This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

FOMC Minutes for Jan Fed Meet Released; ABN Amro Prices €AT1

February 20, 2025

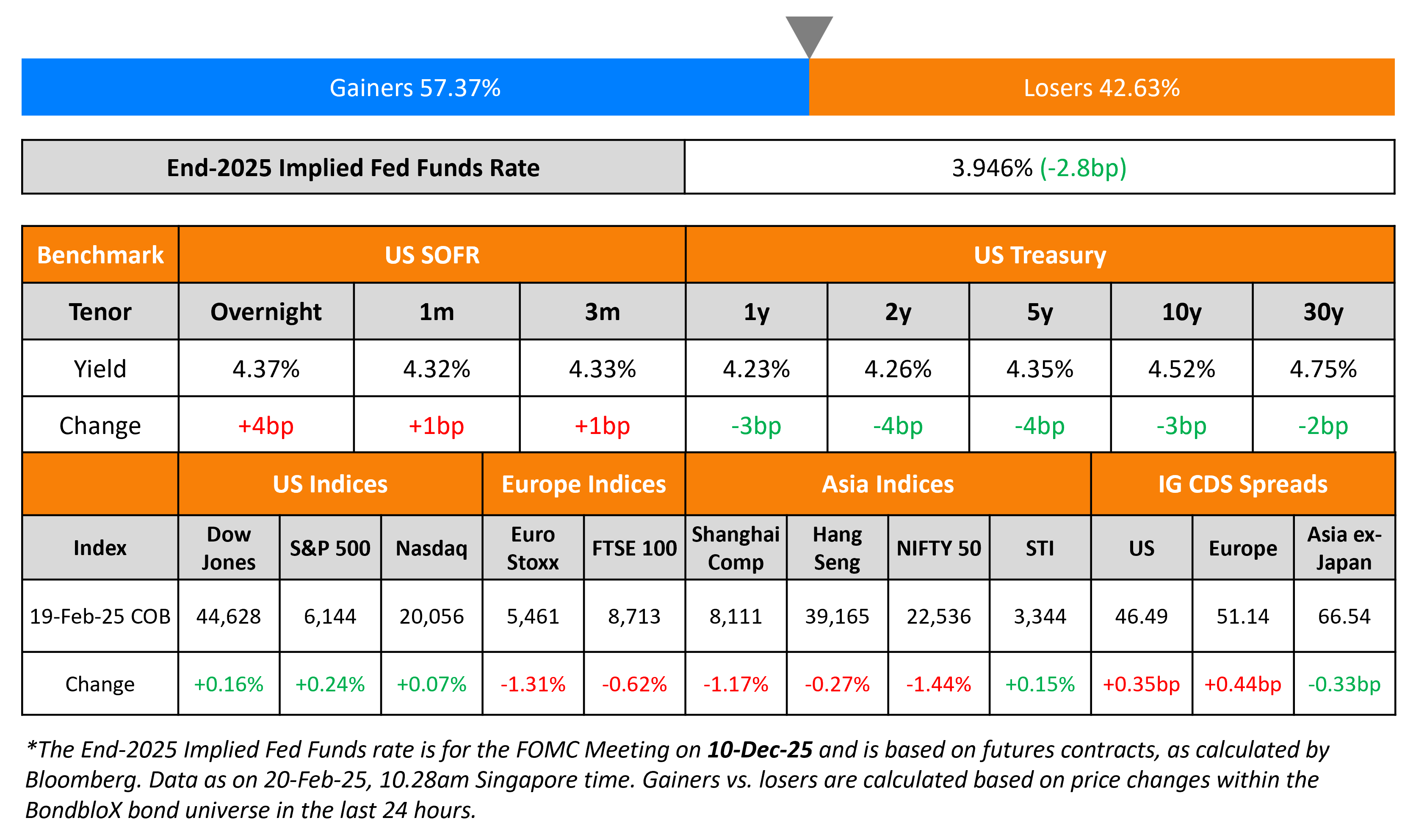

US Treasury yields fell by 3-4bp across the curve yesterday. FOMC minutes from the Fed’s January meeting were released yesterday which revealed that participants were more focused on inflation risks than job market concerns. Fed officials highlighted the potential impacts from changes in trade and immigration policies, geopolitical disruptions, and stronger-than-expected household spending. They also discussed the possibility of slowing or pausing their balance sheet reduction due to federal debt ceiling concerns. The minutes also indicated a longer Quantitative Tightening (QT) timeline, with some market participants expecting it to end by mid-2025. Atlanta’s Fed President Raphael Bostic emphasized patience in evaluating how President Trump’s policies might impact the economy. He noted that while some policies could drive inflation, others might encourage investment, and he preferred to wait for clearer information before adjusting policy.

US equity markets saw the S&P and Nasdaq ending higher by 0.2% and 0.1% respectively. Looking at credit markets, US IG and HY CDS spreads were 0.4bp and 1.bp wider respectively. European equity markets ended lower. The iTraxx Main and and Crossover CDS spreads widened by 0.4bp and 3.4bp respectively. Asian equity markets have opened broadly lower this morning. Asia ex-Japan CDS spreads were tighter by 0.3bp.

New Bond Issues

-

Westpac New Zealand $ 5Y at T+85bp area

-

ESR REIT S$ 5Y at 4.25% area

ABN Amro raised €750mn via a PerpNC8.5 AT1 at a yield of 5.75%, 50bp inside initial guidance of 6.25% area. The junior subordinated bond is rated BBB-(Fitch). If the bond is not called by 22 September 2033, the coupon will reset to 5Y Mid-Swap rate plus 338.9bp. The trigger event will occur if at any time the solo CET1 ratio of the Issuer is less than 5.125% or Consolidated CET1 is less than 7%. The bond was priced 5bp wider than recently issued UniCredit’s 5.625% Perp (rated Ba3), currently yielding 5.7%.

Sharjah Islamic Bank raised $500mn via a 5Y sukuk at a yield of 5.3%, 35bp inside initial guidance of T+125bp area. The senior unsecured bond is rated A-(S&P), and received orders of above $1.7bn, 3x issue size. The SIB Sukuk Company III Limited is the issuer and Sharjah Islamic Bank P.J.S.C is the obligor.

Kraft Heinz raised $1bn via a two-trancher. It raised $500mn via a 7Y bond at a yield of 5.234%, 28bp inside initial guidance of T+105bp area. It also raised $500mn via a 10Y bond at a yield of 5.409%, 28bp inside initial guidance of T+115bp area. The senior unsecured bonds are rated Baa2/BBB/BBB. Proceeds will be used for general corporate purposes, which may include repayment of outstanding indebtedness.

TransCanada Pipelines raised $750mn via a 40NC5 bond at a yield of 7%, 25bp inside the wider-end of initial guidance of 7.125-7.25% area. The subordinated bond is rated Baa3/BBB-/BBB-. The bond’s next reset date is on 1 June 2030. Proceeds will be used to fund the redemption of the 5.625% 2075 notes, to reduce other indebtedness and for general corporate purposes.

Lendlease Global REIT raised S$120mn via a PerpNC3 bond at a yield of 4.75%, 25bp inside initial guidance of 5% area. The subordinated bond is unrated. If the bond is not redeemed by 28 February 2028, the coupon will reset to prevailing SGD 3Y SORA OIS plus 218.5bp. The bond has a Dividend Stopper clause. Proceeds will be used to refinance existing debt including 5.25% Perp, as well as group’s general working capital and capital expenditure requirements.

Johnson & Johnson raised €4bn via a five-trancher. It raised:

The senior unsecured bonds are rated Aaa/AAA. Proceeds will be used to fund recently announced acquisition of Intra-Cellular, a biopharmaceutical company and any net proceeds not so applied will be used for general corporate purposes.

Damac raised $750mn via a 3.5Y sukuk at a yield of 7%, 50bp inside initial guidance of 7.5% area. The senior unsecured bond is rated Ba2/BB. The Alpha Star Holding IX Limited is the issuer and Damac Real Estate Development Limited is the guarantor.

Cisco raised $5bn via a five-trancher. It raised:

The senior unsecured bonds are rated A1/AA-. Proceeds will be used for general corporate purposes, including the repayment of commercial paper borrowings.

New Bonds Pipeline

- Varanasi Aurangabad hires for $ 9NC3 bond

- Saudi Real Estate hires for $ 3Y/10Y bond

Rating Changes

-

Fitch Upgrades Boston Scientific’s Long-Term IDR to ‘A-‘; Outlook Stable

-

Moody’s Ratings affirms Egypt’s Caa1 ratings, positive outlook

-

Fitch Revises Energuate’s Outlook to Positive, Affirms Ratings at ‘BB’

-

Moody’s Ratings affirms LG Electronics’ Baa2 ratings; revises outlook to positive from stable

Term of the Day

Murabaha Financing

Murabaha is an Islamic financing structure where a seller and buyer agree to the cost plus a markup of an asset. It is also known as “Cost-Plus financing”. The seller beforehand declares his cost and profit to the buyer. In the Islamic banking space, since charging interest is prohibited the Murabaha model offers a solution for banks to be able to make money. Banks purchase a commodity/product for the customer, a profit margin mark-up is agreed to by both parties and the bank is typically repaid in instalments. With regard to a financing facility, a bank may raise funds via Murabaha financing and repay its lenders on a cost plus basis. Damac raised $750mn via a 3.5Y Murabaha financing sukuk structure.

Talking Heads

On the US Dollar Despite Distractions From Tariffs

Mark McCormick, Jayati Bharadwaj and Ray Ng, TD Securities

“While the dollar is off the latest highs, this drawdown is a dip-buying opportunity, not the start of a reversal.Our short-term positioning and valuation models have been flagging an overbought dollar since the start of the year…The recent pullback has cleaned out the risk premium and brought positioning back to more neutral levels.”

On Increasing Demand for US Corporate Bonds due to BOJ’s Hawkish Stance

Yuri Seliger, Bank of America

“The (foreign exchange) hedging cost is largely the difference in policy rates between the US and Japan…As a result, more BoJ hikes would further bring down the hedging cost (thus driving Japanese demand for US corporate bonds)”

Top Gainers & Losers 20-February-25*

Go back to Latest bond Market News

Related Posts: