This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

FLCT Launches S$ 8.5Y; Ukraine’s Dollar Bonds Higher on Expected Trump, Putin Talks

August 11, 2025

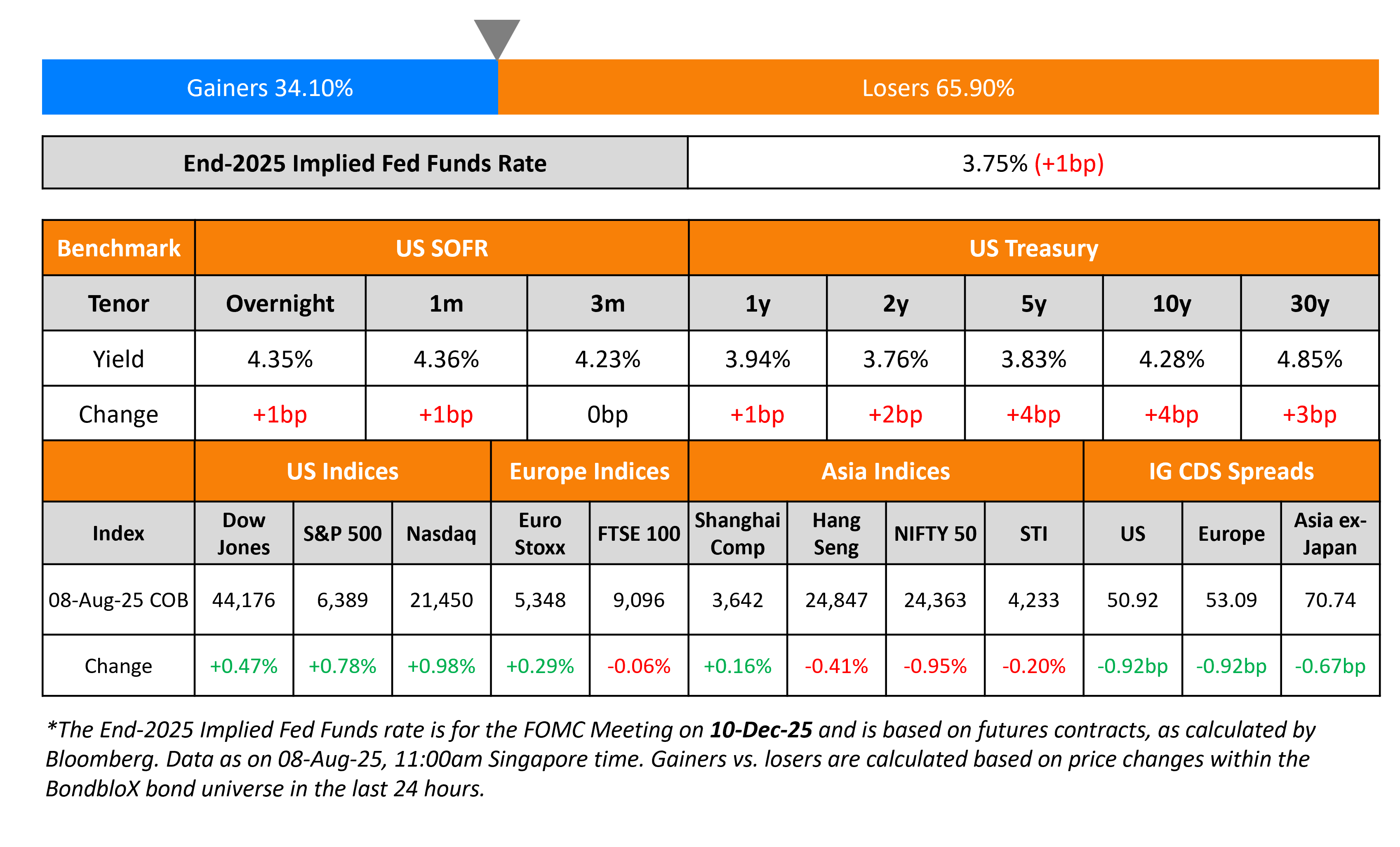

US Treasury yields were marginally higher led by the far-end of the curve, with the 10Y up by 4bp. While there were no major data points on Friday, markets now await Tuesday’s US CPI data. Fed Governor Michelle Bowman made a case for three rate cuts by year end, citing that a delay could see conditions deteriorate in the labor market and the overall US economy. Separately, Donald Trump and Vladimir Putin are set to meet in Alaska on Friday to discuss a potential ceasefire in Ukraine. Ukraine’s dollar bonds have been trending higher on the back of this update.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.8% and 1% respectively. US IG CDS spreads were 0.9bp tighter and HY CDS spreads tightened by 4.9bp. European equity markets ended mixed. The iTraxx Main CDS spreads tightened by 0.9bp and the Crossover spreads tightened by 3.9bp. Asian equity markets have opened higher today, with the Nikkei up by 1.9% at the time of writing. Asia ex-Japan CDS spreads were 0.7bp tighter.

New Bond Issues

- FLCT Treasury S$ 8.5Y at 2.7% area

New Bond Pipeline

- China Aircraft Leasing hires for $ bonds

Rating Changes

- Fitch Upgrades Ohio National Seguros de Vida’s IFS to ‘A-‘; Outlook Stable

- Fitch Revises Alpek’s Outlook to Negative; Affirms Ratings at ‘BBB-‘

- Fitch Revises Iceland’s Outlook to Positive; Affirms at ‘A’

- Outlook On Stellantis Revised To Negative On Weaker Profitability; ‘BBB/A-2’ Ratings Affirmed

Term of the Day: Carry Trades

Carry trades are a popular trading strategy where an investor borrows money from a country with low interest rates (and a weaker currency) and invests the money in another country’s asset with a higher interest rate. Historically, a famous example has been the Japanese yen-funded carry trade. This was mainly owing to the zero-to-negative interest rates in Japan for the better part of two decades, and bets that rates there would remain at rock bottom levels. In this case, investors globally and even locally would borrow at low interest rates in Japan and invest the money in overseas equities and bonds like the US stock market. Carry trades typically work well when central bank policy certainty is high and expectations are for low market volatility.

Talking Heads

On Carry Traders Ramping Up Bets in Emerging Markets as Fed Cuts Loom

Kieran Curtis, Aberdeen

“Carry is an important part of the story…The Brazilian real long is one of our favorite positions – and it’s really driven by the yield.”

Gustavo Medeiros, Ashmore Group

“In a risk-on environment, high carry trades typically do better…So from that perspective, most likely the high carry Asian places like Indonesia, India, the large countries of course would do well, but LatAm is probably better positioned to benefit.”

On Everything’s Expensive and There is Nowhere to Hide

April LaRusse, Insight Investment

“It’s certainly not easy to find ways to get more yield without introducing different risk… It’s pretty tricky. When you get tight spreads, you get a lot less dispersion.”

Al Cattermole, Mirabaud Asset Management

“I don’t want to add CCCs that are trading like Bs…That’s the conundrum for us at the moment.”

Andrew Chorlton, M&G Investments

“It’s proving a challenging market…There’s just quite a lot of complacency in credit at the moment.”

On Fed officials Tilting Dovish as US Job Market Softens

Raphael Bostic, Atlanta Fed President

“The employment number did say that the risk on the employment side is much higher than it had been…I will definitely be looking carefully,”

Alberto Musalem, St. Louis Fed President

“There are risks on both sides of our mandate, and when that happens, when you have risks on both sides, you have to take a balanced approach”

Mary Daly, San Francisco Fed President

“I’m comfortable with the decision we made in July, but I am increasingly less comfortable with making that decision again and again”

Top Gainers and Losers- 11-Aug-25*

Go back to Latest bond Market News

Related Posts: