-. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

-

Clifford Capital $ FRN bond

- YPF holds investor calls

Rating Changes

- Moody’s Ratings takes rating action on eight French credit institutions

- Cadence Bank ‘BBB+’ Rating Placed On CreditWatch Positive On Announced Acquisition By Huntington Bancshares Inc.

- Orient Finans Bank Outlook Revised To Positive On Solid Asset Quality And Operating Performance; Affirmed At ‘B+/B’

Term of the Day: Catastrophe Bonds

Catastrophe bonds also referred as Cat bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies for the issuer against natural disasters, where they pay regular coupons (premium) in exchange for protection. In the event of a natural disaster trigger, issuers will receive a payout from the proceeds of the bond and the principal repayment and interest payments are either deferred or cancelled. If a trigger event doesn’t occur, the issuer continues to pay the coupons as scheduled, similar to a regular bonds and proceeds are returned to the investors at maturity. Cat bonds are generally purchased by governments, insurance and reinsurance companies. These bonds have gained traction as the frequency of natural disasters is on the rise.

Investors in Jamaica’s catastrophe bonds are said to face a full trigger event that would force payment of the entire $150mn bond to help the island deal with the fallout from Hurricane Melissa.

Talking Heads

On Fed Seen Cutting Rates, But With No Added Signal

Krishna Guha, Evercore ISI

“The labor data continues to play a larger role in the debate”… Powell can stay focused on employment and “moving the Fed back to a neutral policy stance”

Matthew Luzzetti, Deutsche Bank Securities

“The hope is that eventually the incoming data helps to bridge the gap between the two camps”… Powell will provide “very little signal about December or beyond”

Guneet Dhingra, BNP Paribas

“Right now, we’re playing a bit with that line between volatility and stress”

On Liquid Credit’s Wobbles Are Good for Private Lenders – Kort Schnabel & Jim Miller, Ares Capital

Neither of the collapses are “really impacting our market that much so far”… “We also get the benefit when the broadly syndicated market does see reverberations”

On Food Inflation Must Continue to Come Down – ECB’s Christine Lagarde

“We have an average of about 2%, and food prices is a bit more than that… We need to continue to make sure it goes down for food, because food matters”

Top Gainers and Losers- 29-Oct-25*

Go back to Latest bond Market News

Related Posts: