This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

FOMC Keeps Rates Unchanged, 2 Officials Dissent

July 31, 2025

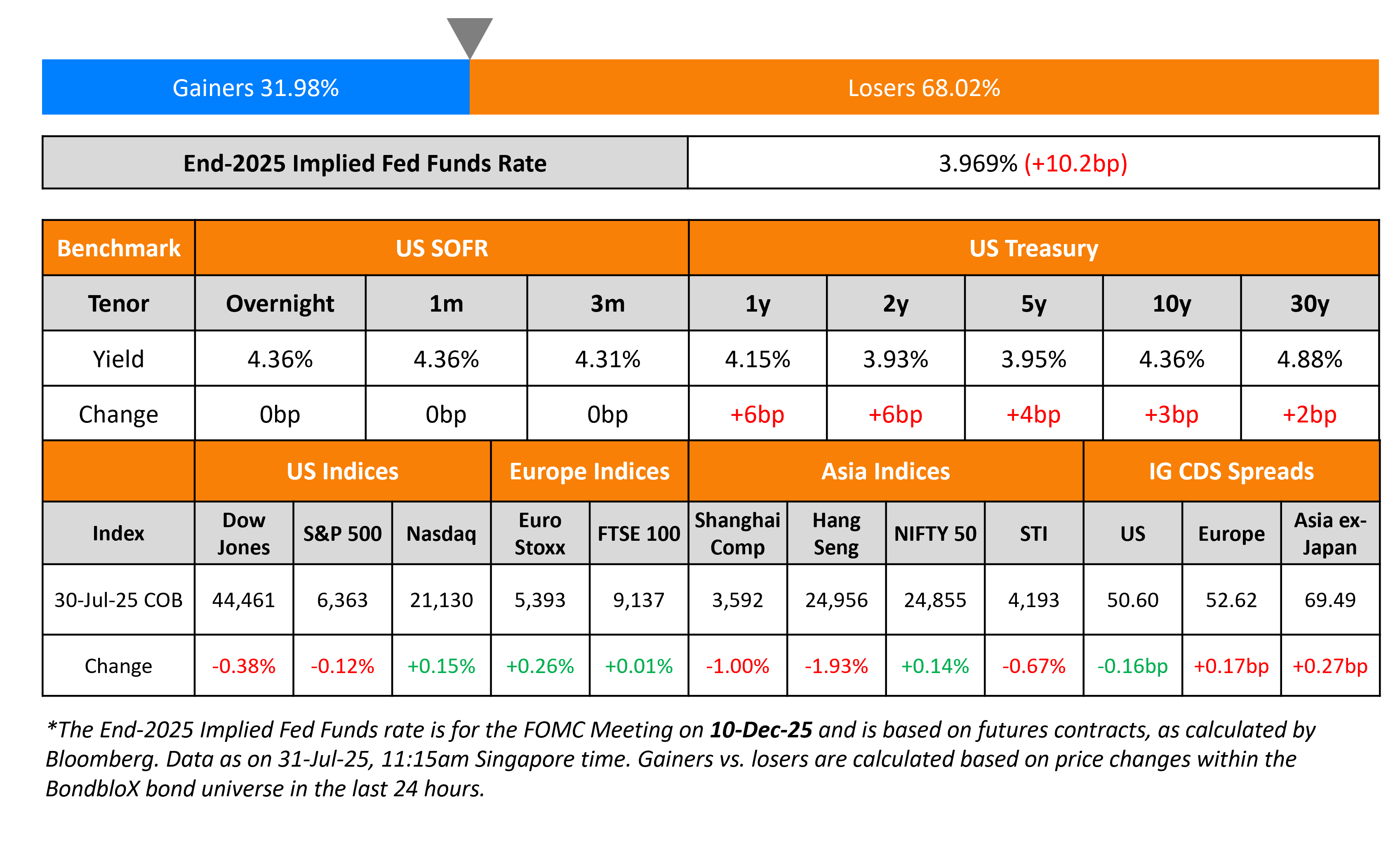

The US Treasury curve bear flattened with the 2Y yield up by 6bp while the 10Y moved higher by 3bp. US Q2 GDP saw a growth of 3% annualized, stronger than expectations of 2.6%. Besides it also rebounded from the -0.5% print seen in the prior quarter, thanks to a jump in net exports and personal consumption. Separately, US President Donald Trump has announced a 50% tariff on Brazil, 25% on India and 15% on South Korea.

The FOMC kept the Fed funds target range unchanged at 4.25-4.50%, in-line with expectations. However, it was not a unanimous vote as Fed governors Chris Waller and Michelle Bowman dissented, voting for a 25bp rate cut. This marked the first time that two officials dissented since 1993. The Fed said that economic activity moderated, noting that the unemployment rate was low and that the labour market was solid. Markets are currently pricing-in about 33bp of rate cuts by end-2025, vs. 43bp prior to the FOMC meeting.

Looking at US equity markets, the S&P ended lower by 0.1% while the Nasdaq closed higher by 0.2%. US IG CDS spreads were 0.2bp tighter while HY CDS spreads widened by 2.1bp. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads widened by 0.2bp and 2bp respectively. Asian equity markets have opened broadly lower today. Asia ex-Japan CDS spreads were 0.3bp wider.

New Bond Issues

-

Keppel REIT S$ PerpNC3 at 4.1% area

SATS raised S$300mn via a 7Y bond at a yield of 2.45%, 30bp inside initial guidance of 2.75% area. The senior unsecured note is rated A3. Proceeds will be used to refinance existing debt, which may include borrowings from banks.

New Bonds Pipeline

- Indonesia hires for A$ 5Y/10Y bond

- Binghatti hires for $ 5Y sukuk

Rating Changes

-

Digital Realty Trust Inc. Upgraded To ‘BBB+’, Outlook Stable, Under Our Updated Methodology; Off UCO

-

Fitch Upgrades Birkenstock Holding plc to ‘BB+’; Outlook Stable

-

Equinix Inc. Upgraded To ‘BBB+’, Outlook Stable, Under Our Updated Methodology; Off UCO

-

Fitch Downgrades Cullinan to ‘B-‘; Places on Rating Watch Negative

Term of the Day: Bid-to-cover ratio

Bid-to-cover is a ratio of the number of bids or orders received for a particular security issuance vs. the amount issued. The bid-to-cover ratio indicates the demand for an issuance – higher the ratio, higher the demand and lower the ratio, lower the demand.

The recent US 7Y note auction saw strong demand with a bid-to-cover ratio of 2.79x, significantly better than the three prior auctions’ average of 2.59x.

Talking Heads

On Risky Borrowers Piling Into a Market Hungry for Junk

Jon Poglitsch, Sycamore Tree Capital

“I haven’t seen a market quite like this post the Great Financial Crisis…There’s a grab for spread where anyone can find it”

Corry Short, Barclays Plc

“The technicals are really in the driver’s seat right now…No one really cares as much about fundamentals, although those are starting to improve as well.”

On Wall Street’s Big Loans to Emerging Markets Spark Risk Worries

Jason Keene, Barclays

“While bank loans can diversify a borrower’s lender base and provide technical support to its eurobond curve, lower interest bills often come at the expense of rollover and foreign exchange risks.”

Samy Muaddi, T. Rowe Price Associates

“If they use that to reform and regain market access, it could be a positive. But on the other hand, if that window’s not used well, it reduces transparency in the country”

On Fed’s Reticence on Rate Cuts Forcing Market to Rethink Outlook

Sonu Varghese, Carson Group

“They’re going to wait for more data, but more data means more time, and more time means rates are going to remain restrictive for a few more months”

Jamie Patton, TCW

“I think the market had gotten a bit ahead of itself thinking we already had enough data to justify a cut in September”

Vishal Khanduja, Morgan Stanley

“This patience from the Fed and strength of the U.S. economy coming through is putting a little bit of a pause to that dollar depreciation”

Top Gainers and Losers- 31-Jul-25*

Go back to Latest bond Market News

Related Posts: