This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

FOMC Delivers Hawkish 25bp Cut; HSBC Launches $ Bonds

October 30, 2025

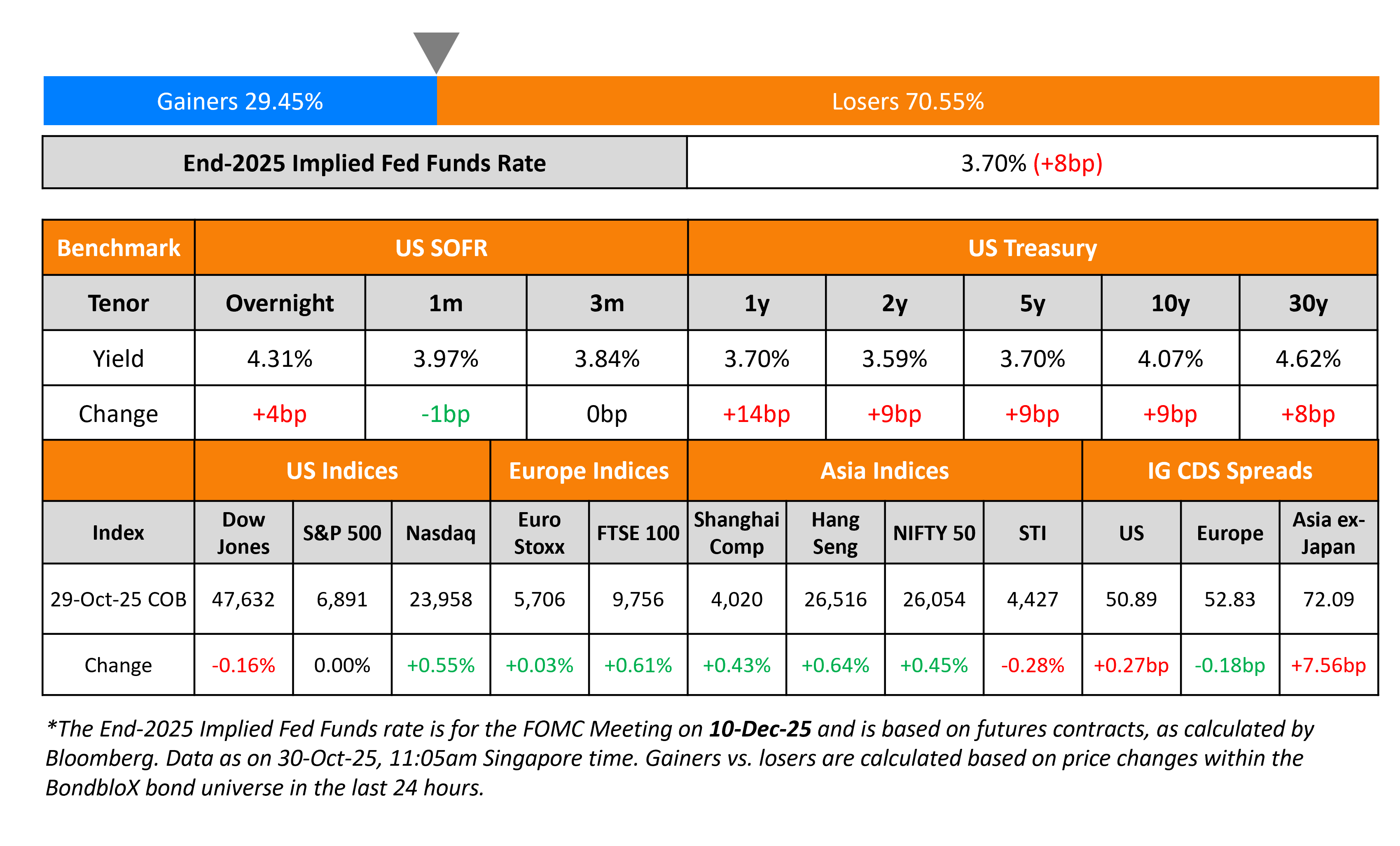

US Treasury yields shot higher by ~9bp, following the FOMC meeting. The FOMC cut its policy rate by 25bp as expected. There were two dissenters leading to a 10-2 voting pattern – Stephen Miran voted for a 50bp cut while Jeffrey Schmid preferred no change in rates. Separately, Fed Chairman Jerome Powell said that a December rate cut was “far from” a foregone conclusion, adding that “there were strongly differing views about how to proceed in December”. Besides, the Fed committed to end its balance sheet reduction from December 1. On the back of this, markets are pricing in a 65% probability of a 25bp rate cut in December vs. over 90% prior to the meeting.

Looking at equity markets, the S&P ended unchanged while the Nasdaq was higher by 0.6%. The US IG and HY CDS spreads widened by 0.3bp and 3.2bp respectively. European equity indices ended higher. The iTraxx Main CDS spreads were 0.2bp tighter while the Crossover CDS spreads were 0.1bp wider. Asian equity markets have opened broadly lower today. Asia ex-Japan CDS spreads were 7.6bp wider.

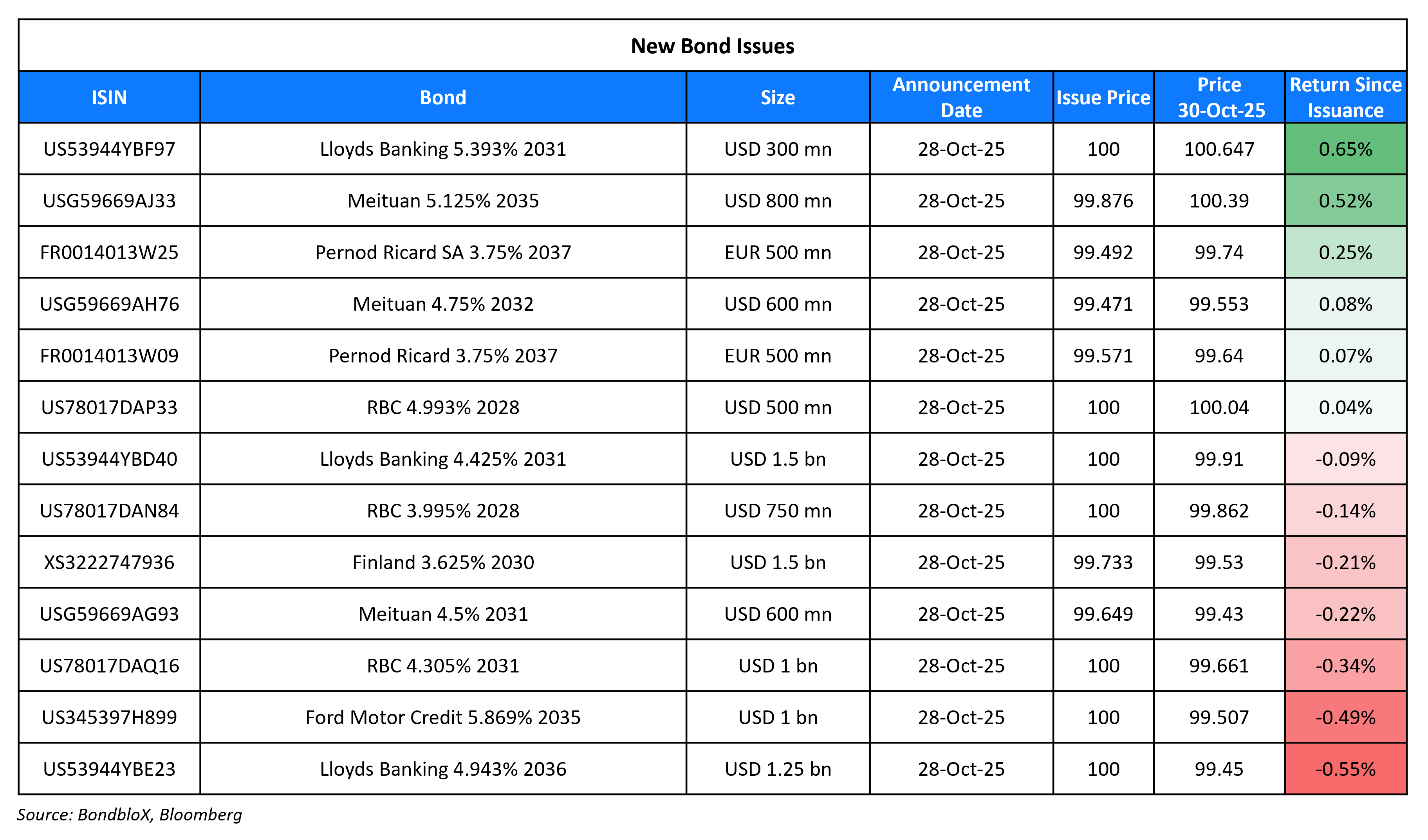

New Bond Issues

- HSBC $ 6NC5/6NC5 FRN/11NC10 at T+115/SOFR eq./T+130bp areas

New Bonds Pipeline

- YPF may reopen 2031 bond, investor talks

-

KEPCO $ sustainability bond

-

Export Finance Australia A$ 5Y bond

Rating Changes

- Fitch Upgrades MSU’s Ratings to ‘CCC+’; Upgrades Senior Secured Notes to ‘B-‘/’RR3’

- Brambles Ltd. Upgraded To ‘A-‘ On Strengthened Market Position And Capital Discipline; Outlook Stable

- Fitch Upgrades Avianca’s IDR to ‘B+’; Outlook Stable

- Fitch Downgrades Orbia’s Ratings to ‘BBB-‘; Outlook Stable

- Fitch Revises Bank Hapoalim’s Outlook to Stable; Affirms IDR at ‘A-‘

- Falabella S.A. Outlook Revised To Positive On Stronger Credit Metrics; ‘BB+’ Ratings Affirmed

Term of the Day: Credit Default Swap (CDS)

A Credit Default Swap (CDS) is a financial contract between two counterparties that allows an investor to “swap” or offset the credit risk with another investor. CDS acts like an insurance policy wherein the buyer makes regular payments to the seller to protect itself from an issuer default. In the event of a default, the buyer receives a payout, typically the face value of the bond or loan, from the seller of the CDS as per the agreement. CDS spreads are a commonly used metric to track the market-priced creditworthiness of an issuer. A widening (increase) in CDS spreads indicates a deterioration in creditworthiness and vice-versa.

Talking Heads

On Treasuries Slumping as Powell Upends Market Bets on December Cut

Kelsey Berro, JPMorgan Asset Management

“What caught the market somewhat by surprise is that he’s resetting deck chairs as related to the probability of a rate cut in December… looks like a deliberate attempt to make December more of a live meeting.”

Jack McIntyre, portfolio manager at Brandywine Global Investment

“It sounds like Powell wants to put some daylight between the Fed’s view of future rate cuts and the markets”

Dan Carter, a senior portfolio manager at Fort Washington Investment

“I don’t think rates will sell off too far. A “slowing” labor market “has been the justification to cut the past two meetings and it’s unlikely that will change between now and December”

On Renew Call for BOE Rate Cut in November – Goldman Sachs Economists

“Taken together, we believe that the data make a convincing case for a cut next week, as key indicators have turned out significantly weaker since the September meeting.”

On Yen weakens after BOJ decision; dollar holds gains

Carol Kong, CBA

“We know that the BOJ tends to be more politically sensitive. So given the Takaichi administration has just been elected, and they are now compiling another economic package, I think the BOJ will stay cautious in the very near term.. FOMC is divided on the policy outlook from here and with the government in shutdown still, I think Powell wants to approach policy more cautiously”

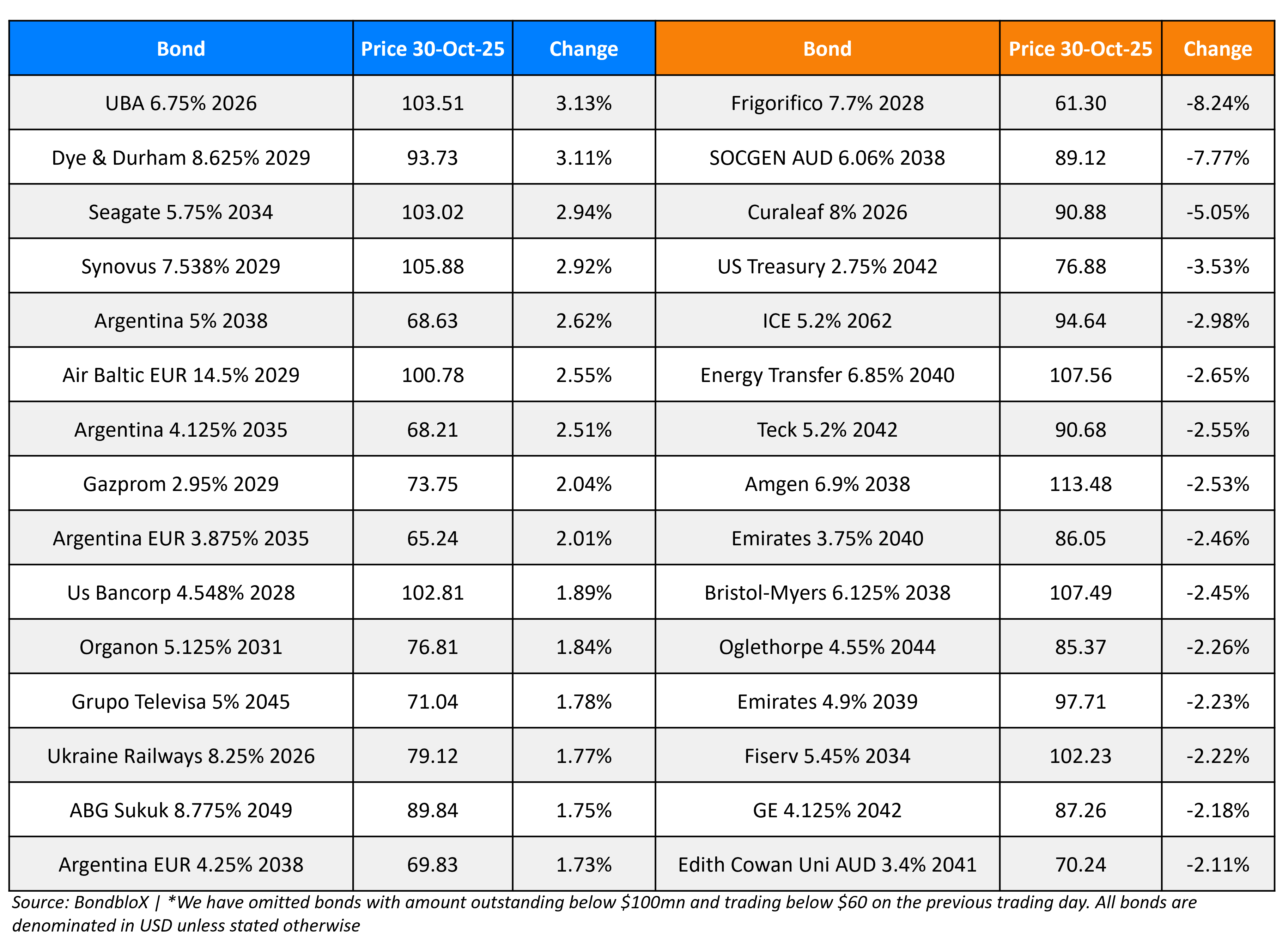

Top Gainers and Losers- 30-Oct-25*

Go back to Latest bond Market News

Related Posts: