This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

FOMC Minutes Show Inflation Risks; Swire Launches $ 7Y Bond; Nordea Bank, BBVA Price Bonds

August 21, 2025

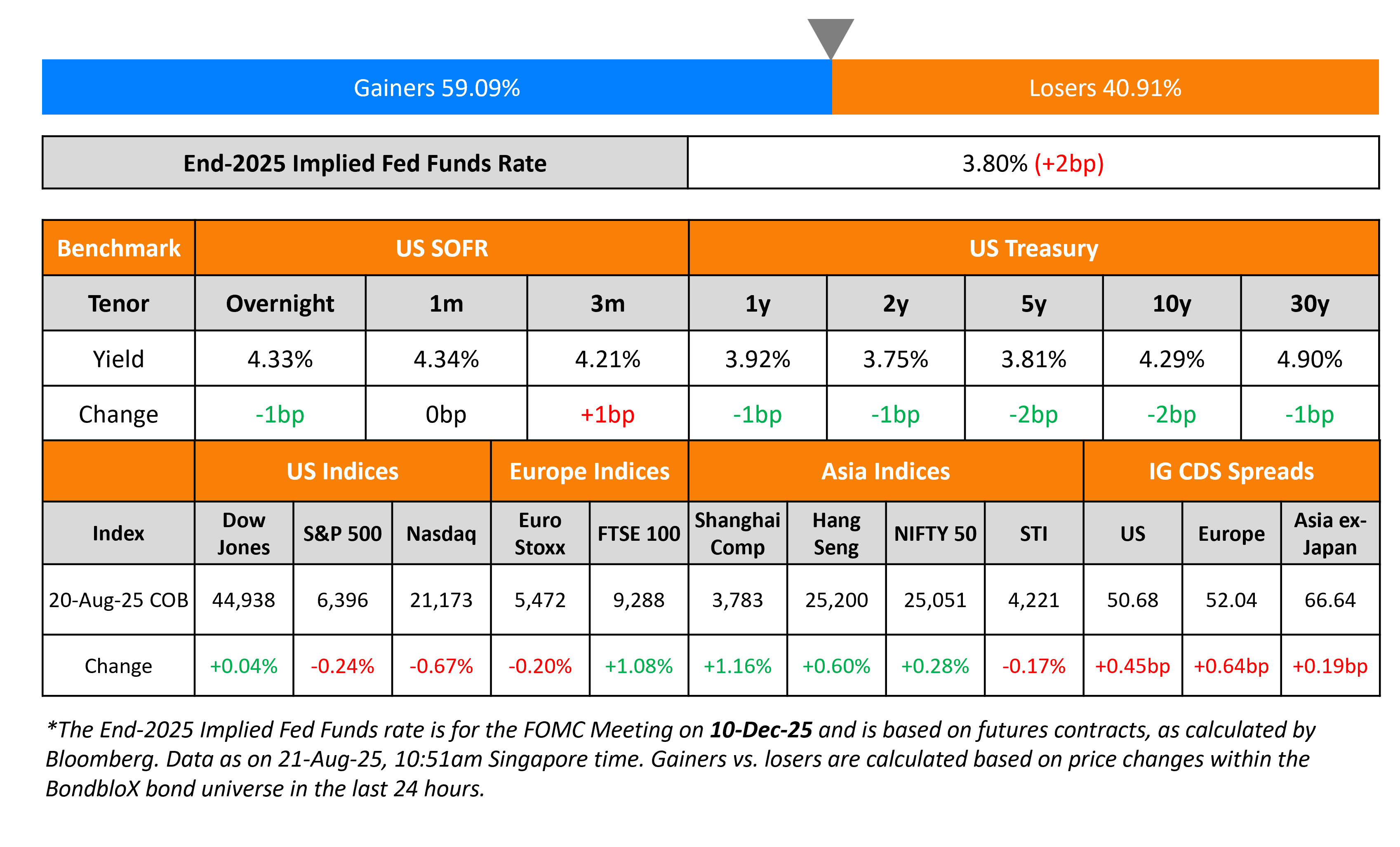

US Treasury yields ended marginally lower by 1-2bp across the board. The FOMC’s July meeting minutes showed that a majority of the members saw the upside inflation risks to be greater than the downside risks to employment. Besides, the minutes also noted that Michelle Bowman and Christopher Waller were alone in their dissent last month, where they had vouched for a 25bp rate cut.

Looking at US equity markets, the S&P and Nasdaq ended 0.2% and 0.7% lower respectively. US IG and HY CDS spreads widened by 0.5bp and 2.4bp each. European equity markets ended lower while FTSE ended higher. The iTraxx Main CDS spreads were 0.6bp wider and Crossover spreads widened by 4bp. Asian equity markets have opened weaker today. Asia ex-Japan CDS spreads were 0.2bp wider.

New Bond Issues

-

Swire Pacific $ 7Y at T+100bp area (books over $3.5bn)

Nordea Bank raised $1bn via a two-tranche deal. It raised:

- $600mn via a 5Y bond at a yield of 4.291%, 25bp inside initial guidance of T+75bp area

- $400mn via a 5Y FRN at SOFR+83bp vs. initial guidance of SOFR equivalent area

These senior preferred notes are rated Aa3/AA-/AA. Proceeds will be used for general banking and other corporate purposes.

BBVA raised €1bn via a 10Y Green bond at a yield of 3.755%, 27bp inside initial guidance of T+135bp area. The bond received orders above €1.85bn. The senior non-preferred bond is rated Baa2/BBB+/BBB+, and has a clean-up call provision at 75%. Proceeds will be used as per BBVA’s Sustainable Debt Financing Framework.

Rating Changes

-

Cinemark Holdings Inc. Upgraded To ‘BB’ From ‘BB-‘; Outlook Stable

-

Fitch Downgrades Newfold Digital to ‘CCC-‘ on Rating Watch Negative

Term of the Day: Clean-Up Call

A clean-up call refers to a call provision, whereby once a stated percentage of a security is retired, the issuer is obliged to call the remainder of the tranche. While clean-up calls are generally more commonly observed in mortgage-backed securities (MBS), they may also be present as a feature in some bonds. This is different from a normal call option in a bond where the issuer has an option to redeem their bond fully during the specified call date./period.

Talking Heads

On Fed Not Independent and Powell Left-Leaning – David Zervos, Jefferies

“The Fed has never been independent, and the political pressures on the Fed have always been growing and continue to grow…He’s operating politically from the left. Or, let’s put it this way, from the anti-Trump side…You’re left now with rates at a much more restrictive rate, without that extra kicker from the balance sheet…So we really need to get rates back toward a more neutral level”

On Latin American FX Outperforming in Down Day for Emerging Markets

Marco Oviedo, XP Investimentos

“Markets in LatAm are reacting to the USD weakness, likely driven by the prevailing weakness in global growth, since there is little new information and little regional news today,”

Anders Faergemann, PineBridge Investments

“Rate cut in September in line with our base case of a ‘soft landing,’ which we believe is positive for credit including emerging markets where valuations are getting slightly stretched,”

On Slower Growth With Some Trade Uncertainty Lingering – Christine Lagarde, ECB

“Recent trade deals have alleviated, but certainly not eliminated, global uncertainty, which persists on account of the unpredictable policy environment…Uncertainty persists as sector-specific tariffs on pharmaceuticals and semiconductors remain unclear”

Top Gainers and Losers- 21-Aug-25*

Go back to Latest bond Market News

Related Posts: